The Tax Cuts and Jobs Act in 2017 overhauled the federal tax code by reforming individual and business taxes. It was pro-growth reform, significantly lowering marginal tax rates and cost of capital. We estimated it reduced federal revenue by $1.47 trillion over 10 years before accounting for economic growth.

What Were the Major Features of the Tax Cuts and Jobs Act?

Individual

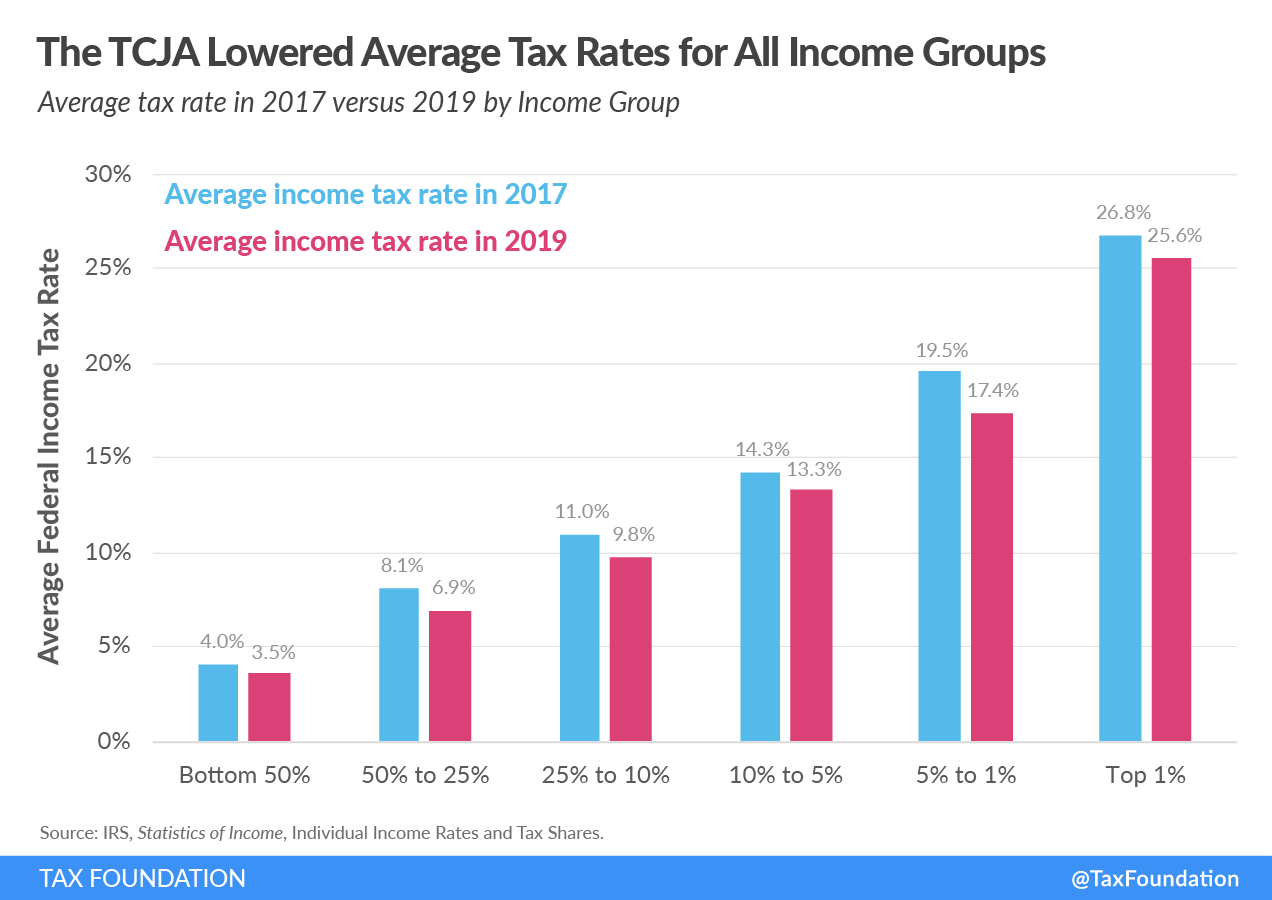

The TCJA lowered most individual income tax rates, including the top marginal rate from 39.6 to 37 percent. The law maintained the seven-bracket rate structure, but the income thresholds were updated. TCJA increased the standard deduction to $12,400 for single filers and $24,800 for married filers (tax year 2020), compared with $6,500 (single) and $9,550 (married) under prior law. The bill eliminated the personal exemption and a variety of other miscellaneous deductions along with limiting certain itemized deductions like the state and local tax (SALT) deduction, mortgage interest deduction (MID), and charitable contribution deduction. TCJA increased the Child Tax Credit (CTC) from $1,000 to $2,000—the first $1,400 of which is refundable—and increased the income thresholds from $110,000 to $400,000.

Most of these changes, among other individual provisions, will expire on December 31, 2025 due to the way Congress passed the legislation. However, some of the individual provisions were made permanent, such as the adoption of chained CPI (an index of a small sample of consumer goods prices meant to measure the effects of inflation on commonly purchased items) and the repeal of the individual mandate under the Affordable Care Act (ACA).

