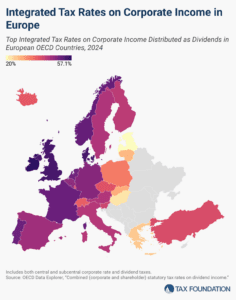

Integrated Tax Rates on Corporate Income in Europe, 2024

In most European OECD countries, corporate income is taxed twice, once at the entity level and once at the shareholder level.

4 min readAlex Mengden is a Policy Analyst at the Tax Foundation, where he focuses on international tax issues and tax policy in Europe. He holds a BA in philosophy and economics from the University of Bayreuth and an MSc in economics from the Ludwig Maximilian University of Munich.

Prior to joining the Tax Foundation, Alex tutored classes in public finance for undergraduate students at LMU Munich. He also worked on economic policy research for IREF Europe and previously interned at the Cato Institute, ifo Institute, and the Institute of Economic Affairs.

He currently lives in Munich, Germany, and spends his free time cooking, reading, and enjoying the outdoors.

In most European OECD countries, corporate income is taxed twice, once at the entity level and once at the shareholder level.

4 min read

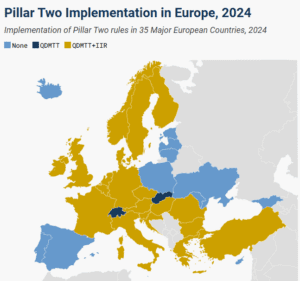

18 of the 27 EU Member States have implemented both the income inclusion rule and the qualified domestic minimum top-up tax in 2024.

4 min read

While there are many factors that affect a country’s economic performance, taxes play an important role. A well-structured tax code is easy for taxpayers to comply with and can promote economic development while raising sufficient revenue for a government’s priorities.

92 min read

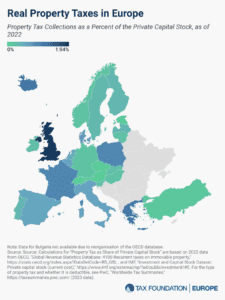

High property taxes levied not only on land but also on buildings and structures can discourage investment in infrastructure, which businesses would have to pay additional tax on.

3 min read

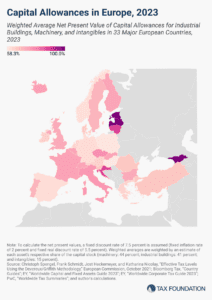

Although sometimes overlooked in discussions about corporate taxation, capital allowances play an important role in a country’s corporate tax base and can impact investment decisions—with far-reaching economic consequences.

4 min read

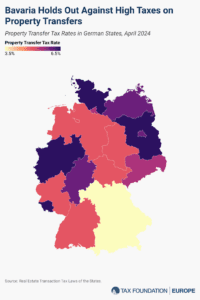

The real estate transaction tax is levied on the gross sales value of a property when it changes ownership, without deductions for investment or purchasing costs. This makes the tax particularly harmful to investment in buildings and structures.

3 min read

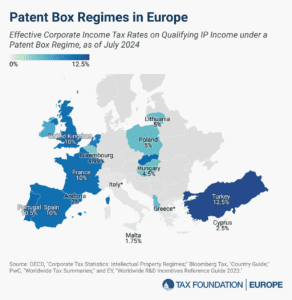

The aim of patent boxes is generally to encourage and attract local research and development (R&D) and to incentivize businesses to locate IP in the country. However, patent boxes can introduce another level of complexity to a tax system, and some recent research questions whether patent boxes are actually effective in driving innovation.

3 min read

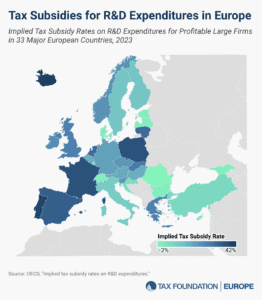

Many countries incentivize business investment in research and development (R&D), intending to foster innovation. A common approach is to provide direct government funding for R&D activity. However, a significant number of jurisdictions also offer R&D tax incentives.

3 min read

Given the positive contribution of full expensing to economic growth and that the UK already incurred the peak-year costs due to the existing policy, it is imperative to maintain it permanently.

5 min read

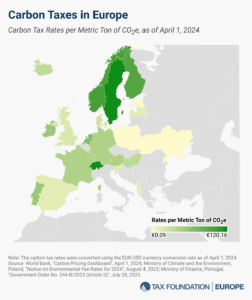

23 European countries have implemented carbon taxes, ranging from less than €1 per metric ton of carbon emissions in Ukraine to more than €100 in Sweden, Liechtenstein, and Switzerland.

3 min read

Rather than adopt temporary policies that phase out and expire, policymakers should focus their efforts on long-term reforms to support investment.

6 min read

To recover from the pandemic and put the global economy on a trajectory for growth, policymakers need to aim for more generous and permanent capital allowances. This will spur real investment and can also contribute to more environmentally friendly production across the globe.

31 min read

Get ready to hit the autobahn and explore the world of German taxes! We’ll navigate the complexities of Germany’s tax structure.

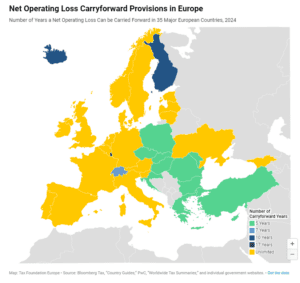

Carryover provisions help businesses “smooth” their risk and income, making the tax code more neutral across investments and over time.

3 min read

Varying local trade tax rates impact business investment and local government revenue across Germany’s municipalities.

4 min read

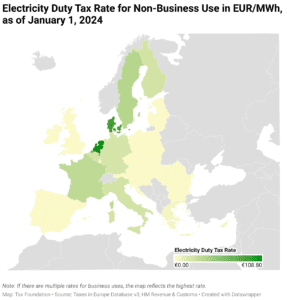

EU Member States should seek to minimize the rate and broaden the base of electricity duties, consolidating their rates to the required minimum rate.

3 min read

Portugal’s personal income tax system levies high tax rates on an unusually narrow set of high earners, striking a poor balance between earnings incentives and revenue contributions.

4 min read

Portugal’s turnover tax on real property transfers places a serious drag on economic growth by making it harder for people to relocate for better jobs and living conditions while constraining investment into the development of housing and buildings.

5 min read

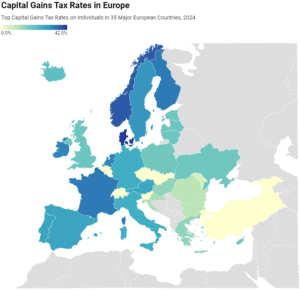

In many European countries, investment income, such as dividends and capital gains, is taxed at a different rate than wage income.

2 min read

Portugal has the second highest top corporate tax rate in the OECD at 31.5 percent, including multiple top-up taxes. Unlike most OECD countries, Portugal imposes a highly progressive tax structure on corporate income.

6 min read