Survey Says Tax Confusion

All Americans are affected by the tax code—but do they understand the tax code?

All Americans are affected by the tax code—but do they understand the tax code?

EU Member States should seek to minimize the rate and broaden the base of electricity duties, consolidating their rates to the required minimum rate.

3 min read

Despite taxes playing a significant role in personal finances and being levied on a sizable portion of the U.S. population, most Americans are not just unhappy with the current tax code but also do not understand it.

4 min read

With proposals to adopt the nation’s highest corporate income tax, second-highest individual income tax, and most aggressive treatment of foreign earnings, as well as to implement an unusually high tax on property transfers, Vermont lawmakers have no shortage of options for raising taxes dramatically.

7 min read

Portugal’s personal income tax system levies high tax rates on an unusually narrow set of high earners, striking a poor balance between earnings incentives and revenue contributions.

4 min read

Facts & Figures serves as a one-stop state tax data resource that compares all 50 states on over 40 measures of tax rates, collections, burdens, and more.

2 min read

The federal income tax drives the tax code’s progressivity. In 2021, taxpayers with higher incomes paid much higher average income tax rates than taxpayers with lower incomes.

4 min read

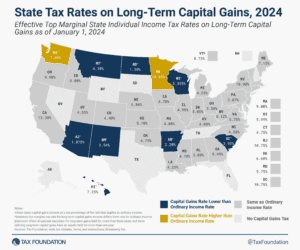

Savings and investment are critical activities, both for individuals’ and families’ financial security and for the health of the national economy as a whole. As such, policymakers should consider how they can help mitigate—rather than add to—tax codes’ biases against saving and investment.

5 min read

With state tax revenues receding from all-time highs, there’s been a great deal of handwringing about whether states can afford the tax cuts adopted over the past few years. Given that 27 states reduced the rate of a major tax between 2021 and 2023, is there reason for concern?

4 min read

Given that U.S. debt is roughly the size of our annual economic output, policymakers will face many tough fiscal choices in the coming years. The good news is there are policies that both support a larger economy and avoid adding to the debt.

6 min read

Different taxes have different economic effects, so policymakers should always consider how tax revenue is raised and not just how much is raised.

3 min read

In the context of the 2024 election year, what does President Biden’s 2025 budget proposal signify regarding his strategies and priorities as he seeks reelection? And how could these proposals shape the overall landscape of this election cycle?

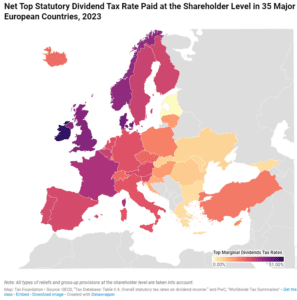

In many countries, corporate profits are subject to two layers of taxation: the corporate income tax at the entity level when the corporation earns income, and the dividend tax or capital gains tax at the individual level when that income is passed to its shareholders as either dividends or capital gains.

2 min read

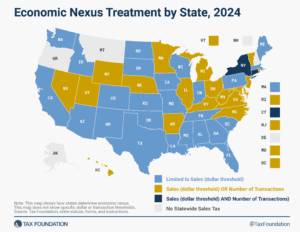

Reforming economic nexus thresholds would not only be better for businesses but for states as well. It is more cost-effective for states to focus on—and simplify—compliance for a reasonable number of sellers than to impose rules that have low compliance and are costly to administer.

4 min read

Designing tax policy in a way that sustainably finances government activities while minimizing distortions is important for supporting a productive economy.

3 min read

The “Bring Chicago Home” ballot measure would make Chicago’s tax structure substantially less neutral by raising taxes on some property transfers while decreasing taxes on others.

7 min read

Portugal’s turnover tax on real property transfers places a serious drag on economic growth by making it harder for people to relocate for better jobs and living conditions while constraining investment into the development of housing and buildings.

5 min read

If student athletes are taxed on their earnings, it’s time the NCAA should be taxed on theirs.

The 2021 tax year was the fourth since the Tax Cuts and Jobs Act (TCJA) made many significant, but temporary, changes to the individual income tax code to lower tax rates, widen brackets, increase the standard deduction and child tax credit, and more.

9 min read