Facts and Figures 2020: How Does Your State Compare?

Our updated 2020 edition of Facts & Figures serves as a one-stop state tax data resource that compares all 50 states on over 40 measures of tax rates, collections, burdens, and more.

1 min read

Our updated 2020 edition of Facts & Figures serves as a one-stop state tax data resource that compares all 50 states on over 40 measures of tax rates, collections, burdens, and more.

1 min read

The prospect of a ban on flavored tobacco and nicotine products highlights the complications of contradictory tax and regulatory policy, the instability of excise taxes that go beyond pricing in the cost of externalities, and the public risks of driving consumers into the black market through excessive taxation or regulation.

6 min read

Several 2020 Democratic presidential candidates have proposed changes to federal payroll tax rates and the Social Security payroll tax wage base to raise revenue and maintain solvency for major federal entitlement programs.

24 min read

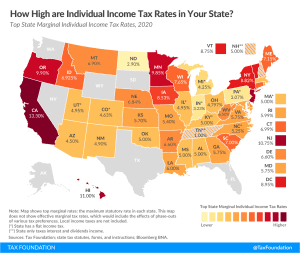

Individual income taxes are a major source of state government revenue, accounting for 37 percent of state tax collections in fiscal year (FY) 2017. Several states had notable individual income tax changes in 2020: Arizona, Arkansas, Massachusetts, Michigan, Minnesota, North Carolina, Ohio, Tennessee, Virginia, and Wisconsin.

9 min read

New modeling finds that the wealth taxes proposed by Sen. Warren and Sen. Sanders would raise significantly less revenue than promised, face serious administrative and compliance challenges, and would increase foreign ownership of U.S. capital.

38 min read

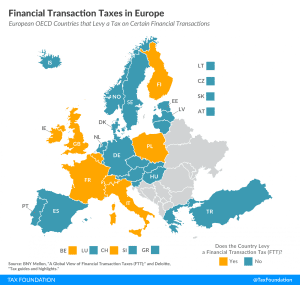

Policymakers should exercise caution in deciding whether to enact an FTT given the uncertainty regarding the FTT’s ability to raise revenue and the significant damage it could cause to the U.S. financial system

39 min read

When considering options to eliminate the deferral advantage of capital gains taxation, a lookback charge provides a reasonable solution for taxing hard-to-value assets. However, policymakers need to understand the limitations of a lookback charge compared to both mark-to-market taxation and the current system.

16 min read

New nicotine products, along with a greater consciousness about the dangers of smoking, have prompted millions to give up smoking. This has contributed to federal and state excise tax collections on tobacco products declining since 2010. Our new report outlines the best way to tax nicotine products based on health outcomes and revenue stability.

49 min read

While many factors influence business location and investment decisions, sales taxes are something within lawmakers’ control that can have immediate impacts.

12 min read