All Related Articles

Summary of the Latest Federal Income Tax Data, 2020 Update

The latest IRS data shows that the U.S. individual income tax continues to be very progressive, borne primarily by the highest income earners. The top 1 percent of taxpayers pay a 26.8 percent average individual income tax rate, which is more than six times higher than taxpayers in the bottom 50 percent (4.0 percent).

6 min read

Recent Study on Financial Transaction Taxes Understates their Economic Harm

FTTs are unreliable sources of revenue and can increase risky financial activities. When looking to address income inequality and raise revenue, lawmakers should look to alternatives to this complicated and distortive tax.

5 min read

Bloomberg’s Financial Transaction Tax (FTT) Proposal Revives Bad Policy

In a way, one should sometimes be most wary of taxes with a very, very, very low rate. It suggests a certain hesitance on the part of the policymaker, as if he knows he’s playing with something potentially very damaging.

4 min read

Sources of Government Revenue in the OECD, 2020

OECD countries have on average become more reliant on consumption taxes and less reliant on individual income taxes. These policy changes matter, considering that consumption-based taxes raise revenue with less economic damage and distortionary effects than taxes on income.

13 min read

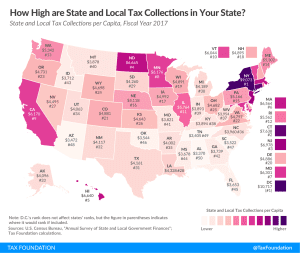

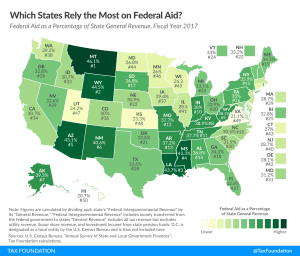

Facts and Figures 2020: How Does Your State Compare?

Our updated 2020 edition of Facts & Figures serves as a one-stop state tax data resource that compares all 50 states on over 40 measures of tax rates, collections, burdens, and more.

1 min read

Banning Flavored Tobacco Could Have Unintended Consequences

The prospect of a ban on flavored tobacco and nicotine products highlights the complications of contradictory tax and regulatory policy, the instability of excise taxes that go beyond pricing in the cost of externalities, and the public risks of driving consumers into the black market through excessive taxation or regulation.

6 min read

Analysis of Democratic Presidential Candidate Payroll Tax Proposals

Several 2020 Democratic presidential candidates have proposed changes to federal payroll tax rates and the Social Security payroll tax wage base to raise revenue and maintain solvency for major federal entitlement programs.

24 min read

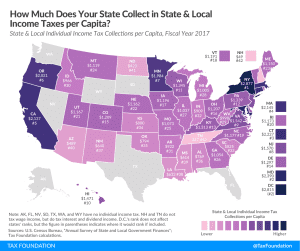

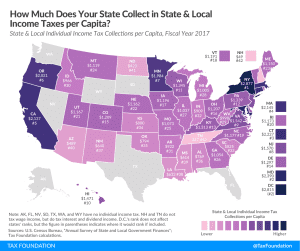

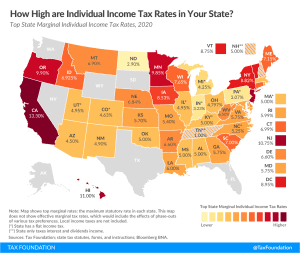

State Individual Income Tax Rates and Brackets, 2020

Individual income taxes are a major source of state government revenue, accounting for 37 percent of state tax collections in fiscal year (FY) 2017. Several states had notable individual income tax changes in 2020: Arizona, Arkansas, Massachusetts, Michigan, Minnesota, North Carolina, Ohio, Tennessee, Virginia, and Wisconsin.

9 min read