Facts and Figures 2021: How Does Your State Compare?

Our updated 2021 edition of Facts & Figures serves as a one-stop state tax data resource that compares all 50 states on over 40 measures of tax rates, collections, burdens, and more.

1 min read

Our updated 2021 edition of Facts & Figures serves as a one-stop state tax data resource that compares all 50 states on over 40 measures of tax rates, collections, burdens, and more.

1 min read

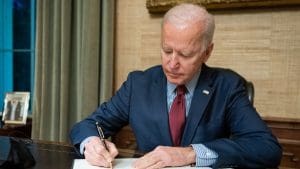

The Biden administration has signaled its openness to raising the corporate tax rate, potentially by phasing in an increase over several years. While phasing in a tax increase, as opposed to hiking immediately, may seem like a reasonable middle ground, it would be the worst of both worlds because it provides old investment with a lower rate while penalizing new investment.

2 min read

R&D is more important than ever as pharmaceutical companies and governments around the world invest in coronavirus research and supply chains. But are the policies currently on the books—the R&D credit and immediate deduction for R&D expenses—the best way to encourage innovation?

A year ago, it seemed possible that New Hampshire was headed toward a triggered tax increase. Instead, lawmakers may trim business tax rates and begin the phaseout of the state’s tax on interest and dividend income, which would take away the asterisk and make New Hampshire the ninth state to forgo an individual income tax altogether.

4 min read

The Nebraska legislature has an excellent opportunity to make progress toward a simpler, stabler, less burdensome, and more competitive tax code.

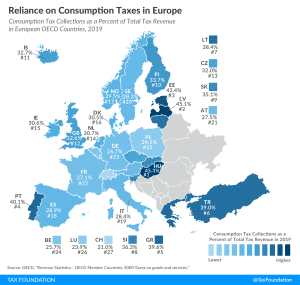

Hungary relies the most on consumption tax revenue, at 45.3 percent of total tax revenue, followed by Latvia and Estonia at 45.1 percent and 42.4 percent, respectively.

2 min read

With several states entertaining proposals to tax the financial transactions of savers and investors who don’t even live in their states, some members of Congress see an interstate commerce question worthy of a federal response.

6 min read

Here’s each state’s estimated revenue gains or losses in 2020, alongside the state and local aid that would be allocated to each under the American Rescue Plan Act.

8 min read

The UK’s Chancellor of the Exchequer Rishi Sunak released the 2021 budget, and most important for near-term growth is the significant boost to capital allowances.

5 min read

While there are several parts of the policy that are subject to further discussion and agreement, GloBE is expected to be different from GILTI in several ways.

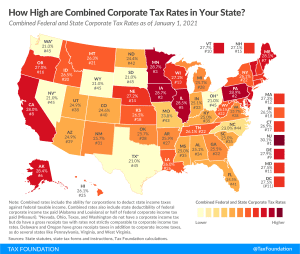

The state with the highest combined corporate income tax rate is New Jersey, with a combined rate of 30.1 percent. Corporations in Alaska, California, Illinois, Iowa, Maine, Minnesota, and Pennsylvania face combined corporate income tax rates at or above 28 percent.

3 min read

While the UK is looking at ways to raise tax revenue to cover the revenue shortfalls and additional spending resulting from the COVID-19 pandemic, short- as well as long-term, investment will be crucial in getting the economy back on track and ensuring economic growth.

3 min read

Amid a debate over water extraction from Florida’s springs, Florida Sen. Annette Taddeo (D) has introduced a bill (SB 562) which, if enacted, would establish an excise tax on water extraction beginning July 1.

4 min read

President Biden and congressional policymakers have proposed several changes to the corporate income tax, including raising the rate from 21 percent to 28 percent and imposing a 15 percent minimum tax on the book income of large corporations, to raise revenue for new spending programs. Our new modeling analyzes the economic, revenue, and distributional impact of these proposals.

46 min read

A new study illustrates how overlooking an important element of the tax system—the structure of the tax base—can lead to an incomplete understanding of how tax reform impacts the economy.

4 min read

Tax hikes or spending cuts implemented early in the year might undermine the desirable rapid recovery of the economy. The UK should focus on implementing tax reforms that have the potential to stimulate economic recovery by supporting business investment and employment while increasing its international tax competitiveness.

4 min read

Under the budget introduced by Gov. Tom Wolf, Pennsylvania’s flat personal income tax rate would increase by 46 percent, partially offset by an outsized increase in the poverty credit, which would see a family of four eligible for partial relief due to poverty until they reached $100,000 in taxable income—four times the poverty line.

6 min read

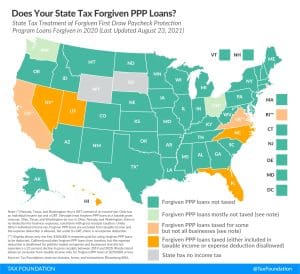

Congress chose to exempt forgiven Paycheck Protection Program (PPP) loans from federal income taxation. Many states, however, remain on track to tax them by either treating forgiven loans as taxable income, denying the deduction for expenses paid for using forgiven loans, or both.

11 min read

Learn more about the recent Alabama tax reform measures (House Bill 170), which combines pandemic-era tax policy responses with broader tax policy reforms.

4 min read

Approximately $78 billion might be owed in federal and state income taxes on the unemployment compensation payments made since the pandemic began.

3 min read