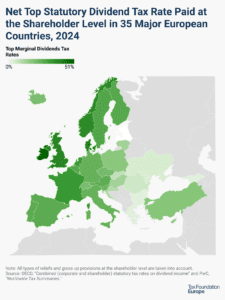

Dividend Tax Rates in Europe, 2025

Many countries’ personal income tax systems tax various sources of individual income—including investment income such as dividends and capital gains.

4 min read

Many countries’ personal income tax systems tax various sources of individual income—including investment income such as dividends and capital gains.

4 min read

Lawmakers should prioritize pro-growth tax policies and use the least economically damaging offsets to make the legislation fiscally responsible. If lawmakers choose to use C-SALT, they should carefully consider the economic trade-off with permanent, pro-growth tax cuts that support investment and innovation in the US.

7 min read

Whether we look at it as consumers of these goods, or as middle-class workers who transform them, low-cost goods have been the underpinning of American prosperity.

With such an important change to Iowa’s property tax system, it’s important that lawmakers get the details right.

33 min read

President Donald Trump surprised many in the tax community by making the global tax deal a day one issue. His Jan. 20 memorandum gave his Treasury secretary 60 days to recommend interactions with tax treaties and possible protective measures to ensure the minimum tax rules have no force or effect in the US.

The Inflation Reduction Act (IRA) introduced a series of new targeted tax breaks, many of which seem to be much more expensive than originally forecasted. Understandably, repealing these subsidies is a key option for policymakers looking to pay to extend the expiring broader tax cuts passed in the Tax Cuts and Jobs Act (TCJA).

7 min read

An update to the EU’s Excise Tax Directive that embraces harm reduction principles would save lives and provide a steady stream of revenue to support public health expenditures.

22 min read

Contrary to the president’s promises, the tariffs will cause short-term pain and long-term pain, no matter the ways people and businesses change their behavior.

5 min read

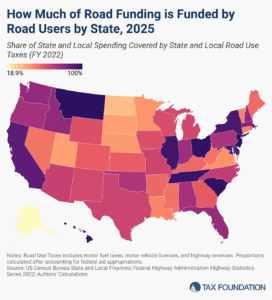

The amount of revenue states raise through roadway-related revenues varies significantly across the US. Only three states raise enough revenue to fully cover their highway spending.

5 min read

As the property tax debate continues in Kansas, two new proposals have emerged that are much better structured, and would be more effective, than the assessment limits. However, policymakers should consider additional modifications.

7 min read

As we learned in the first trade war, retaliation will exact harm on US exporters by lowering their export sales—and the US-imposed tariffs will directly harm exporters too. US-imposed tariffs can burden exporters by increasing input costs, which acts like a tax on exports.

4 min read

Tax legislation in 2025 may have good reason to address international corporate income taxes, because of scheduled changes slated to go into effect or because of international developments like the Pillar Two agreement.

63 min read

In a perilous economic and fiscal environment, with instability created by Trump’s trade war and publicly held debt on track to surpass the highest levels ever recorded within five years, a lot rides on how Republicans navigate tax and spending reforms in reconciliation.

6 min read

While Governor Moore’s tax plan is still being fiercely debated in Maryland, legislators have introduced several additional proposals—mostly aimed at increasing taxes on businesses—to generate revenue and address the state’s chronic budget deficit.

6 min read

Lawmakers should finish the work they have begun over the past few decades, tackling tax rates and structures to give the state a leg up in an era of enhanced competition.

84 min read

A recent proposal in Minnesota exempting certain nonresident workers from having to file and pay income taxes would reduce compliance costs for business travelers and their employers at limited cost to the state.

4 min read

The U.S. Constitution grants authority to Congress to “lay and collect” duties and to “regulate commerce with foreign nations.” But Congress has delegated its powers to set tariffs and negotiate trade to the president. For decades, the executive branch has used those powers to reduce barriers to trade and, sometimes, to impose tariffs in limited fashion.

With property tax bills on the rise, homeowners are searching for answers—and some even want to abolish the tax altogether. In this episode, we break down why property taxes are increasing, common but flawed solutions, and why the property tax remains an economically efficient revenue source.

The Tax Foundation uses and maintains a General Equilibrium Model, known as our Taxes and Growth (TAG) Model to simulate the effects of government tax and spending policies on the economy and on government revenues and budgets.

9 min read

While capping C-SALT has superficial appeal in perceived parity with personal limits, it rests on flawed assumptions about the nature of individual and corporate income taxes.

7 min read