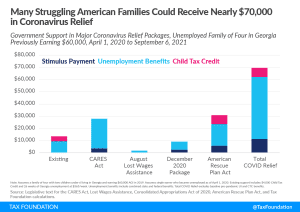

Making the Expanded Child Tax Credit Permanent Would Cost Nearly $1.6 Trillion

As the Biden administration and Congress consider making the expanded child tax credit permanent, a nearly $1.6 trillion expansion of tax code-administered benefits, they should consider financing it in a way that doesn’t create significant headwinds to economic recovery.

3 min read