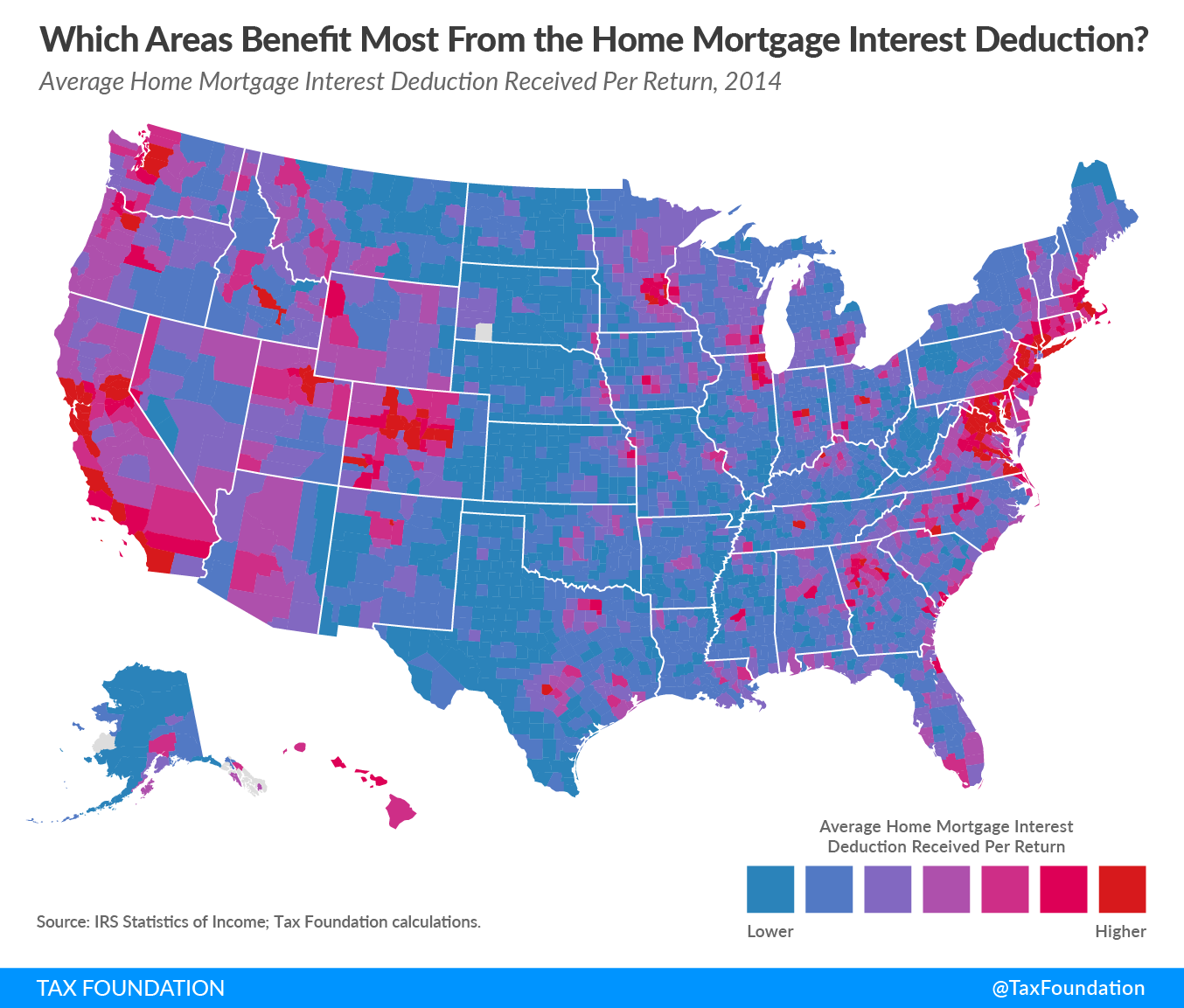

This map shows how much U.S. taxpayers deduct in home mortgage interest by county. The measurement used here is the home mortgage interest deduction per return. It is calculated using the total of all home mortgage interest divided by number of returns filed in each county. The data source is 2014 Statistics of Income from the IRS.

The map below shows that there is tremendous variation in terms of the average home mortgage deductions among counties. Overall, the average deduction in a county spans from a low of zero to a high of $6,365. There is also strong variation among counties within the same state. In Virginia, for example, filers in Dickenson County take only $216 on average. However, filers in Loudoun County in northern Virginia can take a home mortgage deduction of $6,365 on average.

Click here for a larger version.

Home mortgage interest deduction is the third largest deduction taken by high-income households that itemize deductions. High-income households usually own large homes with substantial mortgage loans; thus, counties concentrated by wealthy households tend to enjoy the high home mortgage interest deductions. For example, five of the top 10 counties in the United States with the highest home mortgage interest deductions — Loudoun (VA), Falls Church (VA), Douglas (CO), Fairfax (VA), and Howard (MD) — are from the ten wealthiest counties with the highest median household income.

| County | Average Home Mortgage | Itemized Returns |

|---|---|---|

| Source: IRS Statistics of Income; Tax Foundation calculations. | ||

| Loudoun, VA | $6,365 | 46.9% |

| Marin, CA | $5,604 | 33.2% |

| Falls Church City, VA | $5,450 | 38.6% |

| Douglas, CO | $5,154 | 46.6% |

| Fairfax, VA | $4,805 | 37.8% |

| Elbert, CO | $4,715 | 41.7% |

| Calvert, MD | $4,677 | 43.6% |

| Stafford, VA | $4,667 | 41.1% |

| Howard, MD | $4,656 | 40.9% |

| San Mateo, CA | $4,594 | 28.3% |

Given that the benefits of home mortgage interest deductions vary from county to county, any taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. proposal that changes the home mortgage interest deductionThe mortgage interest deduction is an itemized deduction for interest paid on home mortgages. It reduces households’ taxable incomes and, consequently, their total taxes paid. The Tax Cuts and Jobs Act (TCJA) reduced the amount of principal and limited the types of loans that qualify for the deduction. would have different regional impacts across U.S. counties. We estimated the recent tax proposal on limiting the home mortgage interest deduction on loans up to $500,000 would disproportionately increase the tax burden on the top 80 percent of taxpayers. It is expected that this proposal would have more impact in those high-income counties.

Share this article