What Could a Partial Repeal of the State and Local Tax Deduction Look Like?

A cap on the state and local deduction would limit tax increases for high-income taxpayers but also raise about one-quarter the revenue as full repeal.

2 min read

A cap on the state and local deduction would limit tax increases for high-income taxpayers but also raise about one-quarter the revenue as full repeal.

2 min read

Based on the details we have, the Big Six tax plan would lower taxes on the bottom 80% of taxpayers, and raise the tax burden on the top 20% of taxpayers.

7 min read

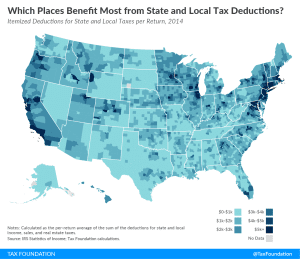

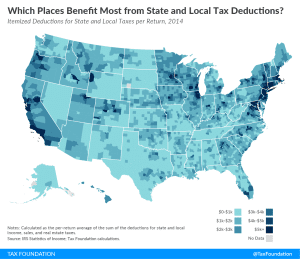

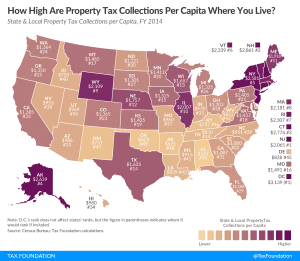

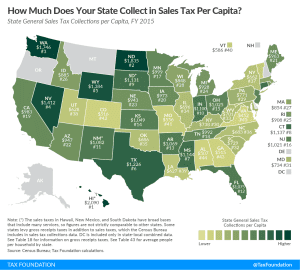

The state and local tax deduction favors high-income individuals in high-tax states. Six states—California, New York, New Jersey, Illinois, Texas, and Pennsylvania—claim more than half of the value of the deduction.

2 min read

Republican leadership in the House, Senate, and White House released a framework for a tax proposal that would lower taxes on businesses and individuals and simplify a number of aspects of the federal tax code. Here are the details we know right now.

3 min read

Repealing the state and local tax deduction will be an important part of pro-growth tax reform. Eliminating the deduction would free up $1.8 trillion to use for lowering rates across the board. Special interest groups will want you to think this deduction protects you against double taxation. Don’t fall for it.

2 min read

These four Tax Foundation tax plans demonstrate ways in which lawmakers could achieve permanent, pro-growth tax reform while keeping the level of federal revenue and the distribution of the tax burden roughly the same as current law.

25 min read

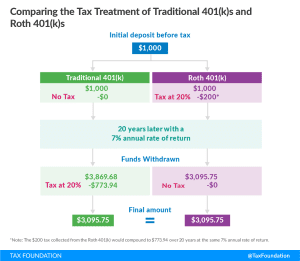

While no concrete plans for Rothification have been proposed, House GOP Republicans have kept the possibility on the table. Here’s what you should know.

4 min read