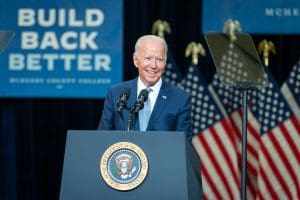

Comparing Three Financing Options for President Biden’s Spending Proposals

While Congress continues to debate how to pay for President Biden’s spending proposals in the fiscal year 2022 budget, it is useful to consider the economic impact of a range of financing options in addition to the President’s proposed tax increases.

3 min read