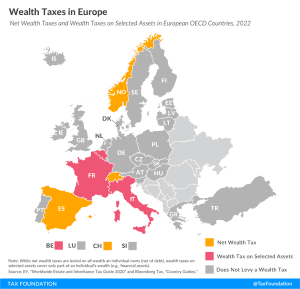

Wealth Taxes in Europe, 2022

Only three European OECD countries levy a net wealth tax, namely Norway, Spain, and Switzerland.

3 min read

Only three European OECD countries levy a net wealth tax, namely Norway, Spain, and Switzerland.

3 min read

As the deadline for tax filing nears, the IRS faces scrutiny for its backlog of returns, inaccessible taxpayer service, and delays in issuing certain refunds.

5 min read

Learn where and when taxes originated and how they resemble taxes we have today. Understand how the American tax code developed from the beginning of the colonies. Learn about some of the weirder taxes throughout history, designed not just to raise revenue, but influence behavior too.

Total tax collections are currently running 25 percent higher than last year, and if that pattern holds, total federal tax collections will reach over $5 trillion in FY 2022—a new all-time high.

3 min read

In times of inflation, a review of the tax code shows that some provisions are automatically indexed, or adjusted, to match inflation, while others are not. And that creates unfair burdens for taxpayers. But it’s not always as simple as just “adjusting for inflation.”

4 min read

As part of President Biden’s proposed budget for fiscal year 2023, the White House has once again endorsed a major tax increase on accumulated wealth, adding up to a 61 percent tax on wealth of high-earning taxpayers.

4 min read

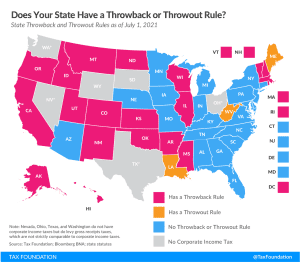

While throwback and throwout rules in states’ corporate tax codes may not be widely understood, they have a notable impact on business location and investment decisions and reduce economic efficiency.

3 min read

Before competing in the UEFA Champions League, football clubs in Europe also compete to lure the best players.

5 min read

Over the course of the last year, it has become clear that Democratic lawmakers want to change U.S. international tax rules. However, as proposals have been debated in recent months, there are clear divides between U.S. proposals and the global minimum tax rules.

5 min read

Tax burdens rose across the country as pandemic-era economic changes caused taxable income, activities, and property values to rise faster than net national product. Tax burdens in 2020, 2021, and 2022 are all higher than in any other year since 1978.

24 min read

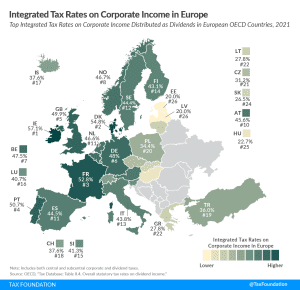

In most European OECD countries, corporate income is taxed twice, once at the entity level and once at the shareholder level.

4 min read

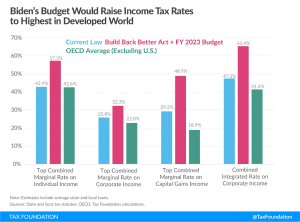

The FY 2023 budget proposes several new tax increases, which in combination with the Build Back Better Act, would give the U.S. the highest top tax rates on individual and corporate income in the developed world.

4 min read

In a letter to lawmakers, the 46th President said that his $5.8 trillion budget package would “[grow] our economy, while ensuring that the wealthiest Americans and the biggest corporations begin to pay their fair share.” We break down what the President is proposing for this upcoming fiscal year and what its impact would be on the U.S. economy in the face of record-high inflation.

The Biden administration should lift the Trump administration’s tariffs, as they have failed in their objective to bring better trading practices and instead brought about significant damage to U.S. businesses and workers.

6 min read

After a whirlwind of cuts and reforms in 2021, it looks like 2022 might be an even bigger year for state tax codes. Republican and Democratic governors alike used their annual State of the State addresses to call for tax reform, and there is already serious momentum from state lawmakers nationwide to get the job done.

3 min read

States are flush with cash, but taxpayers’ purchasing power is being eroded by high inflation. Tax rebates, gas tax holidays, and other temporary tax expedients have the potential to add to existing inflation—but good intentions do not always make for good policy.

5 min read

Facts & Figures serves as a one-stop state tax data resource that compares all 50 states on over 40 measures of tax rates, collections, burdens, and more.

2 min read

In recent years, EU countries have undertaken a series of tax reforms designed to maintain tax revenue levels while supporting investment and economic growth. However, not all tax reforms were created equal.

7 min read

The U.S. tax system is biased against capital investments. Ending these tax penalties would boost economic output, productivity, and employment.

4 min read

Digital advertising taxes are poor tax policy and legally dubious in the extreme. Maryland has a long fight ahead of it—all for the right to enact a tax for which lawmakers struggle to even articulate a rationale.

5 min read