No, We Don’t Need a Federal Work-From-Home Tax

A recent Deutsche Bank analysis proposes a federal work-from-home tax (“privilege tax”), which is designed to strip away the financial benefit of remote work.

5 min read

A recent Deutsche Bank analysis proposes a federal work-from-home tax (“privilege tax”), which is designed to strip away the financial benefit of remote work.

5 min read

President Biden and Congress should concentrate on areas of common ground, finding incremental places to improve the tax code. A bipartisan bill recently introduced to help retirement savings is a good model for what incremental reform may look like.

4 min read

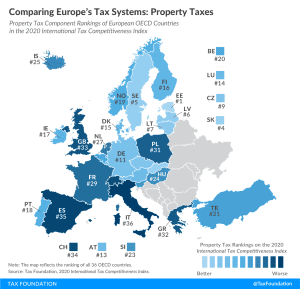

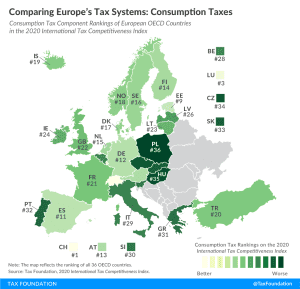

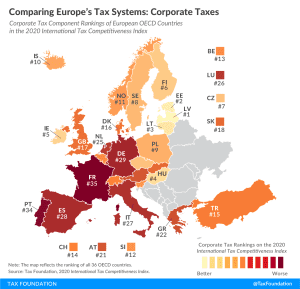

How do consumption tax codes compare among European OECD countries? Explore our new map to see how consumption tax systems in Europe compare.

2 min read

In Tuesday’s election, voters in two states—California and Colorado—were tasked with deciding whether to amend their states’ constitution to change how the property tax burden is distributed. In many ways, the ballot measures were mirror images of each other, but the outcomes were similar.

3 min read

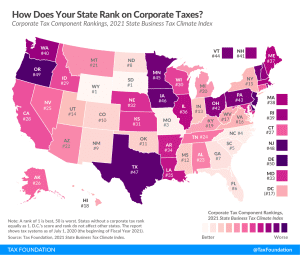

The corporate tax component of our Index measures each state’s principal tax on business activities. Most states levy a corporate income tax on a company’s profits (receipts minus most business expenses, including compensation and the cost of goods sold), while some states levy gross receipts taxes, which allow few or no deductions for a company’s expenses.

2 min read

See the results of the most notable state and local tax ballot measures during Election 2020 with our curated resource page.

11 min read

While other countries in Europe are working towards introducing tax cuts and stimulating economic recovery by supporting business investment and employment, Spain is putting more fiscal pressure on households and businesses.

4 min read

Increasing the corporate tax rate is often offered as a solution to income inequality because higher-income individuals tend to own more corporate shares than others and may bear the burden of a tax increase on corporate income.

4 min read

Zoom Video Communications announced that, come November, the company will start collecting and remitting local utility and communications taxes in California, New York, Maryland, and Virginia.

5 min read

The IRS recently released the new 2021 tax brackets and rates. Explore updated credits, deductions, and exemptions, including the standard deduction & personal exemption, Alternative Minimum Tax (AMT), Earned Income Tax Credit (EITC), Child Tax Credit (CTC), capital gains brackets, qualified business income deduction (199A), and the annual exclusion for gifts.

6 min read

They may not draw as much attention as elections for office, but Election Day 2020 will also feature a number of important votes on tax-related ballot initiatives in states around the country. What are the ballot measures taxpayers should be paying attention to this year and what could they mean for the future of state tax policy? Tax Foundation Vice President of State Projects Jared Walczak and Senior Policy Analyst Katherine Loughead break down measures ranging from recreational marijuana legalization in New Jersey and Montana to income tax increases in Illinois and Arizona.

Our new guide identifies key areas for improvement in UK tax policy and provides recommendations that would support long-term growth without putting a dent in government revenues.

24 min read

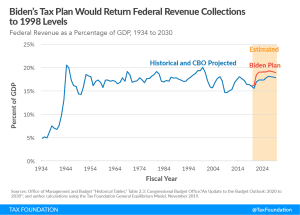

If we consider Biden’s tax plan over the entire budget window (2021 to 2030) as a percentage of GDP—1.30 percent—it would rank as the 6th largest tax increase since the 1940s and and one of the largest tax increases not associated with wartime funding.

6 min read

What has President Joe Biden proposed in terms of tax policy changes? Our experts provide the details and analyze the potential economic, revenue, and distributional impacts.

23 min read

The UN tax committee will be considering a change to the UN’s model tax treaty that, if adopted and implemented, could result in digital companies paying more taxes in countries where their customers are located even if those companies do not have physical locations there.

5 min read

A tax code that is competitive and neutral promotes sustainable economic growth and investment while raising sufficient revenue for government priorities.

3 min read

The difference that the OECD presents between the potential impact in the context of agreement compared to a harmful tax and trade war should show policymakers the value of continuing multilateral discussions.

6 min read