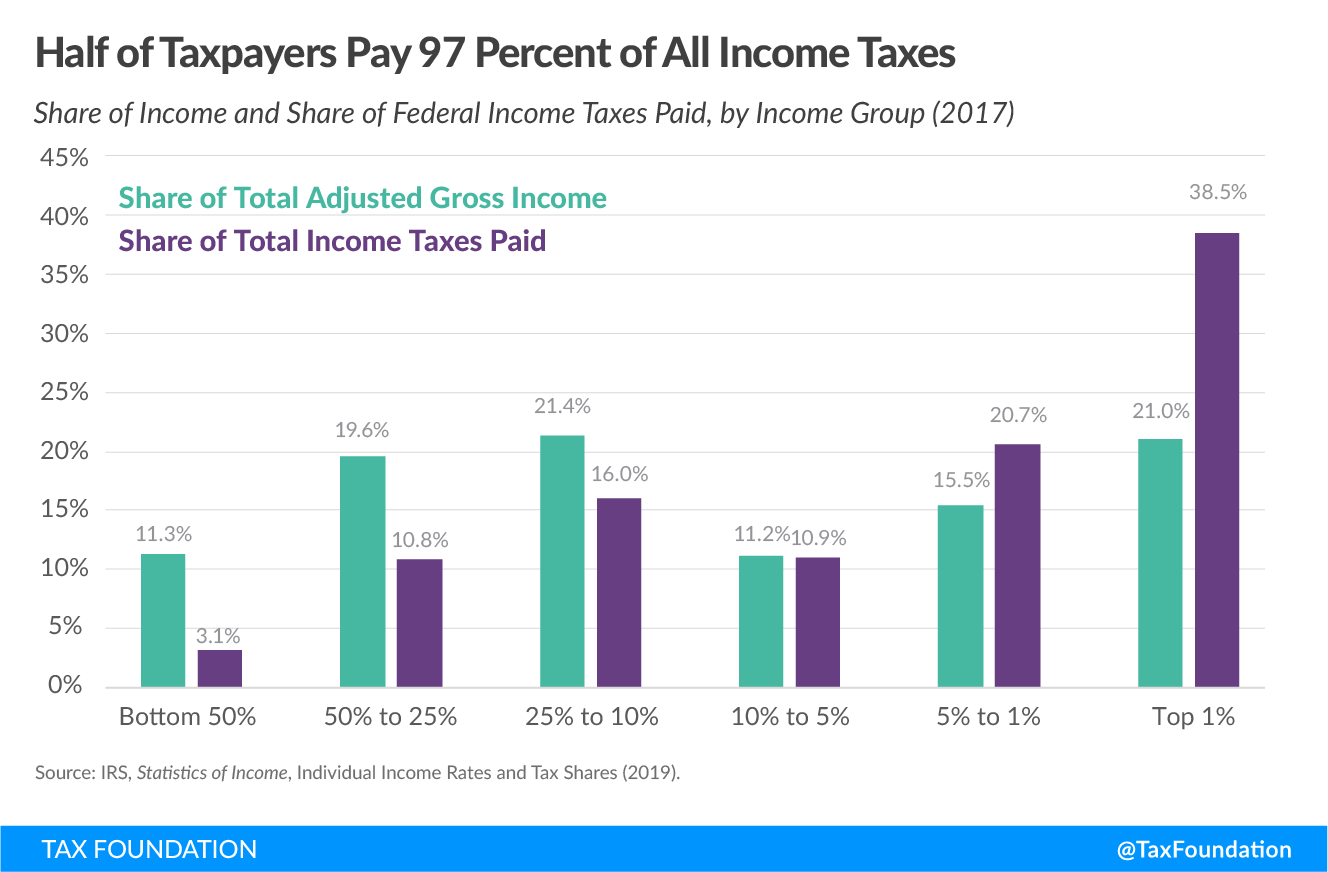

A progressive tax is one where the average tax burden increases with income. High-income families pay a disproportionate share of the tax burden, while low- and middle-income taxpayers shoulder a relatively small tax burden.

What Makes a Tax System Progressive?

