Trump Tariffs: Tracking the Economic Impact of the Trump Trade War

The tariffs amount to an average tax increase of nearly $1,300 per US household in 2025.

38 min readResearch & Analysis

Historical evidence and recent studies show that tariffs are taxes that raise prices and reduce available quantities of goods and services for US businesses and consumers, which results in lower income, reduced employment, and lower economic output. For example, the effects of higher steel prices, largely a result of the Bush administration’s 2002 US steel tariffs, led to a loss of nearly 200,000 jobs in the steel-consuming sector, a loss larger than the total employment in the steel-producing sector at the time. It’s also worth noting that measures of trade flows, such as the trade balance, are accounting identities and should not be misunderstood to be indicators of economic health.

We estimate Trump’s proposed tariffs and partial retaliation from all trading partners would together offset more than two-thirds of the long-run economic benefit of his proposed tax cuts. Explore Trump’s latest trade actions with our Tariff Tracker

The tariffs amount to an average tax increase of nearly $1,300 per US household in 2025.

38 min read

Do tariffs really level the playing field, or are they just bad economics? In this emergency episode, we fact-check the Trump administration’s claims that retaliatory tariffs make trade fairer.

Despite characterizing the tariffs as “reciprocal,” the White House didn’t actually measure tariffs, currency manipulation, or trade barrier policies employed by other countries. Instead, it drew its estimates from something else entirely: bilateral trade deficits in goods.

7 min read

Rather than hurting foreign exporters, the economic evidence shows American firms and consumers were hardest hit by tariffs imposed during President Trump’s first-term.

5 min read

Contrary to the president’s promises, the tariffs will cause short-term pain and long-term pain, no matter the ways people and businesses change their behavior.

5 min read

President Trump has announced that new tariffs will go into effect on April 2, following several weeks of threats. These new tariffs are likely to be broader in scope than the limited ones implemented thus far. So who is likely to pay for them?

7 min read

While tariffs are often presented as tools to enhance US competitiveness, a long history of evidence and recent experience shows they lead to increased costs for consumers and unprotected producers and harmful retaliation, which outweighs the benefits afforded to protected industries.

As we learned in the first trade war, retaliation will exact harm on US exporters by lowering their export sales—and the US-imposed tariffs will directly harm exporters too. US-imposed tariffs can burden exporters by increasing input costs, which acts like a tax on exports.

4 min read

President-elect Trump may want to impose tariffs to encourage investment and work, but his strategy will backfire. Tariffs will certainly create benefits for protected industries, but those benefits come at the expense of consumers and other industries throughout the economy.

5 min read

The Trump administration appears to be moving in a “reciprocal” policy direction despite the significant negative economic consequences for American consumers of across-the-board tariffs on goods coming into the US. However, the EU’s VAT system should not be used as a justification for retaliatory tariffs.

6 min read

We estimate Trump’s proposed tariffs and partial retaliation from all trading partners would together offset more than two-thirds of the long-run economic benefit of his proposed tax cuts.

12 min read

Using tariff policy to reallocate investment and jobs is a costly mistake—that’s a history lesson we should not forget.

6 min read

Lawmakers will need to pursue fiscal responsibility as they address the tax law expirations, but fiscal responsibility requires finding sound ways to pay for spending priorities. Tariffs don’t make the cut.

4 min read

Estimating the economic effects of different types of taxes informs policymakers about the trade-offs of raising revenue in a given way.

5 min read

Can tariffs truly replace income taxes in today’s economy? In this episode, we examine the bold and controversial proposal from former President Trump to replace income taxes with tariffs. What would this dramatic shift mean for everyday Americans, particularly those with lower incomes? And would it actually work?

Our experts explain how this major tax legislation may affect you and how policymakers can better improve the tax code.

24 min read

The administration has a strong desire to boost manufacturing investment and there are many provisions in the new tax bill that support this aim. But the administration’s erratic trade policy is driving up the costs of key inputs that manufacturers rely on to build things in the US.

Our analysis finds that the Trump tariffs threaten to offset much of the economic benefits of the new tax cuts, while falling short of paying for them.

3 min read

The tariffs amount to an average tax increase of nearly $1,300 per US household in 2025.

38 min read

President Trump made clear that the US wouldn’t accept the global minimum tax (known as Pillar Two) from the OECD in its current form.

Policymakers continue to debate international tax rules after the US gained agreement on a new approach at the G7 that could result in US anti-avoidance policies existing side-by-side with the global minimum tax.

4 min read

President Trump signed the One Big Beautiful Bill Act into law on July 4, 2025.

16 min read

Lawmakers are right to be concerned about deficits and economic growth. The best path to address those concerns is to ensure OBBB provides permanent full expensing of capital investment, avoids inefficient tax cuts, and offsets remaining revenue losses by closing tax loopholes and reducing spending.

8 min read

President’s Trump’s policies would throw high-tax states a life raft as they swim against the tide—before potentially hitting all states with a tariff-induced economic tsunami that could force lawmakers’ hands and reverse recent tax relief.

When you hear about tax policy, you may think of the IRS, the agency responsible for collecting federal taxes. But who is responsible for drafting, reviewing, assessing, and passing tax legislation at the federal level?

4 min read

It’s been a whirlwind 24 hours in tariff news: first, a trade court blocked Trump’s sweeping new tariffs, calling them executive overreach. Then, a federal appeals court reinstated them—at least for now. We break down what happened, what’s next, and why it matters.

When governments restrict trade—through tariffs and retaliation—no one truly wins.

The US Ways and Means Committee’s “Big Beautiful Bill” includes a retaliatory provision called Section 899, along with an expansion of the base erosion and anti-abuse tax (BEAT).

7 min read

Lawmakers have a prime opportunity to achieve a more stable economy through the debate about the tax code that is now ramping up.

The Republican party, led by President Trump, has decided that growth is no longer a priority. This is evident in the president’s trade war, the minimal opposition among Republican members of Congress, and the seemingly endless supply of bad policy ideas that will do little to support growth.

The Trump administration advocates an “energy dominance” agenda to boost US energy production and lower costs. Its tariff agenda runs directly counter to it.

5 min read

Catastrophic rhetoric about US manufacturing is not justified. The tariffs are extremely counterproductive. Still, all is not well in the US manufacturing sector. What should we do?

7 min read

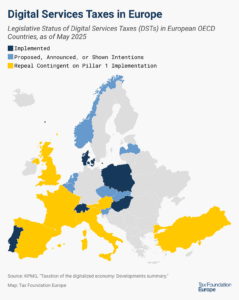

Currently, about half of all European OECD countries have either announced, proposed, or implemented a digital services tax. Because these taxes mainly impact US companies and are thus perceived as discriminatory, the US responded with retaliatory tariff threats.

5 min read

President Trump has repeatedly floated the idea of entirely replacing the federal income tax with new tariffs. Recently, he has said that when tariff revenues come in, he will use them to replace or substantially cut income taxes for people making under $200,000.

8 min read

Could tariffs, a form of government finance heavily relied upon in the 18th and 19th centuries, function as a major source of revenue for a modern, developed economy in the 21st century?

16 min read