Distilled spirits continue to lead American alcohol sales. With 42.2 percent of market share, spirit sales slightly outpaced beer sales for the third straight year. The recent growth in market share, a 13 percent increase since 2000, has been driven in large part by newer products like ready-to-drink cocktails and hard seltzers.

Innovative products have blurred the lines of the categorical tax system that defines taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. rates based on alcohol type. The spirited competition throughout the alcohol industry and the challenges presented when new products enter the market under the categorical system have spurred calls for reform.

Distilled spirits suffer the stiffest tax rates of all alcoholic beverages. Spirits have a higher alcohol content than wine or beer, but spirits are also taxed higher per alcohol content than other alcohol types. A standard drink of spirits (a one ounce shot of 40 percent alcohol) bears a greater tax burden than an identical standard drink of beer (12 ounces of 4.8 percent alcohol), despite both containing 0.4 ounces of alcohol.

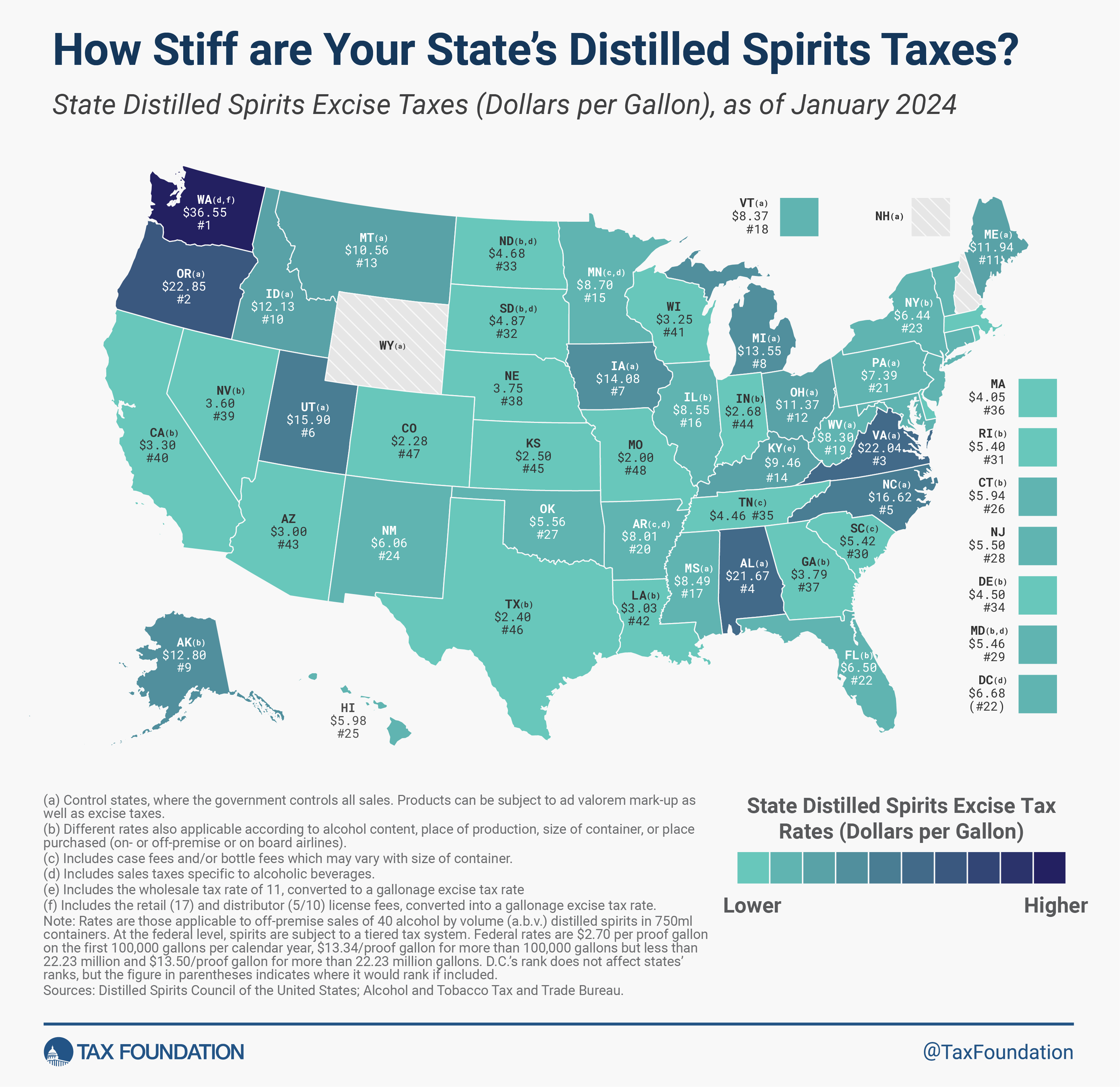

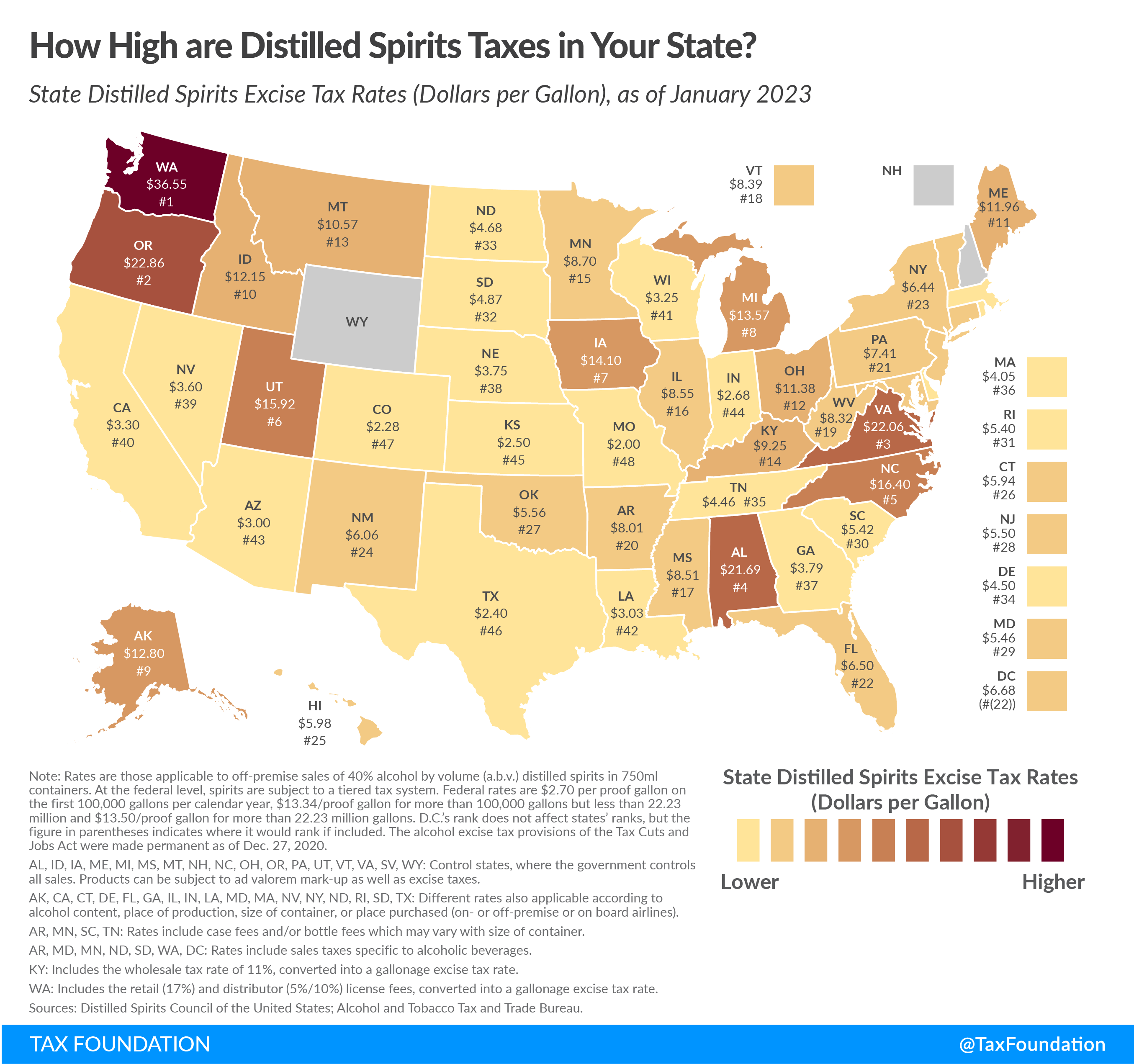

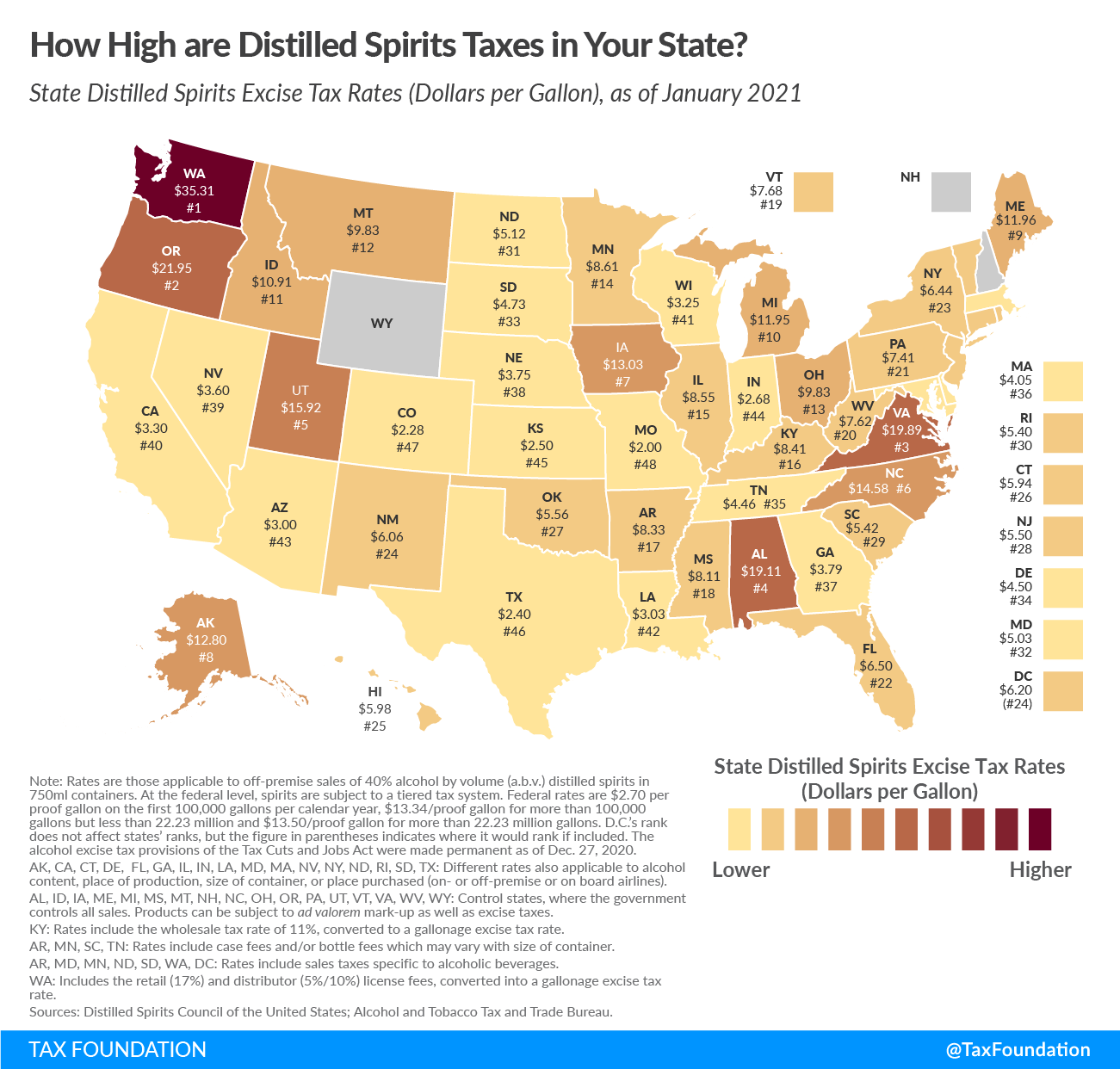

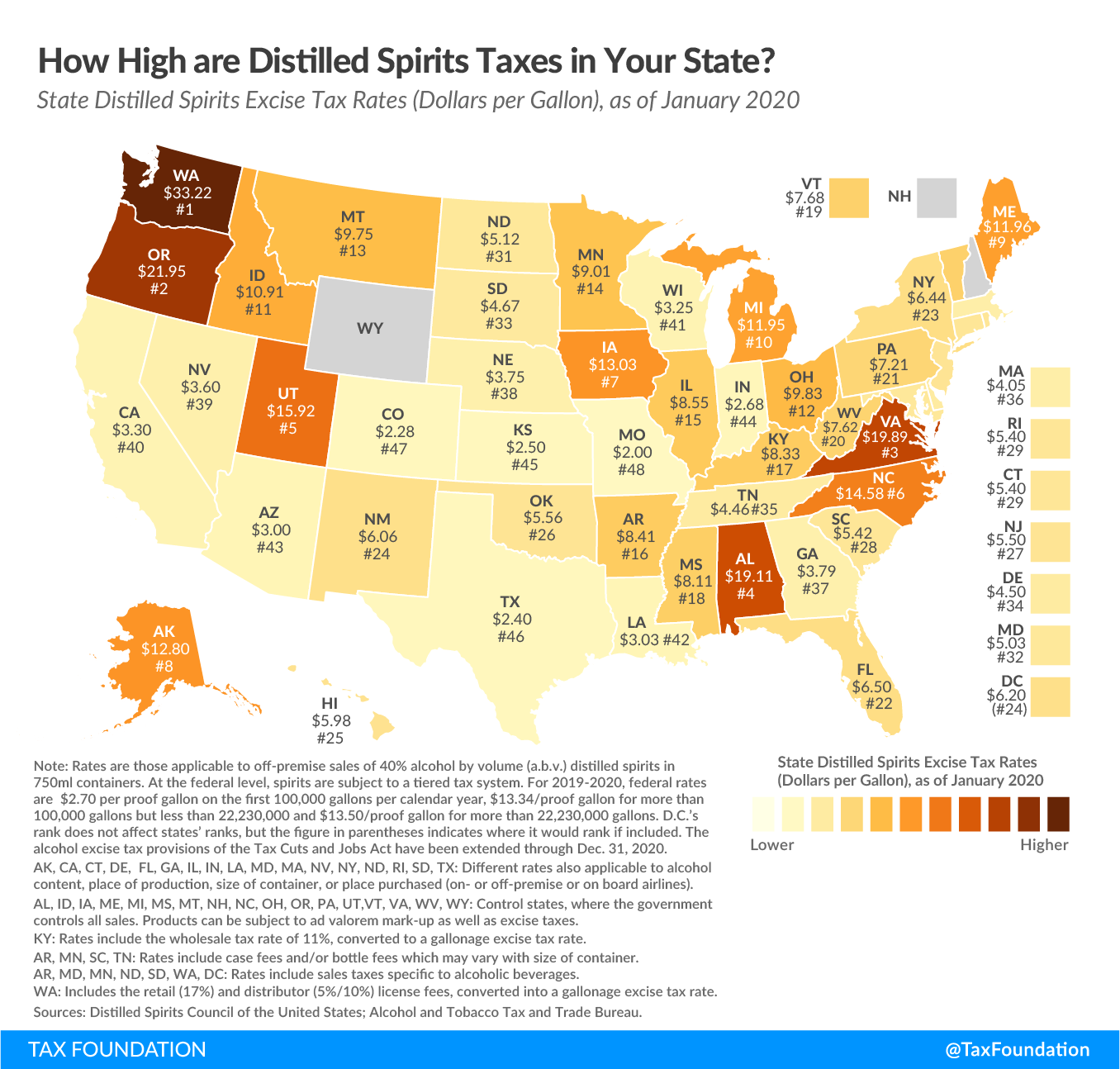

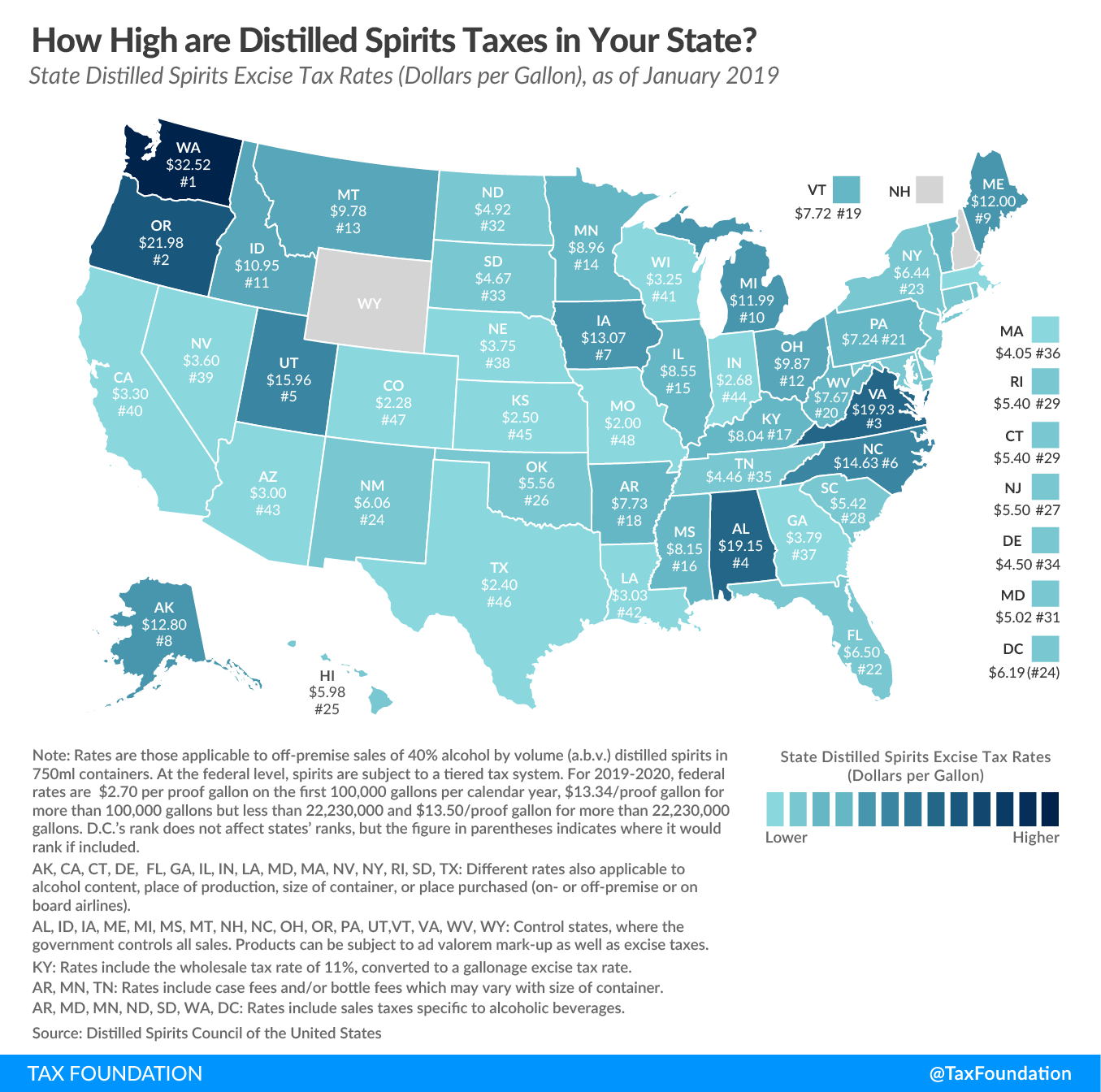

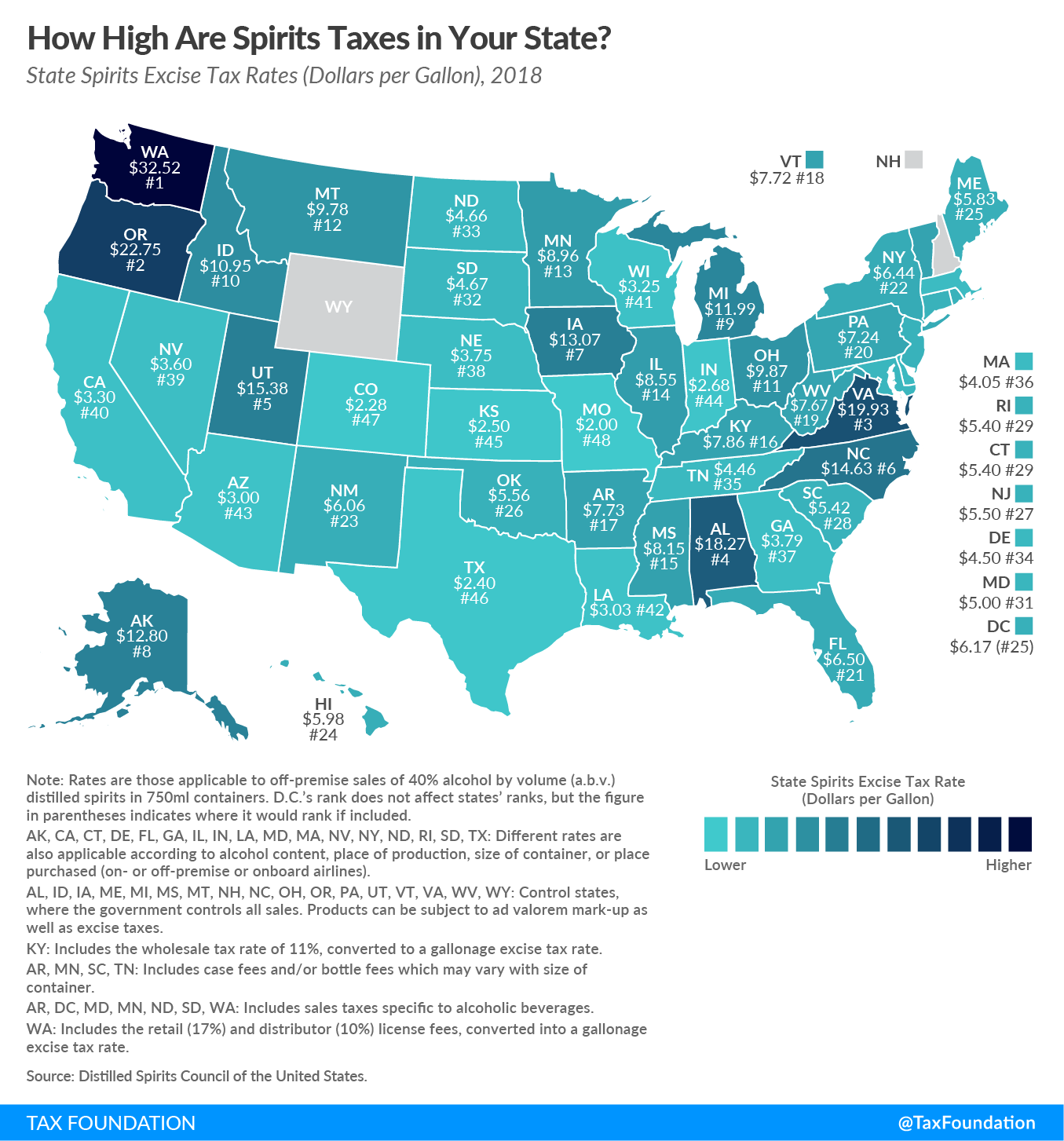

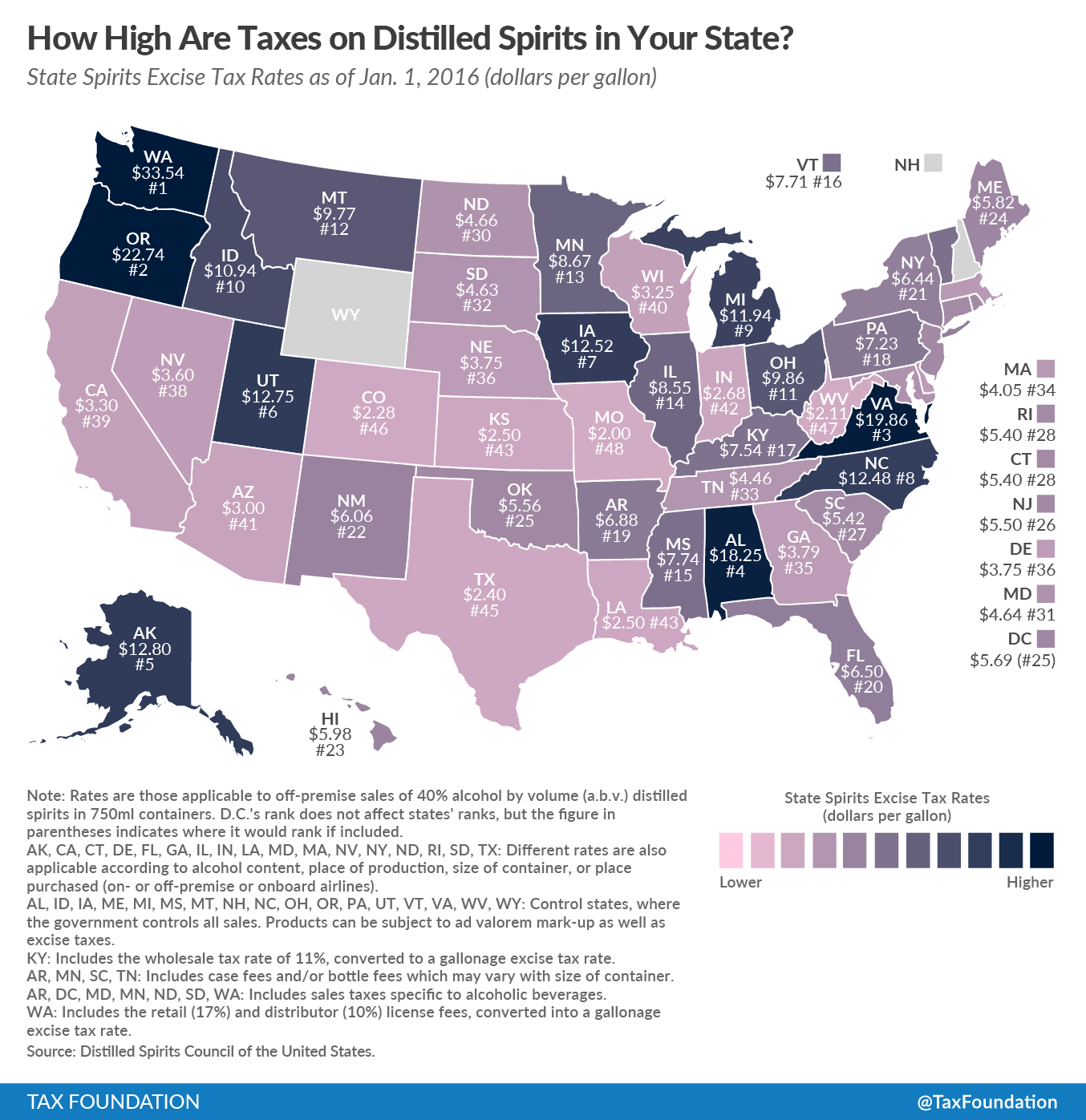

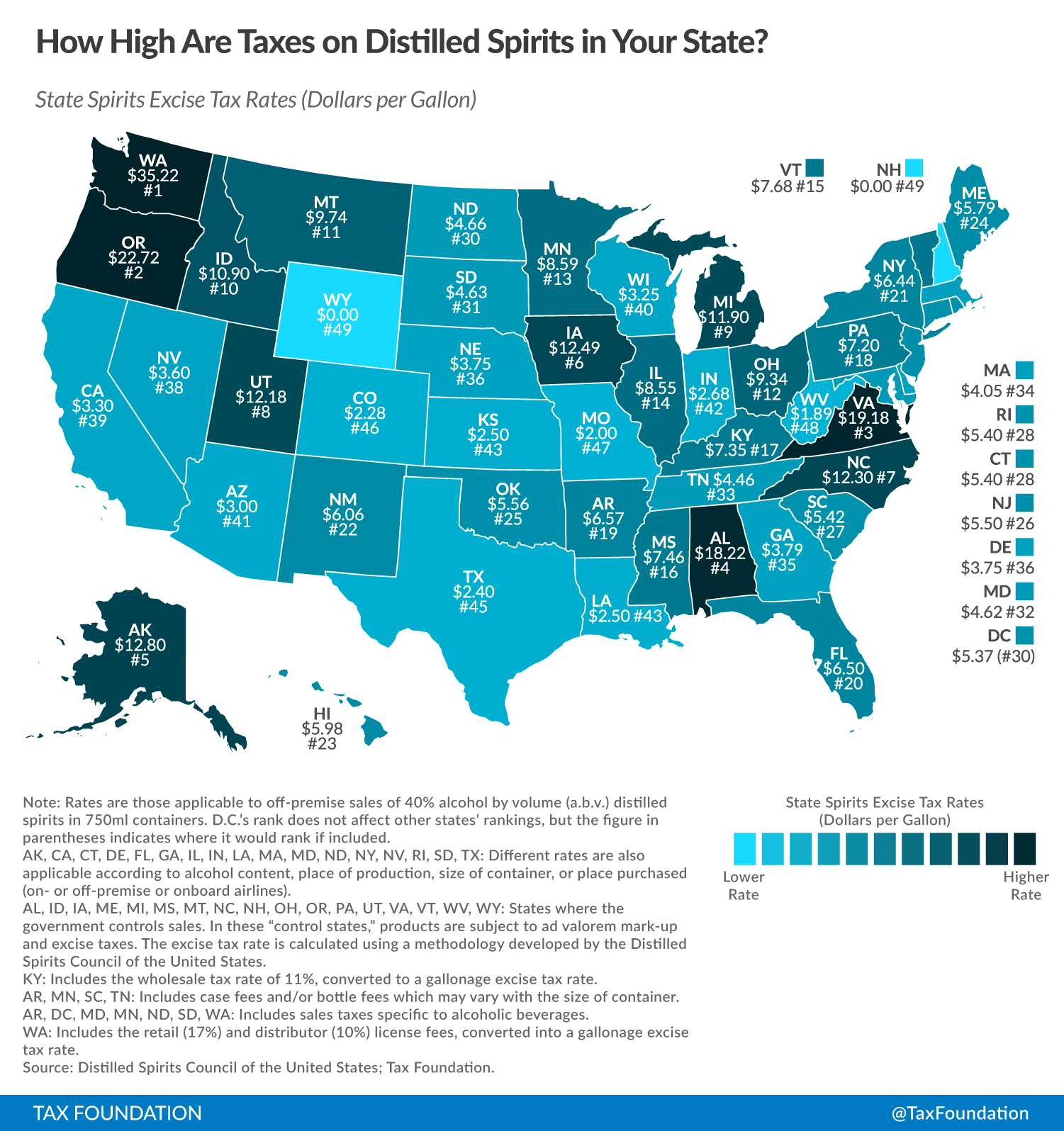

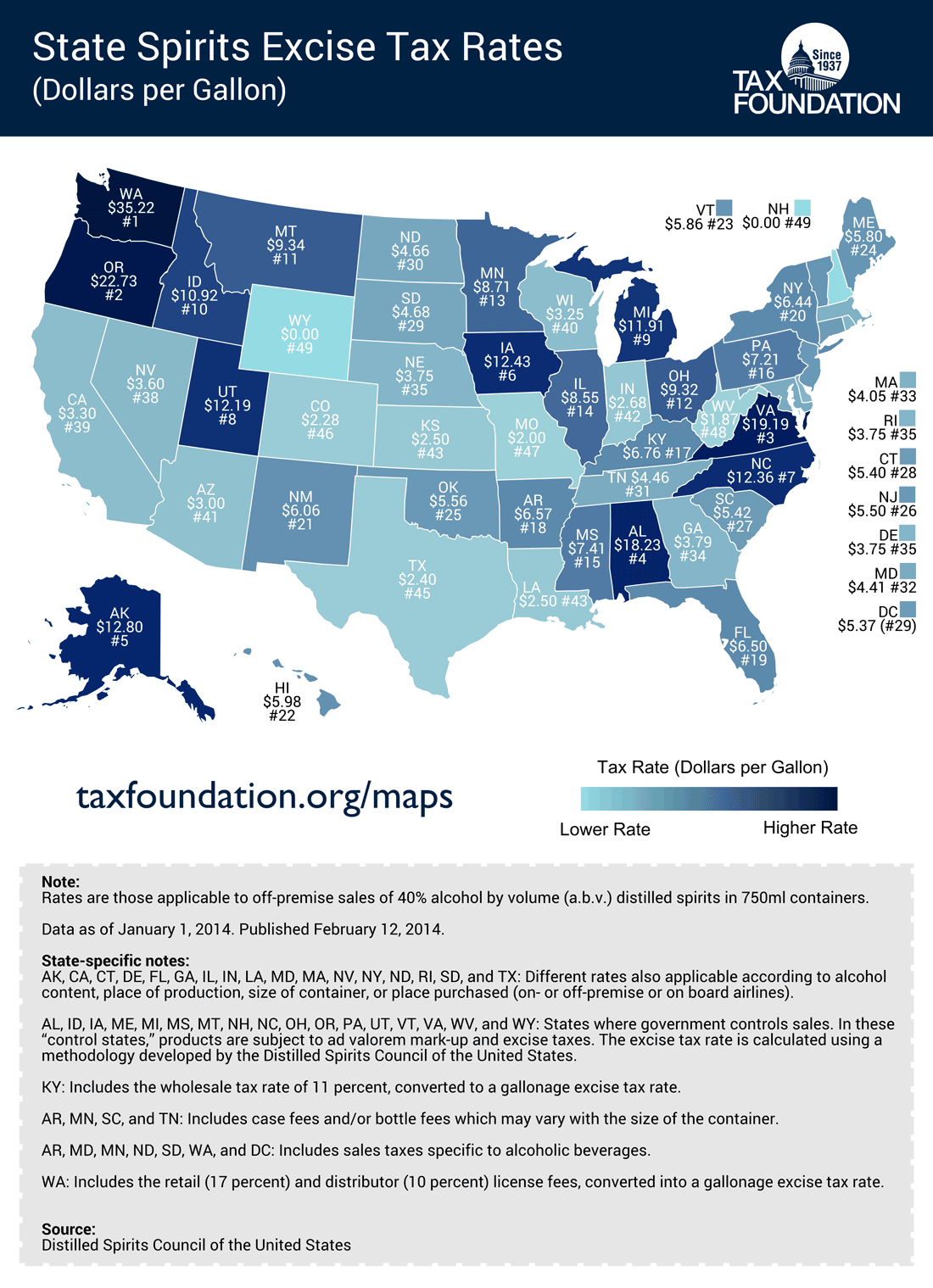

Across states, Washington levies the highest excise taxAn excise tax is a tax imposed on a specific good or activity. Excise