In response to high oil prices, Sen. Ron Wyden (D-OR) has proposed raising taxes on oil and gas companies in three ways. His “Taxing Big Oil Profiteers Act” would create an additional 21 percent taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. on so-called excess profits earned over 10 percent of revenues of oil companies with annual revenues over $1 billion; levy a tax on stock buybacks; and remove last-in, first-out (LIFO) tax treatment of inventory accounting. These changes would risk making our economic situation worse, not better.

The underlying idea of the excess profits tax is that 10 percent returns roughly corresponds to a “normal” rate of return.

Normal returns are the baseline expected return on capital—people typically need some kind of payoff to postpone consuming income. Then, there are returns that go well above that normal rate of return, called supernormal returns. Often the result of wide-ranging economic phenomena such as luck, returns to innovation, or monopoly profits, these returns are at least somewhat less responsive to taxation than normal returns.

However, taxing supernormal returns is not as easy as just taxing returns above 10 percent in a given year. The missing factor here is risk. Some high-risk investment might be expected to have a higher return than 10 percent, but only because it also comes with a higher risk of losing money. This is especially true over time for very cyclical businesses, which may see high profits during strong economic times but paired with major losses when the economy declines.

The bill does not address this problem—which is especially common in the fossil fuel industry. We have seen this illustrated in the past few years. Oil and gas struggled mightily in 2020, with most major companies losing money and numerous smaller firms declaring bankruptcy. Now, certainly firms are making large profits this year, but that is something of the nature of the industry—the good years are very good, and the bad years are very bad. An excess profits tax would be penalizing the industry for this pattern of earning profits.

The excess profits tax also removes the tax code’s existing way to adjust for this across-year variability. When calculating excess profits, the bill would disallow deductions for net operating losses (NOLs) from previous years. Deductions for NOLs prevent the tax code from punishing businesses with high profits in some years but high losses in others. Disallowing NOL deductions only worsens the excess profits tax’s fundamental flaw.

There is a way to make the tax code tax only supernormal returns—and that is through the regular corporate income tax. By making all costs, including investment costs, fully deductible, the corporate income taxA corporate income tax (CIT) is levied by federal and state governments on business profits. Many companies are not subject to the CIT because they are taxed as pass-through businesses, with income reportable under the individual income tax. would move closer towards excluding the normal return on capital and solely taxing supernormal returns. Meanwhile, continuing to allow deductions for losses from previous years would iron out year-by-year variation.

However, the Wyden plan fails to do that. Instead of just capturing some windfall gain, this tax would reduce the incentives to invest in new production, as was the effect of the excess profits taxes enacted in the wake of both World Wars.

