The Alternative Minimum Tax (AMT) is a separate tax system that requires some taxpayers to calculate their tax liability twice—first, under ordinary income tax rules, then under the AMT—and pay whichever amount is highest. The AMT has fewer preferences and different exemptions and rates than the ordinary system.

How Is the Alternative Minimum Tax (AMT) Calculated?

The AMT eliminates or reduces the value of tax preferences taken under the ordinary system. Taxpayers add certain deductions back into their income to figure out their Alternative Minimum Taxable Income (AMTI).

Next, the AMT allows an exemption of $85,700 for singles and $133,300 for married couples filing jointly to be excluded from the tax (for tax year 2024). However, exemptions phase out once AMTI hits $609,350 for single filers and $1,218,700 for married taxpayers filing jointly in 2024.

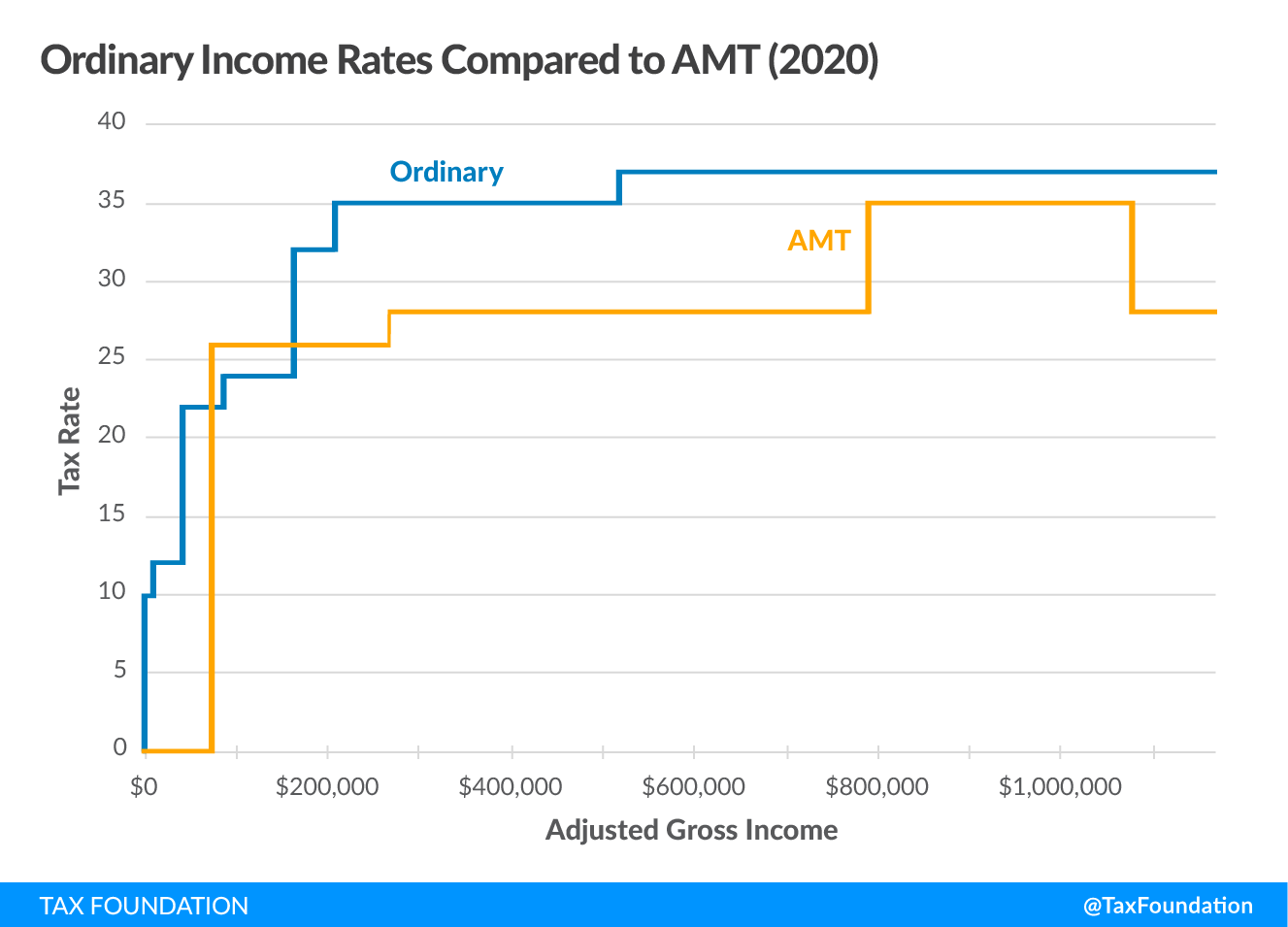

After calculating their AMTI and applying the exemption, taxpayers (single and married filing status) are taxed at a rate of 26 percent on AMTI below $197,900 and 28 percent on AMTI above $197,700 (tax brackets for tax year 2020). After addressing foreign tax provisions, taxpayers calculate their tentative tax amount under the AMT. Taxpayers then pay either their ordinary individual income tax liability or their AMT liability, whichever is greater.

In tax year 2017, the last year before the Tax Cuts and Jobs Act (TCJA) took effect, approximately 5 million taxpayers had to pay under the AMT. The TCJA increased the AMT’s exemption and exemption phaseout through 2025, greatly reducing the number of taxpayers subject to the AMT, to an estimated 200,000.

Why Was the Alternative Minimum Tax (AMT) Created?

The AMT was enacted in 1969 to keep wealthy taxpayers from using what was viewed as too many tax preferences. In 1969, U.S. Treasury Secretary Joseph Barr testified that in 1966, 155 high-income people paid zero income tax. Instead of eliminating the tax preferences that enabled these taxpayers to reduce their taxable income, Congress created a minimum tax.

The progressive structure of the income tax affects higher-income taxpayers more acutely. As income rises, exclusions become more valuable since each dollar excluded avoids the prospect of being subject to a higher marginal tax rate. In some cases, taxpayers may be able to avoid income tax altogether, or greatly reduce their level of tax, by structuring their income to qualify under current exemption rules. The AMT tries to limit this by reducing the number of eligible exemptions able to be claimed, thus increasing the amount of income subject to tax, and by using a different rate structure.

Visualizing the Alternative Minimum Tax (AMT):

| Individual Income Tax Returns (Form 1040) | Alternative Minimum Tax (Form 6251) |

|---|---|

| Input all income, including wages, salaries, tips, taxable interest, capital gains, IRA distributions, pension and annuity income, Social Security benefits, other income etc. | Enter taxable income (if zero, enter adjusted gross income) from form 1040 |

| Make adjustments to income, including for educator expenses, certain business expenses, health savings accounts, moving expenses for Armed Forces members, self-employment tax, etc. |

Add back or reduce certain tax preferences taken under the ordinary income tax, including:

|

| = Adjusted Gross Income (AGI) | = Alternative Minimum Taxable Income (AMTI) |

|

Choose the larger of the standard deduction or itemized deductions

Apply qualified business deduction (if applicable) |

Apply the following AMT exemptions if income is under the phaseout threshold ($518,400 in AMTI for single filers and $1,036,800 for married taxpayers filing jointly, both for tax year 2020)

|

| = Taxable income |

Apply AMT tax rates and take AMT foreign tax credit if applicable

|

| Apply ordinary tax rates and take applicable tax credits | |

| = Total ordinary tax | = Tentative minimum tax |

|

Pay whichever amount is greater |

|

Stay updated on the latest educational resources.

Level-up your tax knowledge with free educational resources—primers, glossary terms, videos, and more—delivered monthly.

Subscribe