All Related Articles

Reforming Arkansas’s Income Taxes

1 min read

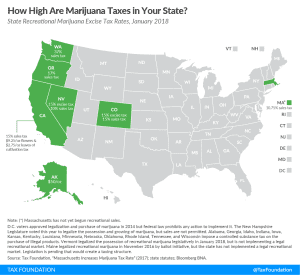

Recreational Marijuana Taxes by State, 2018

As public opinion increasingly favors the legalization of recreational marijuana, a growing number of states must determine how to structure marijuana taxes.

3 min read

Seattle Proposes a New Tax on Jobs

3 min read

Property Tax Limitation Regimes: A Primer

26 min read

Testimony: Texas Policy Options for Tax Reform

Texas lawmakers considering ways to reform the state’s tax code should seek to fix the sales tax base and repeal the economically-damaging margins tax.

Recommendations to Congress on the 2018 Tax Extenders

Congress should allow these tax extenders to expire and instead focus on making permanent features of the tax code that move it toward a more ideal system, such as full expensing.

12 min read

Kentucky Legislature Overrides Governor’s Veto to Pass Tax Reform Package

By broadening bases while lowering rates, policymakers in Kentucky took a responsible approach to comprehensive tax reform.

2 min read

Tax Freedom Day 2018 is April 19th

Tax Freedom Day is the day when the nation as a whole has earned enough money to pay its total tax bill for the year. In 2018, Tax Freedom Day falls on April 19th, 109 days into the year.

5 min read

Will Illinois Double Down on High Taxes?

Amending the Illinois constitution and adopting a graduated-rate income tax cannot solve the state’s fundamental problems. Instead, it doubles down on an already uncompetitive tax code.

16 min read