The Biden administration has put forward significant plans for changing tax policy, including changes that would impact workers. While the administration is mainly concerned with increasing the top individual income tax rate to 39.6 percent on income above $400,000 for single filers and $450,000 for joint filers as well as providing tax relief for families, it is helpful to understand what the existing taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. burden looks like for workers.

Workers in the United States generally face two major taxes on income: the individual income taxAn individual income tax (or personal income tax) is levied on the wages, salaries, investments, or other forms of income an individual or household earns. The U.S. imposes a progressive income tax where rates increase with income. The Federal Income Tax was established in 1913 with the ratification of the 16th Amendment. Though barely 100 years old, individual income taxes are the largest source of tax revenue in the U.S. and the payroll tax (levied on both the employee and the employer). Slightly more than half of the payroll taxA payroll tax is a tax paid on the wages and salaries of employees to finance social insurance programs like Social Security, Medicare, and unemployment insurance. Payroll taxes are social insurance taxes that comprise 24.8 percent of combined federal, state, and local government revenue, the second largest source of that combined tax revenue. burden is paid by employers, but workers ultimately bear this burden through lower take-home pay.

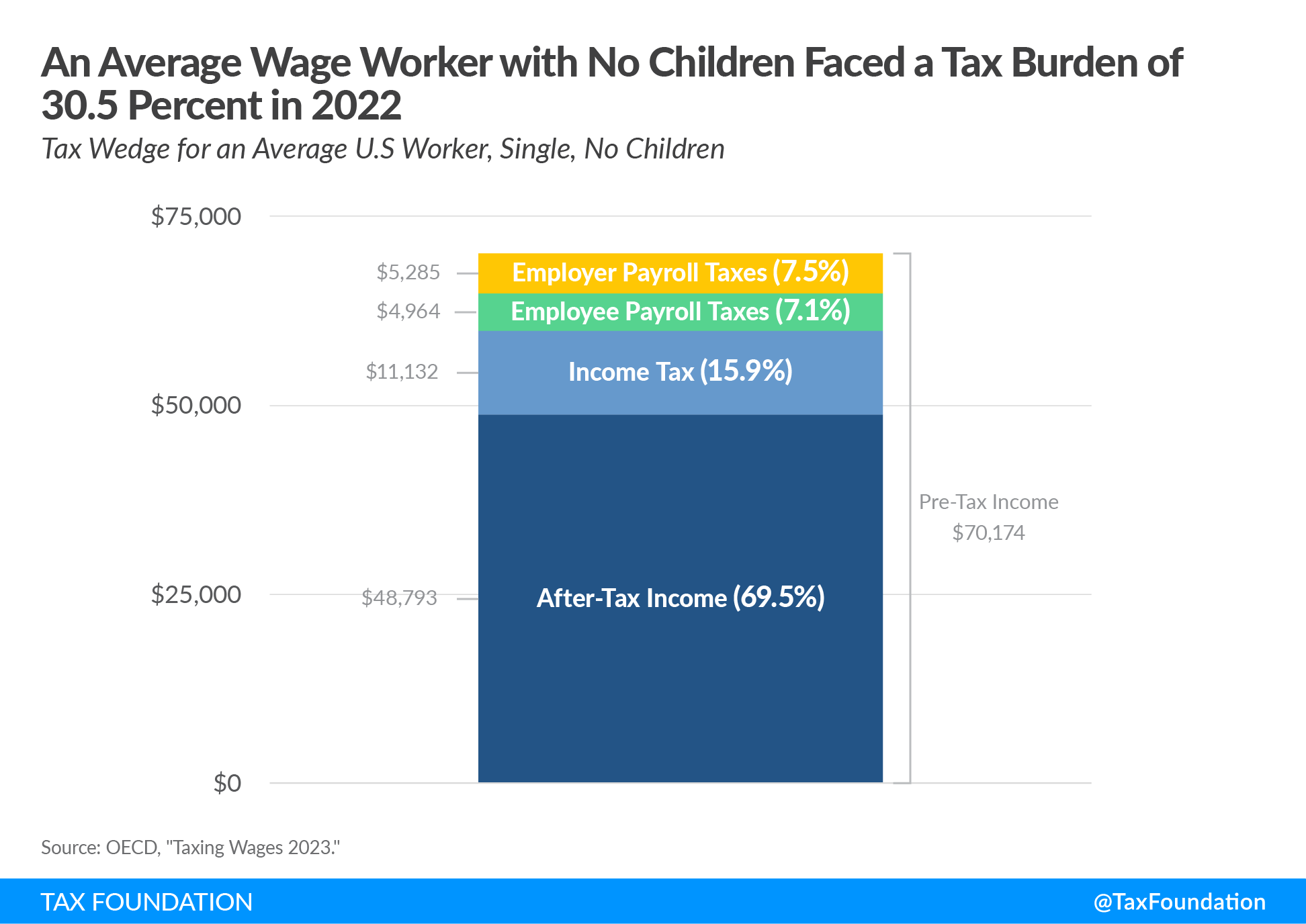

In 2022, the Organisation for Economic Co-operation and Development (OECD) reported that the overall tax burden on an average single worker in the U.S. with $70,170 in pre-tax income was $21,380— amounting to a 30.5 percent tax wedge. This is 4 percentage points lower than the average tax burden on labor for single workers among OECD countries.

The worker’s tax burden includes the income tax share of 15.9 percent of pre-tax income, employee payroll taxes of 7.1 percent, and employer payroll taxes of 7.5 percent. Payroll taxes fund federal programs such as Social Security, Medicare, and Unemployment Insurance (UI).

