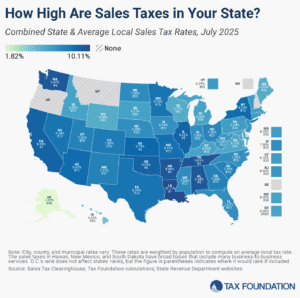

One Big Beautiful Bill Does Better with Permanence, but Is Still Full of Temporary Provisions

Several major new tax breaks are scheduled to expire at the end of 2028, setting the stage for another tax fight to either extend them or allow them to expire.

5 min read