Add another study to the growing literature of the importance of state taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. policy on economic outcomes. On January 2nd, the D.C. branch of the Federal Reserve released an article by Professor E. Mark Curtis of Wake Forest University and Ryan A. Decker of the Federal Reserve examining how state tax policies impact employment at start-ups. They find that the corporate tax has the most robust identifiable impact on start-ups. In their words:

… [W]e find that increases in corporate tax rates have a statistically and economically significant negative effect on employment among start-up firms. Specifically, for every one percentage point increase in the corporate tax rate, employment in start-up firms declines 3.7 percent.

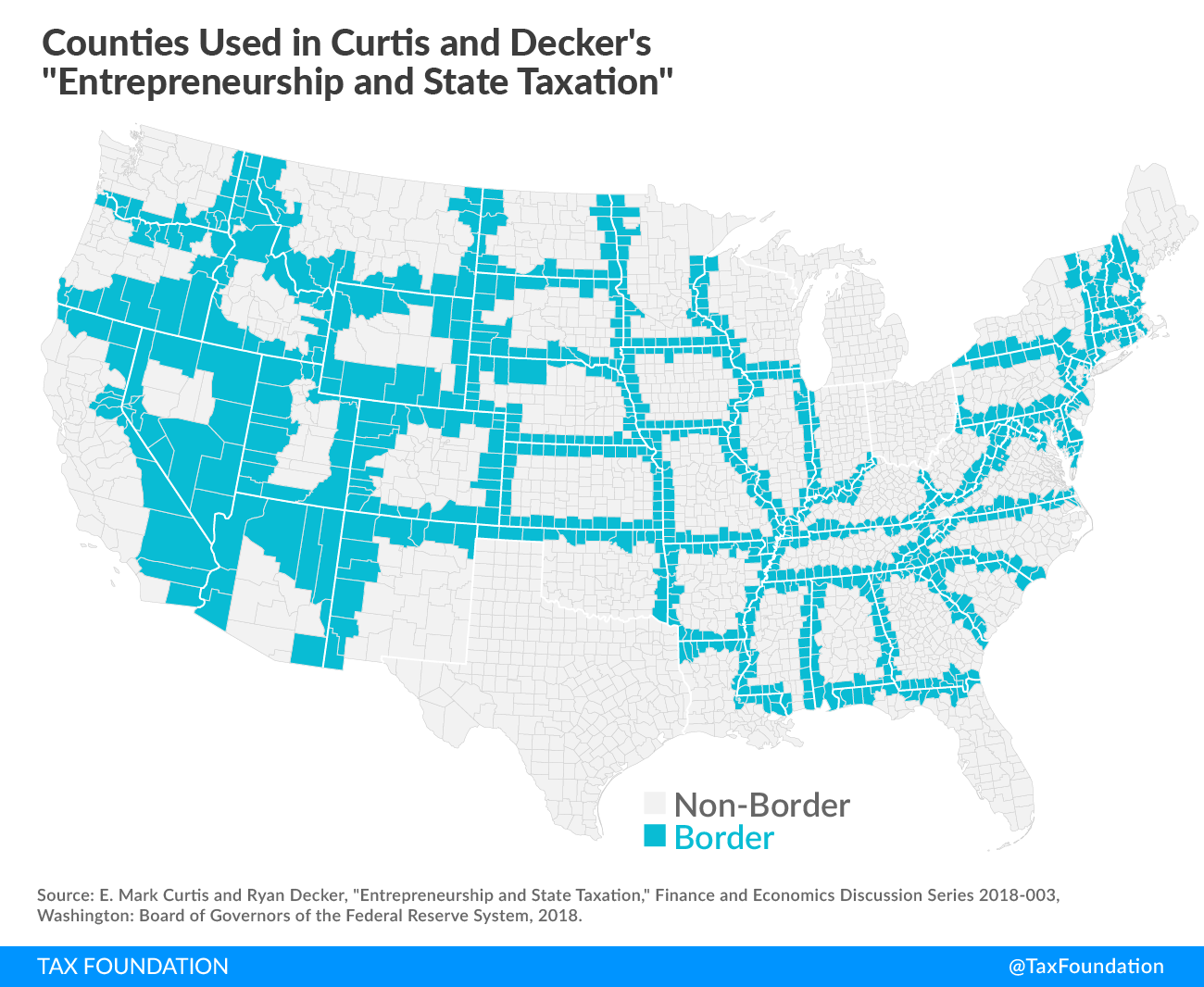

The way the researchers compare policies is quite interesting. Their report uses the newly-constructed Quarterly Workforce Indicators (QWI) firm age dataset, which allows researchers to isolate effects on new versus established firms. It also has local granularity that enables a comparison of economic outcomes in states against adjoining border counties in other states.

In essence, this allows you to hold demographic and industrial characteristics constant (because you are examining areas right next to each other), while examining impacts of changes in policy in one place against another.

Thought of another way, we often compare Illinois to Indiana, or Washington to Oregon, because the states have similar geographical position to one another and industrial makeup, but in some cases broadly different public policies. It makes less sense to compare Illinois to Wyoming or Maine to Nevada. Curtis and Decker employ a border counties comparison across the country for every state, giving them hundreds of observations across 14 observed years (2000-2013).

The finding of the significance of state corporate income taxes is in line with other studies on taxes and growth. Though the Curtis and Decker study only finds statistically significant impacts on start-up employment with regard to corporate income taxes (and does not find statistically significant results for individual income taxes or sales taxes), corporate taxes are generally those that are considered most influential on economic growth in the literature.

For example, Jens Arnold et. al. of the Organisation for Economic Co-operation and Development (OECD) found in an extensive panel review that corporate income taxes are most harmful to growth, followed by personal income taxes, then consumption taxes, and finally property taxes.

By homing in just on the entrepreneurial start-up sector and just on state taxes, Curtis and Decker give us more insight into policies state policymakers can employ to nurture that upstart activity. The full Curtis and Decker study is available here, and worth a read.

Compare corporate taxes in your state

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe