Taxes impact every American in one way or another. The IRS reported more than 162 million individual income taxAn individual income tax (or personal income tax) is levied on the wages, salaries, investments, or other forms of income an individual or household earns. The U.S. imposes a progressive income tax where rates increase with income. The Federal Income Tax was established in 1913 with the ratification of the 16th Amendment. Though barely 100 years old, individual income taxes are the largest source of tax revenue in the U.S. returns filed in 2023, and research from the Joint Committee on Taxation (JCT) estimates around 90 percent of the U.S. population is represented annually on these returns.. And when you include the other federal taxes (like corporate, payroll, excise, and estate taxes), no one is left untouched.

All Americans are affected by the taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. code—but do they understand the tax code?

To find out, the Tax Foundation’s educational program, TaxEDU, and Center for Federal Tax Policy conducted a poll with Public Policy Polling. The poll surveyed more than 2,700 U.S. taxpayers over 18 years old—spanning the political spectrum and income distribution—to gauge Americans’ knowledge of basic tax concepts and opinions of the current tax code.

The results: most Americans are confused by and dissatisfied with the federal tax code.

Most U.S. Taxpayers Do Not Understand the Federal Tax Code

Tax literacy was a focal point of the poll for two reasons: taxpayers should understand the taxes that impact their daily lives and financial decision-making, and knowledge helps improve the tax policy debate, leading to more sound tax policy.

The poll results showed that:

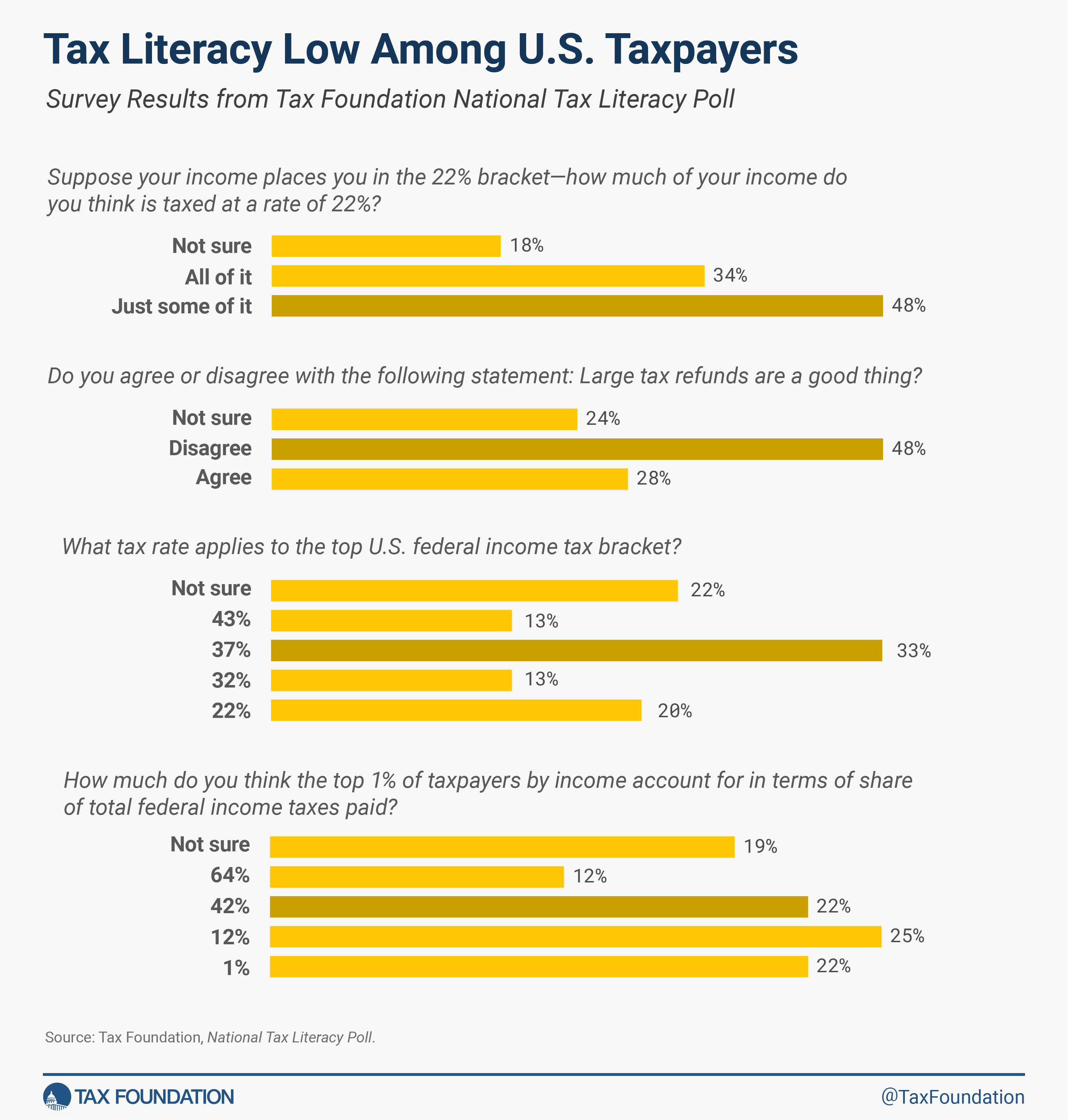

On average, over 61 percent of respondents did not know or were not sure of basic tax concepts related to income tax filing.

When surveyed about federal income tax rates, more than two-thirds of respondents did not know the top federal income tax rate and over half did not know how tax brackets work.

When asked which was more valuable: a $1,000 tax creditA tax credit is a provision that reduces a taxpayer’s final tax bill, dollar-for-dollar. A tax credit differs from deductions and exemptions, which reduce taxable income rather than the taxpayer’s tax bill directly. or a $1,000 tax deductionA tax deduction allows taxpayers to subtract certain deductible expenses and other items to reduce how much of their income is taxed, which reduces how much tax they owe. For individuals, some deductions are available to all taxpayers, while others are reserved only for taxpayers who itemize. For businesses, most business expenses are fully and immediately deductible in the year they occur, but others, particularly for capital investment and research and development (R&D), must be deducted over time. , 64 percent of respondents answered incorrectly or were unsure which provided more value when filing.

When asked about concepts frequently included in tax discussions in the media or popular discourse, 78 percent did not know the share the top 1 percent of earners pay in taxes and only 48 percent understood tax refunds were nothing to celebrate.

These results reveal a general lack of tax literacy among U.S. taxpayers.