taxes are commonly levied on cigarettes, alcoholic beverages, soda, gasoline, insurance premiums, amusement activities, and betting, and typically make up a relatively small and volatile portion of state and local and, to a lesser extent, federal tax collections. rate on distilled spirits at $36.98 per gallon. The next highest rates are levied in Virginia, at $23.47 per gallon, and Alabama, at $22.87 per gallon. Spirits bear the lowest burden in Wyoming and New Hampshire, with both states levying an effective rate of $0.00 per gallon, followed by Missouri at $2.00 per gallon.

The significant disparity in tax rates across states underscores the complex tax and regulatory environment governing distilled spirits. Distilled spirits are generally taxed according to increasingly hard to define categories of alcohol. The arcane categorical system could be made more simple and more neutral by modernizing the structure and taxing according to actual alcohol content. This would enable neutral tax treatment across different types of alcohol, incentivizing competition between spirits, beer, and wine.

As the product landscape continues to develop and calls for policy reform intensify, principled public policy changes should support both industry growth and responsible consumption with neutral, simple, and transparent taxes.

Distilled Spirits Taxes by State, 2025

State Spirits Excise Tax Rates (Dollars per Gallon) as of January 1, 2025

| State | Rate | Rank | Notes |

|---|---|---|---|

| Alabama | $22.87 | 3 | (a) |

| Alaska | $12.80 | 10 | (b) |

| Arizona | $3.00 | 44 | |

| Arkansas | $9.47 | 15 | (c, d) |

