State Income Taxes and the 2024 NFL Draft Class

Here’s how much NFL players can expect to pay in state and local income taxes—to all relevant states—at multiple salary levels, by team.

7 min readHow does Virginia’s tax code compare? Virginia has a graduated individual income tax, with rates ranging from 2.00 percent to 5.75 percent. Virginia also has a flat 6.00 percent corporate income tax rate and permits local gross receipts taxes. Virginia has a 5.30 percent state sales tax rate, a max local sales tax rate of 0.70 percent, and an average combined state and local sales tax rate of 5.75 percent. Virginia’s tax system ranks 26th overall on our 2023 State Business Tax Climate Index.

Each state’s tax code is a multifaceted system with many moving parts, and Virginia is no exception. The first step towards understanding Virginia’s tax code is knowing the basics. How does Virginia collect tax revenue? Click the tabs below to learn more! You can also explore our state tax maps, which are compiled from our annual publication, Facts & Figures: How Does Your State Compare?

Here’s how much NFL players can expect to pay in state and local income taxes—to all relevant states—at multiple salary levels, by team.

7 min read

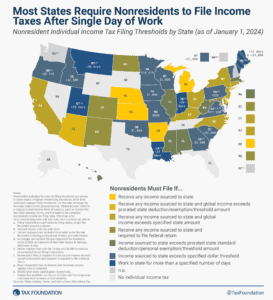

One relatively easy but meaningful step policymakers can take to make future tax seasons less burdensome is to modernize their state’s nonresident income tax filing, withholding, and reciprocity laws.

7 min read

Facts & Figures serves as a one-stop state tax data resource that compares all 50 states on over 40 measures of tax rates, collections, burdens, and more.

2 min read

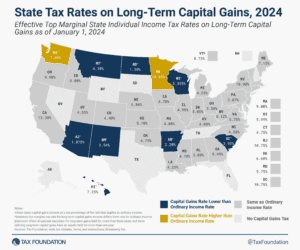

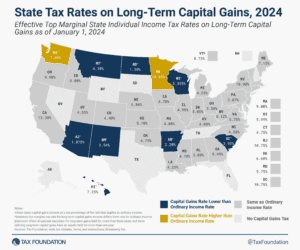

Savings and investment are critical activities, both for individuals’ and families’ financial security and for the health of the national economy as a whole. As such, policymakers should consider how they can help mitigate—rather than add to—tax codes’ biases against saving and investment.

5 min read

With state tax revenues receding from all-time highs, there’s been a great deal of handwringing about whether states can afford the tax cuts adopted over the past few years. Given that 27 states reduced the rate of a major tax between 2021 and 2023, is there reason for concern?

4 min read

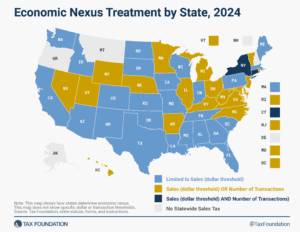

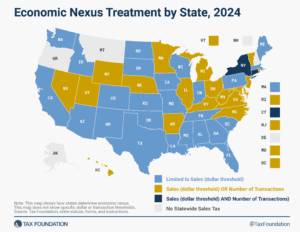

Reforming economic nexus thresholds would not only be better for businesses but for states as well. It is more cost-effective for states to focus on—and simplify—compliance for a reasonable number of sellers than to impose rules that have low compliance and are costly to administer.

4 min read

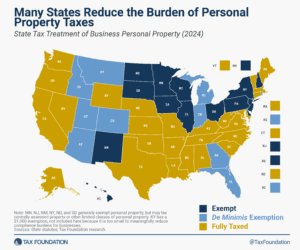

Does your state have a small business exemption for machinery and equipment?

3 min read

Expanding Virginia’s sales tax base to include B2B digital transactions could lead to tax pyramiding, hide the true cost of government, and make the sales tax system much less neutral and transparent.

5 min read

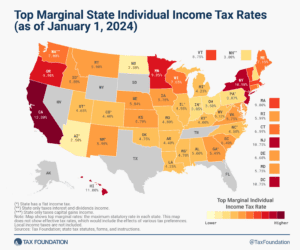

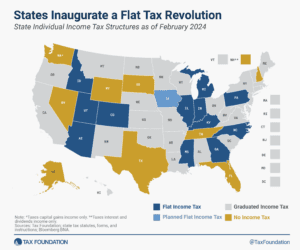

Individual income taxes are a major source of state government revenue, accounting for more than a third of state tax collections. How do income taxes compare in your state?

8 min read

In 2021 and 2022 alone, more states enacted laws converting graduated-rate individual income tax structures into single-rate income tax structures than did so in the whole 108-year history of state income taxation up until that point.

10 min read