Americans Generally Dissatisfied with Tax Code

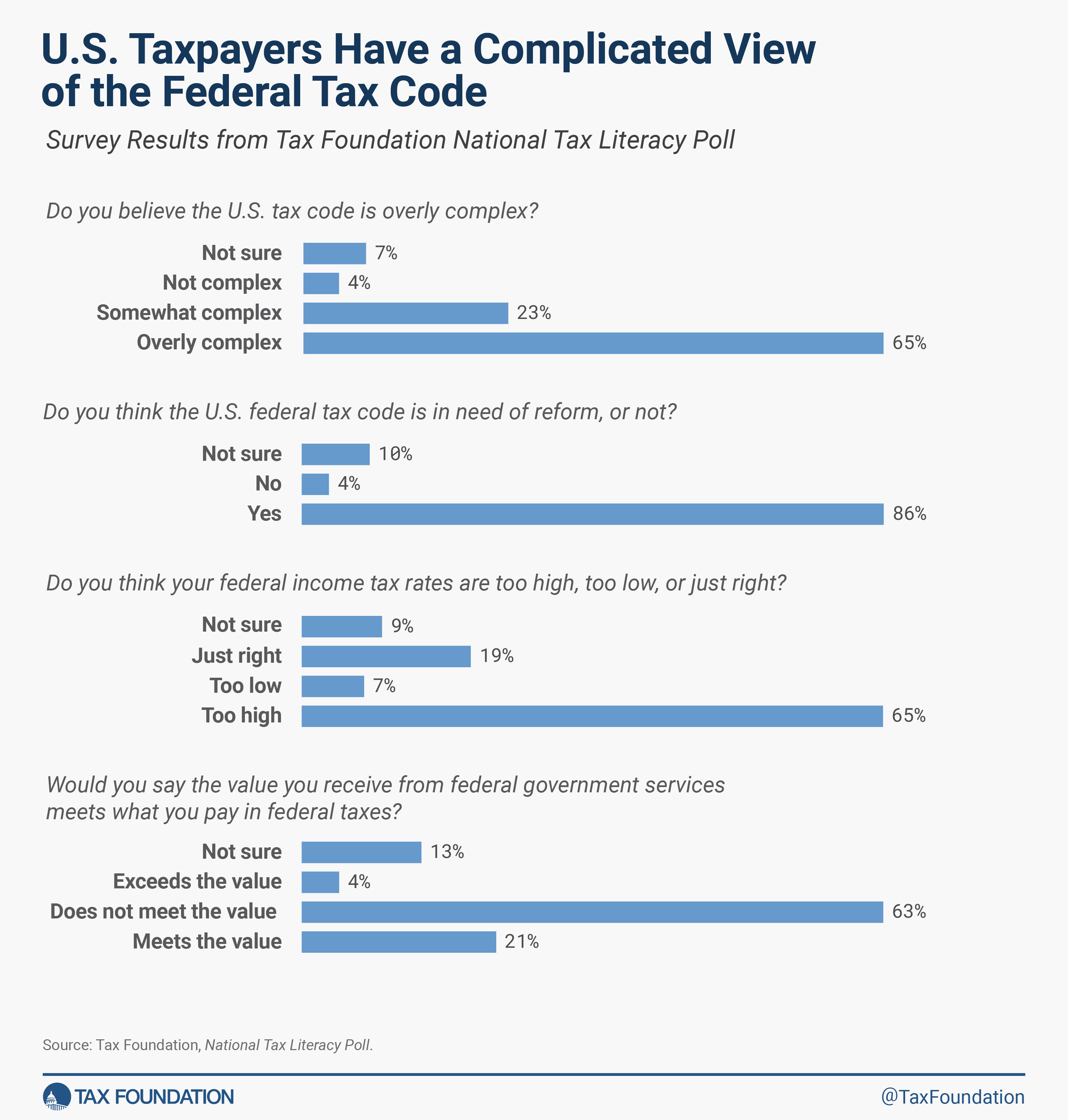

The survey also helps understand taxpayers’ attitudes about the U.S. tax code, which may be influenced by misunderstandings of how taxes work.

Across the political spectrum, the results showed a general dissatisfaction with the current tax code. About two-thirds of respondents indicated the tax code is unfair and about the same share say it is overly complex, while 86 percent believe the tax code needs reform.

When examining the popularity of different tax reforms, the poll found:

71 percent support lowering the top income tax rate, yet 54 percent of respondents want high earners to pay more in taxes.

The contradictions in some responses in this portion of the survey confirm the results from the tax literacy section: the general public tends to misunderstand how taxes work.

Many of the responses point to a desire for lower taxes overall. Two-thirds of respondents think their own income taxes are too high. This sentiment has increased in the past 15 years—of those surveyed in 2009, only 56 percent expressed their income taxes were too high. As well, 63 percent believe what they pay in federal taxes exceeds the value received from government services.

This survey reveals how, despite taxes playing a significant role in personal finances and being levied on a sizable portion of the U.S. population, most Americans are not just unhappy with the current tax code but also do not understand it. Education is the first step in achieving more accurate and productive conversations about taxes, more informed financial decision-making, and even better tax policies.

Note: This is the first in a series of blog posts about the Tax Foundation’s National Tax Literacy Poll. A full analysis will be released at the end of the series. The survey data is available upon request at this time and will be accessible via our website with the release of the full analysis.