The tax wedgeA tax wedge is the difference between total labor costs to the employer and the corresponding net take-home pay of the employee. It is also an economic term that refers to the economic inefficiency resulting from taxes. on labor income is the difference between total labor costs to the employer and the net take-home pay of the employee. To calculate a country’s tax wedge, the OECD adds the income tax payment, employee payroll tax payment, and employer-side payroll tax payment of a worker making the country’s average wage. The OECD divides this amount by the total labor cost of this average worker, or what the worker would have earned in the absence of these three taxes. The economic literature finds a negative relationship between a country’s tax wedge and employment rate; as the former increases, the latter decreases.

Personal income taxes in the U.S. are progressive. This means that as individuals earn more, they face higher tax rates on additional income. Currently, the seven income tax brackets range from 10 percent to 37 percent.

However, various provisions in the tax code provide tax reductions for workers, including benefits for families with children and incentives for work. While the tax burden was 30.5 percent for a single worker making the average wage in 2022, that burden was just 19.8 percent for a family with one income earner and two children.

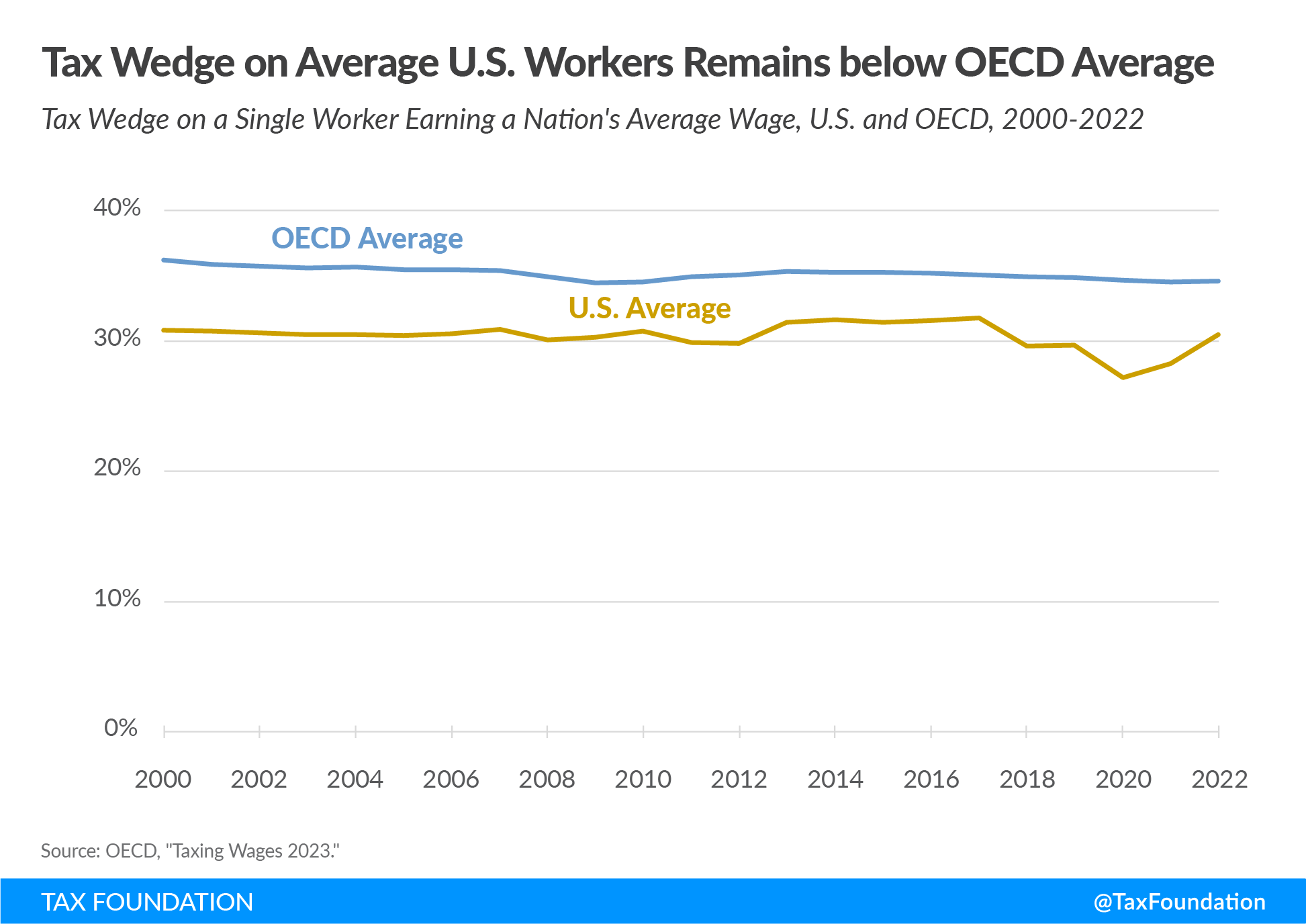

The U.S. tax burden on single workers making the average wage has consistently remained below the OECD average, with the difference expanding slightly in the years since the 2017 Tax Cuts and Jobs Act (TCJA). That difference was largest in 2020 when the U.S. tax burden on workers earning the average wage shrank to 27.2 percent, before rebounding in 2022.

The 2020 low point was partially a result of the economic impact payments that provided direct relief to millions of taxpayers in the United States. There were two rounds of these payments in 2020 and a third round in 2021. Overall, $867 billion in direct payments were provided to taxpayers.

Although the U.S. has a progressive tax system and a relatively low tax burden compared to the OECD average, average-wage workers still pay more than 30 percent of their wages in taxes.

To make the taxation of labor more efficient, policymakers in the U.S. and abroad should understand how the tax wedge is generated, and taxpayers should understand how their tax burden funds government services. This will be particularly important as policymakers explore ways to encourage a robust economic recovery.

Share this article