How the Tax Code Handles Inflation (and How It Doesn’t)

While parts of the U.S. tax code can handle inflation, full expensing of capital investment would be a major improvement along these lines.

5 min read

While parts of the U.S. tax code can handle inflation, full expensing of capital investment would be a major improvement along these lines.

5 min read

Expanding the generosity of tax credits for lower-income individuals can help make the tax code more progressive, but it also reduces federal revenue. Pairing a credit expansion with a tax offset may sustain federal revenue but can also hamper economic growth.

3 min read

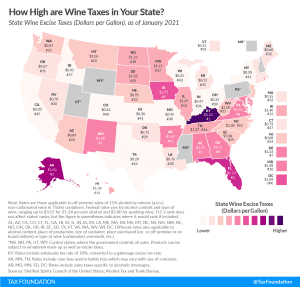

States tend to tax wine at a higher rate than beer but at a lower rate than distilled spirits due to wine’s mid-range alcohol content. You’ll find the highest wine excise taxes in Kentucky at $3.23 per gallon, far above Alaska’s second-place $2.50 per gallon. Those states are followed by Florida ($2.25), Iowa ($1.75), and Alabama and New Mexico (tied at $1.70).

2 min read

New Hampshire lawmakers are scheduled to take up a budget conference report which contains several tax reforms negotiated by both chambers that would ultimately make New Hampshire the ninth state to impose no tax on individual income. These reforms floated at the beginning of the 2021 session found their way into HB 2, including rate reductions in the Business Profits Tax (BPT) and Business Enterprise Tax (BET) and a phaseout of the interest and dividends tax.

4 min read

With many state legislative sessions wrapping up for this year, and a new fiscal year about to begin, it’s a good time to examine some of the 2021 legislative trends—and sports betting taxes are among the more prominent.

5 min read

The Tax Foundation recently submitted regulatory comment on the U.S. Treasury’s state tax cuts limitation rule, highlighting three areas of concern and suggesting revisions to the rule.

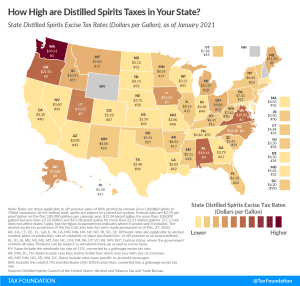

Of all alcoholic beverages subject to taxation, stiff drinks—and all distilled spirits—face the stiffest tax rates. Like many excise taxes, the treatment of distilled spirits varies widely across the states.

2 min read

Explore President Biden budget proposals, including tax and spending in American Jobs Plan and American Families Plan. See Biden tax and spending proposals.

12 min read

Taxes are once again at the forefront of the public policy debate as legislators grapple with how to fund new infrastructure spending, among other priorities. Our tax tracker helps you stay up-to-date as new tax plans emerge from the Biden administration and Congress.

1 min read

The Biden administration has suggested several tax increases for his infrastructure plan. Public infrastructure can help increase economic growth, but by raising taxes on private investment, the net effect on growth may be negative. However, tax options like retaining expensing for private R&D investment or making 100 percent bonus depreciation for equipment permanent would be complementary to the goals of infrastructure spending.

5 min read

While falling short of comprehensively reforming the complex U.S. retirement savings system, House and Senate lawmakers have proposed bipartisan bills to help simplify and expand access to retirement savings accounts to more workers.

4 min read

Early signs indicate that flavors bans will not decrease tobacco consumption. It is not in the interest of the District of Columbia to pursue a public health measure that merely sends tax revenue to its neighboring jurisdictions without improving public health.

3 min read

It took until the last day of the session, but Louisiana lawmakers succeeded in passing a tax reform package Thursday that would simplify a complicated tax code and make the state more economically competitive.

4 min read

As spending priorities are dividing lawmakers trying to negotiate among the various federal infrastructure plans, less time is being spent on the funding of one of the key components—our highways, both current and future taxes and fees. One of the current taxes, a federal excise tax on heavy commercial vehicles and trailers, is an important revenue generator, but its flawed tax design has a negative impact on investment and leads to unstable revenue.

4 min read

Rather than relying on damaging corporate tax hikes, policymakers should consider user fees and consumption taxes as options for financing new infrastructure to ensure that a compromise does not end up being a net negative for the U.S. economy.

2 min read

As Wisconsin emerges from the pandemic, state policymakers have a rare opportunity to reinvest excess revenues in a structurally sound manner that will make the state more attractive to individuals and businesses, promote a quicker and more robust economic recovery, and put the state on the path to increased in-state investment and growth for many years to come.

7 min read

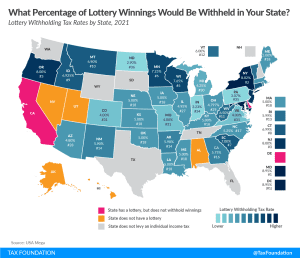

Krispy Kreme may have started the vaccine incentive ball rolling, but many states are putting big money into the effort with vaccine lotteries. Unlike a normal lottery, no one is paying for tickets—but the tax collector still gets paid when someone wins.

3 min read

Policymakers concerned about the current tax treatment of unrealized capital gains would be better off exploring policy solutions like consumption taxes rather than tried-and-failed strategies.

5 min read

In our new Options for Reforming America’s Tax Code 2.0, there are several options that would simplify the tax code, including eliminating the alternative minimum tax (AMT). While this move would remove a source of complexity, policymakers should also consider reforming the deductions that created a justification for the AMT in the first place.

3 min read

Details and analysis of the American Jobs Plan tax proposals. Learn more about the major tax changes in the proposed Biden infrastructure plan.

9 min read