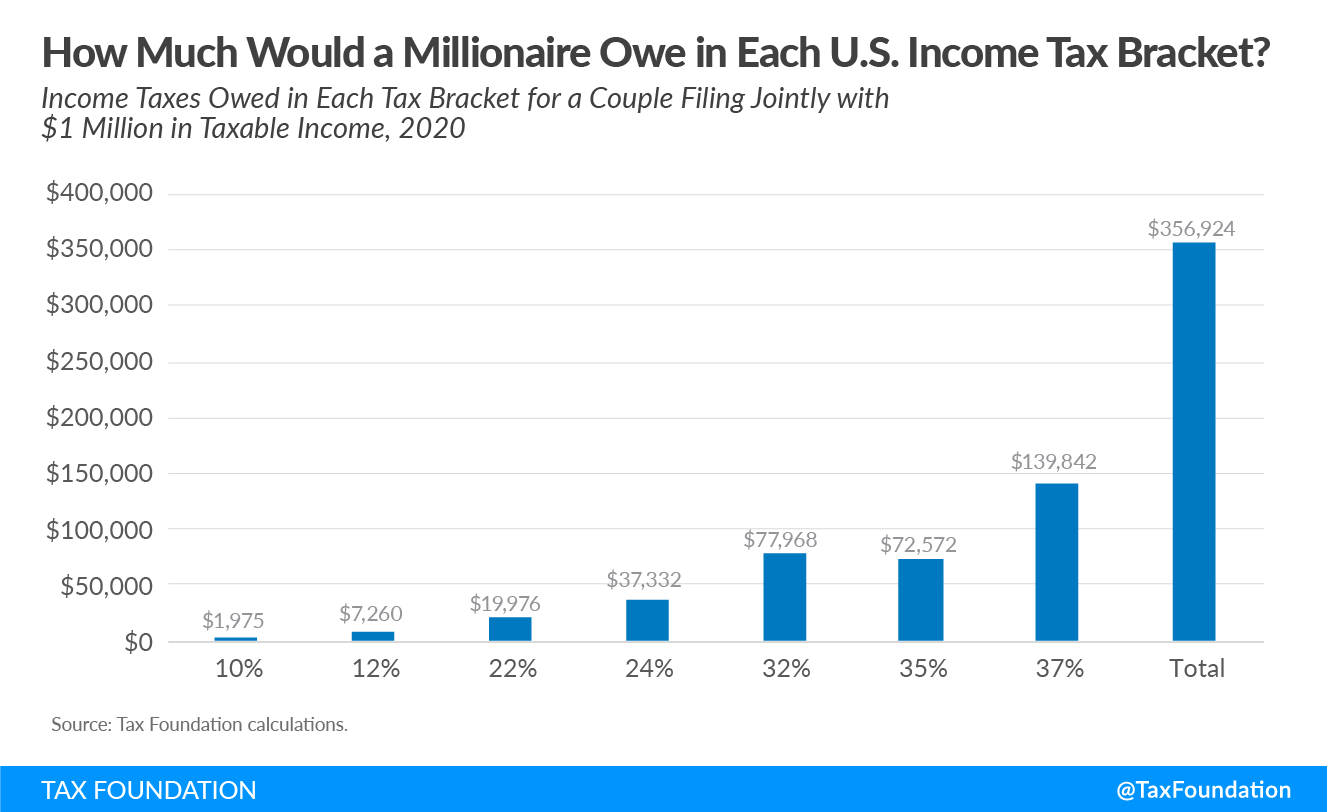

A tax system that is progressive applies higher tax rates to higher levels of income. In the United States, the federal individual income tax has rates that range from 10 percent to 37 percent. This design leads to higher-income individuals paying a larger share of income taxes than lower-income individuals.

| Tax Rate | For Single Filers | For Married Individuals Filing Joint Returns | For Heads of Households |

