Colorado Proposition 116: Will Voters Reduce the State Income Tax Rate?

This Election Day, Colorado voters will weigh in on Proposition 116, which would permanently reduce the state’s flat income tax rate from 4.63 to 4.55 percent.

2 min read

This Election Day, Colorado voters will weigh in on Proposition 116, which would permanently reduce the state’s flat income tax rate from 4.63 to 4.55 percent.

2 min read

After six unsuccessful tries at passage, it appears the coronavirus crisis has tipped the scales in favor of Gov. Phil Murphy’s (D) millionaires tax. New Jersey may be feeling the financial squeeze right now, but this large income tax change will not solve budget problems and may exacerbate funding issues by making the state even unfriendlier to businesses.

3 min read

One of the many policy questions Colorado voters will be tasked with deciding this November is whether to amend the state constitution to repeal the Gallagher Amendment, a provision within the Colorado constitution that, since 1982, has limited residential property to 45 percent of the statewide property tax base. Repealing the Gallagher Amendment would cause residential property taxes to rise over time but would also enhance the neutrality and overall competitiveness of the tax code.

4 min read

Making the Tax Cuts and Jobs Act’s individual provisions permanent combined with a carbon tax can be a revenue-neutral trade and increase the long-run size of the economy by 1 percent, making it a sustainable pro-growth option.

23 min read

Legalizing recreational marijuana is a hot topic in many states where the state budgets are in disarray because of the coronavirus pandemic and new revenue sources are being sought.

7 min read

A recent OECD report on 2020 tax reforms reveals an increase in the number of environmentally-related tax policies, including gas taxes, carbon taxes, and taxes on electricity consumption.

5 min read

Depending on the outcome of the 2020 presidential election, we could be looking at a very different tax code in the years to come. What tax changes has former Vice President Joe Biden proposed and what would they mean for U.S. taxpayers, businesses, and the overall economy?

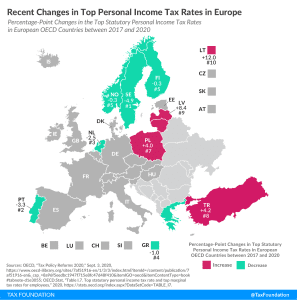

Ten European OECD countries recently changed their top personal income tax rates. Of the ten countries, six cut their top personal income tax rates while the other four raised their top rates.

4 min read

On Election Day this year, California voters will vote on Proposition 15, a ballot measure that would create a “split roll” property tax system in the Golden State, increasing taxes on just commercial property by $8 billion to $12.5 billion.

15 min read

Sweden’s 2021 budget outlines an aggressive plan to both cut income taxes in a permanent manner alongside multiple other tax cuts and spending increases

3 min read

Implemented in 1991, Sweden’s carbon tax was one of the first in the world. Since then, Sweden’s carbon emissions have been declining, while there has been steady economic growth. Today, Sweden levies the highest carbon tax rate in the world and its carbon tax revenues have been decreasing slightly over the last decade.

21 min read

The pandemic precipitated the steepest decline in economic output and employment in recent history, which is leading to a drop in tax revenue. At the same time, the federal response to the crisis is producing a large increase in spending. This combination will cause the federal budget deficit to spike.

5 min read

While there are legitimate reasons for increasing and levying excise taxes, legislatures should proceed with caution in the aftermath of the pandemic. Importantly, revenue from increased excise taxes should generally be allocated to spending related to the negative externalities as that revenue is too volatile and unreliable to rely on for long-term budget priorities.

3 min read

The House Republican Study Committee released a proposal, “Reclaiming the American Dream,” which includes 118 policy recommendations to address education, labor, and welfare policy with the aim of expanding opportunity, liberty, and free enterprise for all Americans.

7 min read

Joe Biden recently released a piece reviewing his tax proposals, contrasting them with President Donald Trump’s tax ideas. A major theme within this piece can be summarized in the title: “A Tale of Two Tax Policies: Trump Rewards Wealth, Biden Rewards Work.”

4 min read

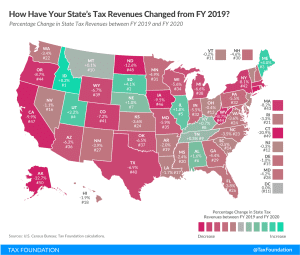

State tax revenue collections were down 5.5 percent in FY 2020, driven by a dismal final quarter (April through June) as states began to feel the impact of the COVID-19 pandemic. While these early losses are certainly not desirable, they are manageable and far better than many feared.

16 min read

A recent OECD report reveals a tendency towards higher property taxes, often in the form of base broadening, tax rate increases, or both.

5 min read

Even during a crisis when budgets are squeezed, policymakers should put their efforts into serious reforms of existing income and consumption taxes rather than leaving good tax policy behind for an excise state of mind.

6 min read

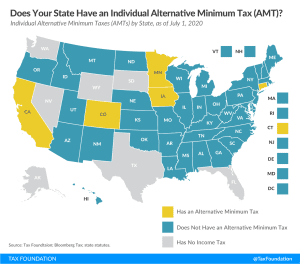

Under an individual AMT, many taxpayers are required to calculate their income tax liability under two different systems and pay the higher amount.

2 min read

As the NYSE prepares to conduct a test of their server capacity elsewhere, New Jersey lawmakers may be forced to rethink the viability of their financial transaction tax proposal.

4 min read