The Fiscal Consequences of Increased German Spending

Without aligning fiscal discipline with pro-growth tax policies, Germany and the EU risk high deficits, mounting debt, and sustained inflation.

5 min read

Without aligning fiscal discipline with pro-growth tax policies, Germany and the EU risk high deficits, mounting debt, and sustained inflation.

5 min read

Daniel Bunn had the opportunity to interview the Vice-Minister for Economy and Finance of Italy, Maurizio Leo, about the tax policy priorities of the Italian government. The conversation shows a commitment to reforming rules that create legal uncertainty and support competitiveness.

5 min read

Without businesses as their taxpayers and tax collectors, governments would not have the resources to provide even the most basic services.

5 min read

Policymakers may consider a broader, more comprehensive property tax reform that creates a uniform system with effective levy limits to prevent unauthorized increases in property tax revenues and, in most cases, property tax bills.

4 min read

New leadership at the FDA will have the opportunity to revisit decisions that have shifted consumption to illicit products and discouraged harm reduction—policies that, however well intended, have come at a significant cost in lives.

7 min read

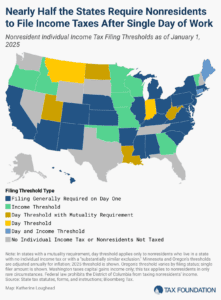

One area of the tax code in which extreme complexity and low compliance go hand-in-hand—and where reform is desperately needed—is in states’ nonresident individual income tax filing and withholding laws.

7 min read

The flat tax trend is gaining momentum nationwide, and Missouri lawmakers are right to identify income tax rate reductions as particularly pro-growth.

4 min read

The tariffs amount to an average tax increase of nearly $1,300 per US household in 2025.

32 min read

The better we understand taxes, the better we can manage our finances, but it starts with familiarizing ourselves with basic tax concepts like how tax brackets work.

3 min read

On April 10, the House adopted the Senate’s amended version of the budget resolution, which allows $5.3 trillion in deficit-financed tax cuts.

8 min read

The trend of tax exemptions on tips, overtime, and bonuses may sound like a win for workers, but it is a shortsighted fix with long-term drawbacks.

11 min read

North Dakota’s financial position provides it with a rare capacity to deliver meaningful property tax relief. However, policymakers must balance immediate relief with fiscal sustainability and ensure that local governments remain adequately funded in the years ahead.

5 min read

If adopted, these reforms would make Kansas’ tax code substantially more competitive while returning revenue growth to taxpayers in a fiscally responsible manner.

4 min read

As Congress attempts to prevent the expiration of major Tax Cuts and Jobs Act provisions, it needs to find ways to pay for them. Ideally, it should use the least economically harmful means possible.

3 min read

The proposed changes to federal tax code conformity in Oregon are a good example of a change that could significantly reshape the state’s tax code in the future, despite being framed as temporary technical adjustments.

4 min read

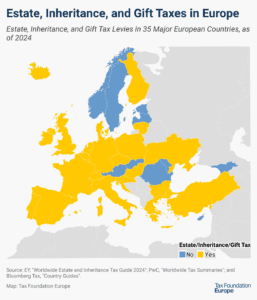

Twenty-four out of the 35 European countries covered in this map currently levy estate, inheritance, or gift taxes.

3 min read

Lawmakers are right to enact a single-rate individual income tax. However, lawmakers should consider the full effects of the reform, ensuring that relief is not financed by shifting the tax burden to lower-income individuals and families.

4 min read

Among the many other tax proposals being considered in Washington this year, policymakers have proposed separate bills that would impose a carbon tax on cigarettes and implement a state-wide flavor ban on tobacco products.

3 min read

Do tariffs really level the playing field, or are they just bad economics? In this emergency episode, we fact-check the Trump administration’s claims that retaliatory tariffs make trade fairer.

What are the biggest tax stories shaping policy today—and what do they mean for you? In our 100th episode, we break down the five biggest tax stories, from the global tax deal to the looming expiration of the Tax Cuts and Jobs Act.