All Related Articles

States Explore Taxing Carried Interest

3 min read

Getting “Real” by Indexing Capital Gains for Inflation

Many elements of the income tax are adjusted for inflation, such as tax brackets, but the purchase price of assets that are later sold for capital gains or losses is not. Here’s the case for changing that.

17 min read

State Individual Income Tax Rates and Brackets, 2018

Individual income tax rates and brackets vary widely by state. Keep track of top marginal income tax rates in your state and others with our new guide.

4 min read

Tax Foundation Brief in Wayfair Online Sales Tax Case: SCOTUS Should Set Meaningful Limits on State Taxing Power

In the South Dakota v. Wayfair online sales tax case, the U.S. Supreme Court should ensure that state sales tax laws don’t burden interstate commerce.

3 min read

Sources of Personal Income, Tax Year 2015

Taxpayers reported $10.4 trillion of total income on their 2015 tax returns. This report breaks down the sources of this income: wages and salaries, business income, investment income, and retirement income.

9 min read

Watch: Tax Foundation Excise Tax Event

1 min read

Tax Reform Moving Quickly in Georgia

In response to federal tax reform, Georgia is poised to reform its own tax code in a way that would make the state more competitive with its neighbors.

3 min read

Idaho Tax Reform Bill Advances

3 min read

Tax Compliance Burden Could Cost America as much as 1.2 Percent of its GDP

The time and effort associated with tax compliance is a drag on the economy, as researchers have shown. Will the Tax Cuts and Jobs Act reduce that burden?

3 min read

Marriage Penalties and Bonuses under the Tax Cuts and Jobs

The marriage penalty and the marriage bonus are each ways that the income tax code violates the principle of neutrality and affects taxpayer behavior. Here’s how each works and why they deserve attention.

13 min read

State and Local Sales Tax Rates, 2018

In addition to state-level sales taxes, consumers also face local sales taxes in 38 states. These rates can be substantial, so a state with a moderate statewide sales tax rate could actually have a very high combined state and local rate.

11 min read

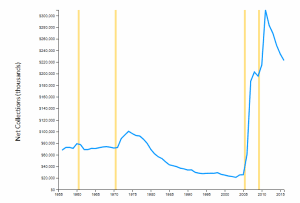

Electric Vehicles Will Have a Long-Term Impact on the Gas Tax

In the wake of the Trump administration’s infrastructure plan, it’s worth considering how the gas tax will remain viable with the rise of electric vehicles.

3 min read