Trump Tariffs: Tracking the Economic Impact of the Trump Trade War

The tariffs amount to an average tax increase of nearly $1,200 per US household in 2025.

38 min read

The tariffs amount to an average tax increase of nearly $1,200 per US household in 2025.

38 min read

The One Big Beautiful Bill Act makes many of the individual tax cuts and reforms of the TCJA permanent. It improves upon the TCJA by making expensing for R&D and equipment permanent. However, for the most part, it does not include further structural reforms, and instead introduces many new, narrow tax breaks to the code, adding complexity and raising revenue costs.

7 min read

Alabama’s 2025 legislative session mostly demonstrates a commitment to pro-growth tax policies that enhance competitiveness and reduce compliance burdens.

5 min read

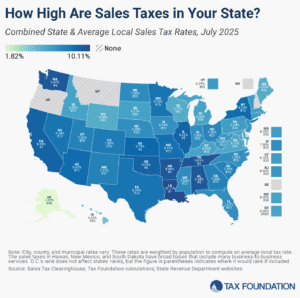

Retail sales taxes are an essential part of most states’ revenue toolkits, responsible for 24 percent of combined state and local tax collections.

17 min read

While well-designed excise taxes can make society better off, some of the health taxes proposed by the WHO use a pretty façade to cover for policies that fail to deliver their promised benefits.

5 min read

We estimate the One Big Beautiful Bill Act would increase long-run GDP by 1.2 percent and reduce federal tax revenue by $5 trillion over the next decade on a conventional basis.

11 min read

President Trump signed the One Big Beautiful Bill Act into law on July 4, 2025.

16 min read

The increased senior deduction with the phaseout would deliver a larger tax cut to lower-middle- and middle-income taxpayers compared to exempting all Social Security benefits from income taxation and would not weaken the trust funds as much. But given the temporary nature of the policy, it would increase the deficit-impact of the reconciliation bills without boosting long-run economic growth.

3 min read

With reports that Republican legislative leaders and Wisconsin Gov. Evers (D) have reached a budget deal for FY 2026 and 2027, it is worth examining two significant tax relief proposals included in the plan.

7 min read

Independence Day is notable for its insistence not just on light taxation, but more importantly on taxation being subject to the consent of the governed through a representative form of government.

4 min read

Tax Foundation Europe’s Sean Bray interviews Dr. Monika Köppl-Turyna, director of the EcoAustria Institute for Economic Research, about the future of the EU tax mix.

14 min read

Congress is racing to pass the One Big Beautiful Tax Bill before the July 4 deadline. In this episode, Kyle Hulehan and Erica York break down what just happened over the weekend, what’s actually in the bill, and what comes next as the House and Senate try to reconcile their differences.

In recent years, several countries have taken measures to reduce carbon emissions, including instituting environmental regulations, emissions trading systems (ETSs), and carbon taxes.

4 min read

The American Revolution was a tax revolt over the power to tax, not over tax burdens. It serves as a reminder that tax policy can have impacts (big and small) that last for centuries.

Summer has arrived, and states are beginning to implement policy changes that were enacted during this year’s legislative session (or that have delayed effective dates or are being phased in over time).

28 min read

If Michiganders are interested in increasing the state’s spending on education or other priorities—and believe that current revenues are insufficient to support such an increase—there are several ways to do so without significantly affecting residents’ incentives to live and work in Michigan.

4 min read

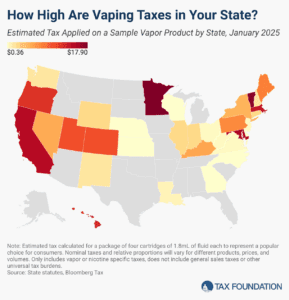

The vaping industry has grown rapidly in recent decades, becoming a well-established product category and a viable alternative to cigarettes for those trying to quit smoking. US states levy a variety of tax structures on vaping products.

7 min read

New Jersey’s residents deserve tax relief, and the state must stem the tide of out-migration. Affordable reforms in the near term could pave the way for more sweeping, and competitive, reforms to take root in the future.

The House-passed reconciliation bill leaves out Trump’s promise to eliminate taxes on Social Security benefits, opting instead to expand the standard deduction for seniors.

If the federal government really wanted to make saving more accessible for taxpayers, it would swap the proposal for Trump Accounts to replace the complicated mess of savings accounts currently available with universal savings accounts.

4 min read