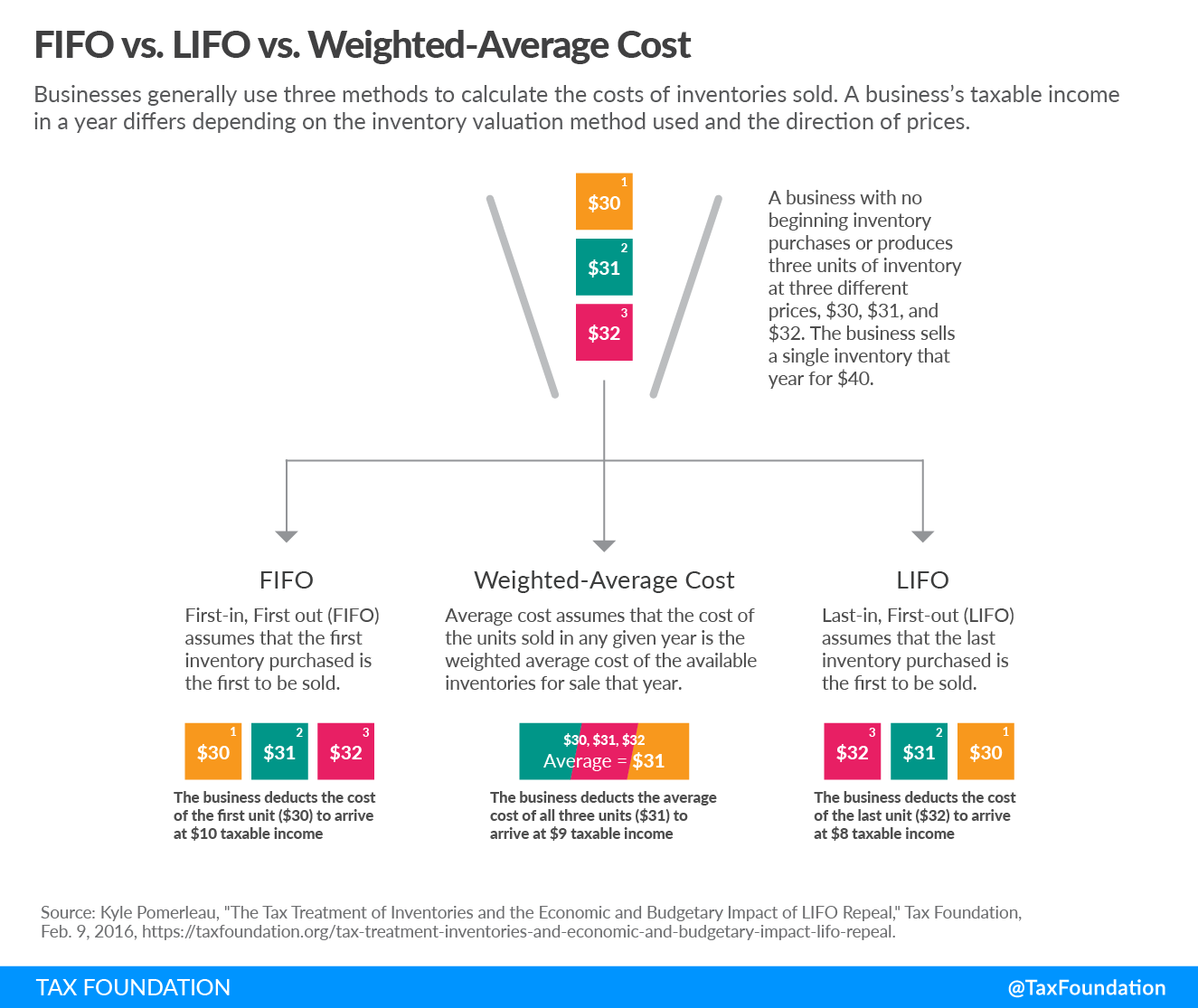

The proposal’s treatment of inventory accounting would also make matters worse. The LIFO accounting system for inventory is often a target for politicians looking to raise a little revenue as part of a larger package, perhaps due to the provision’s obscurity. However, it is not a tax break; it is one of several standard accounting methods for companies to deduct the cost of their inventories. LIFO generally does a better job of accounting for inflation as compared to alternative methods. Repealing LIFO in a time of high inflationInflation is when the general price of goods and services increases across the economy, reducing the purchasing power of a currency and the value of certain assets. The same paycheck covers less goods, services, and bills. It is sometimes referred to as a “hidden tax,” as it leaves taxpayers less well-off due to higher costs and “bracket creep,” while increasing the government’s spending power. would create a particularly high penalty for investment in inventories.

The Wyden proposal only targets the oil and gas industry, rather than repealing the provision broadly, but the oil and gas industry uses LIFO extensively. Creating such a tax bias by narrowly repealing LIFO for one industry could make existing issues regarding disrupted supply chains even worse.

Issues surrounding LIFO and the tax treatment of inventory revolve around the differences between how accountants and economists measure income. Under the accounting view, deductions for costs should match with the revenues those costs generate. Economists often argue that deductions for costs should occur immediately, when they are incurred. This is because spreading deductions out means companies do not get to deduct the full real value of their costs, as inflation and the time value of money eat away at the real value of deductions.

However, the current tax code does not include immediate deductions for costs as an option. LIFO inventory accounting allows companies to deduct the cost of the most recently purchased unit of inventory after making a sale. This approach roughly approximates immediate expensing for inventories, economically speaking.

First-in, first-out (FIFO) accounting, meanwhile, allows companies to deduct the cost of their oldest piece of inventory first. Weighted-Average Cost accounting allows companies to deduct the weighted-average cost of their per-unit inventory costs.

It is worth keeping in mind that LIFO is not a particularly large provision, so the scale of the repeal’s impact would be small in either direction (comparatively small amount of new revenue and reduction in economic growth). However, all told, it would not raise much revenue relative to its economic costs, and repeal would be a significant cost for the oil and gas industry, which relies heavily on LIFO—on average, holding 50 percent of LIFO reserves between 2011 and 2016.

| GDP | <-0.05% |

| GNP | <-0.05% |

| Capital Stock | -0.1% |

| Wage Rate | <-0.05% |

| Full-Time Equivalent Jobs | -5,000 |

| Static 10-Year Revenue | $60.2 Billion* |

| Dynamic 10-Year Revenue | $56.04 Billion* |

|

Source: Tax Foundation, “Option 41: Repeal Last-In, First Out Accounting,” Options for Reforming America’s Tax Code 2.0, Apr. 19, 2021, https://www.taxfoundation.org/tax-reform-options/?option=41. |

|

In May, the Tax Policy Center argued for repealing LIFO, saying that, under current inflationary pressures, LIFO becomes more valuable. It is true that LIFO becomes more valuable as inflation rises, but that is as much an argument against LIFO repeal as it is for LIFO repeal. When inflation is higher, the tax penalty created by an alternate system would be larger.

For example, say a taxpayer sold a unit of inventory for $125 in July. The piece of inventory they purchased most recently (or the “Last-In”) was purchased on the previous day, for $105. Excluding all other costs, deducting the $105 inventory against the $125 sale leads to taxable income of $20. With a 21 percent corporate tax rate, that means $4.20 in taxes owed.

However, say their oldest piece of inventory (or the “first-in”) was purchased in January, for $100—assuming prices have increased 5 percent. Setting all other deductions aside, deducting that $100 piece of inventory against the $125 sale leads to taxable incomeTaxable income is the amount of income subject to tax, after deductions and exemptions. For both individuals and corporations, taxable income differs from—and is less than—gross income. of $25 and $5.25 in taxes owed.

Companies generally like to avoid keeping too much inventory on hand for several reasons. At the same time, they want to avoid running out of stock. The FIFO system creates a tax penalty for holding more inventory on hand, particularly in an inflationary environment. As some critics raise concerns that excessively lean just-in-time inventory management contributed to supply chain disruptions since COVID-19, the last thing one would want to do is create a tax penalty on inventory.

The third component of the bill, a 25 percent tax on stock buybacks, places a new burden on equity-financed investment and interrupts efficient reallocation of capital. After the money is returned to shareholders via a stock buyback, it does not just disappear—it goes back into the rest of the economy, funding investments in other firms.

We can see a form of this dynamic in the oil and gas industry today. While oil prices have risen dramatically, the fossil fuel industry has a lot of long-term risks that make massive investments relatively unappealing for some firms. However, while some have drawn back, others, particularly smaller drillers, have continued to invest, as their owners are less concerned about those long-run risks.

Ultimately, all three of the proposed policies would fail to address high oil prices, and more likely would raise prices by penalizing domestic production. To the extent climate is the concern, the measures do not constitute efficient environmental taxes geared at addressing pollution. Instead, they punitively target one industry without a sound tax base in mind.