|---|---|---|---|

| 10% | $0 to $11,600 | $0 to $23,200 | $0 to $16,550 |

| 12% | $11,600 to $47,150 | $23,200 to $94,300 | $16,550 to $63,100 |

| 22% | $47,150 to $100,525 | $94,300 to $201,050 | $63,100 to $100,500 |

| 24% | $100,525 to $191,950 | $201,050 to $383,900 | $100,500 to $191,950 |

| 32% | $191,950 to $243,725 | $383,900 to $487,450 | $191,950 to $243,700 |

| 35% | $243,725 to $609,350 | $487,450 to $731,200 | $243,700 to $609,350 |

| 37% | $609,350 or more | $731,200 or more | $609,350 or more |

| Source: Internal Revenue Service | |||

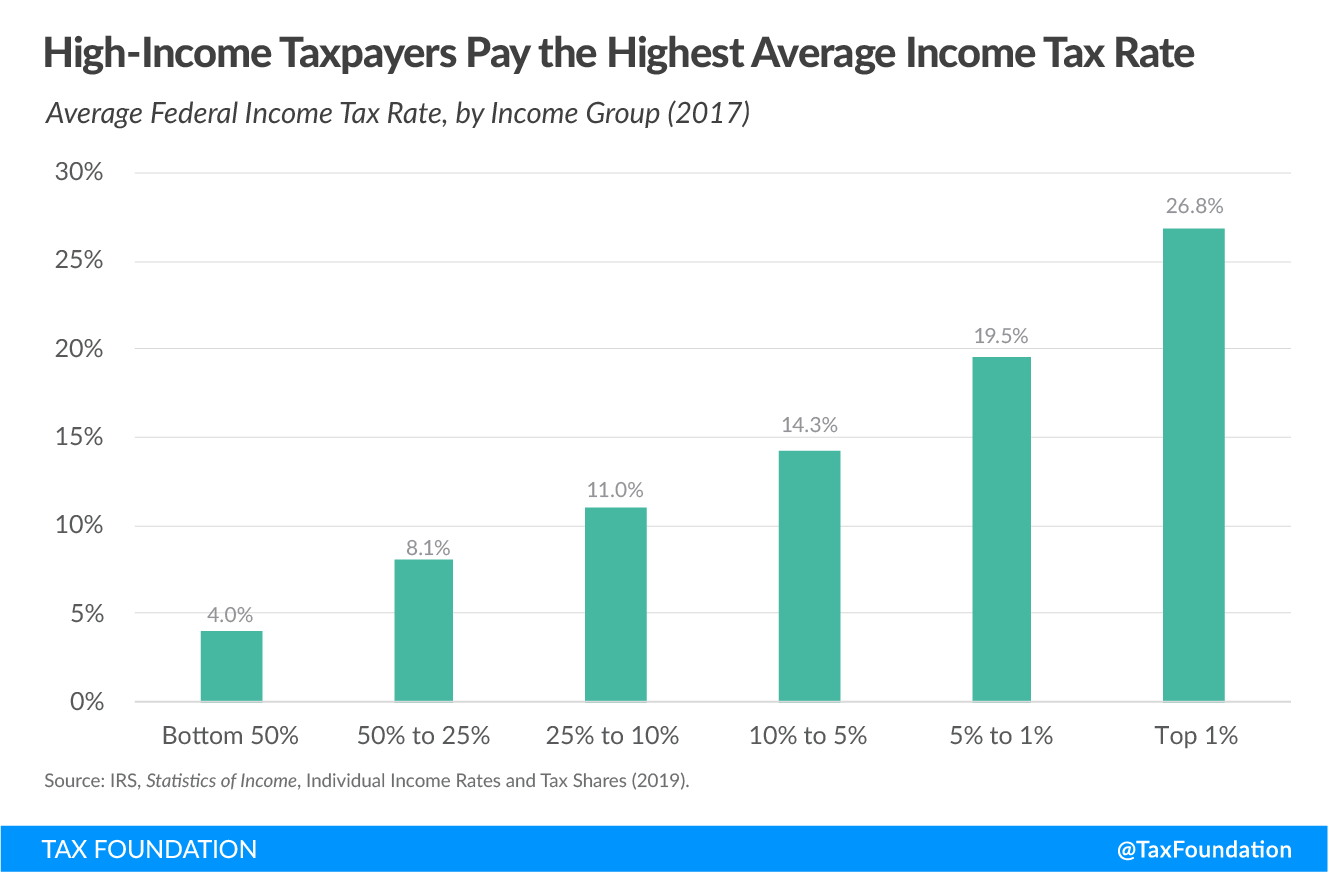

The top 1 percent of taxpayers (AGI of $548,336 and above) paid the highest average income tax rate of 25.99 percent—more than eight times the rate faced by the bottom half of taxpayers in 2020.

In addition to having a federal progressive tax system, many states also apply higher state tax rates to higher-income individuals.

How Progressive Is the U.S. Tax System?

The U.S. has a progressive income tax system that taxes higher-income individuals more heavily than lower-income individuals. Though the top 1 percent of taxpayers earn 19.7 percent of total adjusted gross income, they pay 37.3 percent of all income taxes. Just 3 percent of taxes are paid by the lowest half of income earners.

How Do Progressive Taxes Impact Workers?

Progressive taxes mean that as an individual earns more, they will face higher rates of tax. This acts as a negative incentive on working more. If an individual who is currently in the 12 percent tax bracket would like to work extra hours or take a second job, they could end up facing the 22 percent bracket on their extra earnings. At that higher tax bracket, they would need to work more to achieve their after-tax earnings goals.

Some progressive tax systems apply significantly higher rates of tax to high-income earners. The higher rates can also influence decisions on ways to minimize tax liability by maximizing available deductions and credits or avoiding taxes in other ways.

Stay updated on the latest educational resources.

Level-up your tax knowledge with free educational resources—primers, glossary terms, videos, and more—delivered monthly.

Subscribe