Business

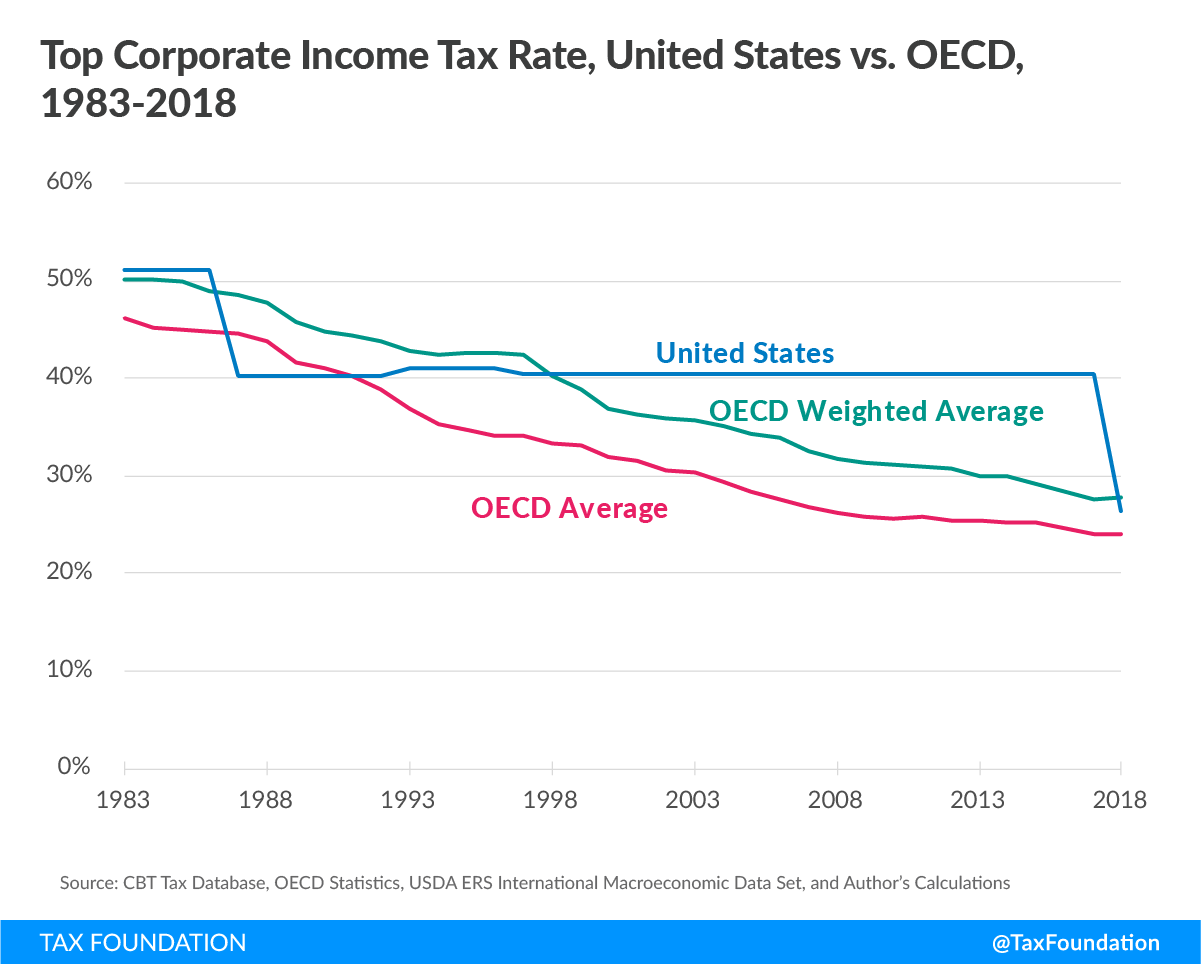

The TCJA lowered the corporate income tax (CIT) rate from 35 to 21 percent starting in 2018. The measure also allows full and immediate expensing of short-lived capital investments for five years and increases the section 179 expensing cap from $500,000 to $1 million. The bill eliminated or curtailed a variety of business taxes and expenditures, including the deductibility of net interest, net operating loss carrybacks and carryforwards, and the corporate alternative minimum tax (AMT). Additionally, the TCJA moved the United States toward a territorial tax system and instituted rules to prevent base erosion.

What Is the Economic Impact of the Tax Cuts and Jobs Act?

According to the Tax Foundation’s Taxes and Growth Model, the Tax Cuts and Jobs Act would increase the long-run size of the U.S. economy by 1.7 percent. The larger economy would result in 1.5 percent higher wages and a 4.8 percent larger capital stock. The tax law would also result in 339,000 additional full-time equivalent jobs.

The larger economy and higher wages are mostly due to the lower cost of capital, encouraging greater investment that leads to greater productivity and higher output and wages.

Stay updated on the latest educational resources.

Level-up your tax knowledge with free educational resources—primers, glossary terms, videos, and more—delivered monthly.

Subscribe