| California | $3.30 | 41 | (b) |

| Colorado | $2.28 | 48 | |

| Connecticut | $5.94 | 27 | (b) |

| Delaware | $4.50 | 35 | (b) |

| District of Columbia (DC) | $6.68 | 22 | (d) |

| Florida | $6.50 | 23 | (b) |

| Georgia | $3.79 | 38 | (b) |

| Hawaii | $5.98 | 26 | |

| Idaho | $12.94 | 9 | (a) |

| Illinois | $8.55 | 20 | (b) |

| Indiana | $2.68 | 45 | (b) |

| Iowa | $15.14 | 7 | (a) |

| Kansas | $2.50 | 46 | |

| Kentucky | $9.56 | 14 | (e) |

| Louisiana | $3.03 | 43 | (b) |

| Maine | $11.93 | 12 | (a) |

| Maryland | $5.46 | 30 | (b, d) |

| Massachusetts | $4.05 | 37 | (b) |

| Michigan | $14.61 | 8 | (a) |

| Minnesota | $8.74 | 19 | (c, d) |

| Mississippi | $8.88 | 18 | (a) |

| Missouri | $2.00 | 49 | |

| Montana | $10.55 | 13 | (a) |

| Nebraska | $3.75 | 39 | |

| Nevada | $3.60 | 40 | (b) |

| New Hampshire | -- | -- | (a) |

| New Jersey | $5.50 | 29 | |

| New Mexico | $6.06 | 25 | |

| New York | $6.44 | 24 | (b) |

| North Carolina | $18.23 | 5 | (a) |

| North Dakota | $4.93 | 33 | (b, d) |

| Ohio | $12.33 | 11 | (a) |

| Oklahoma | $5.56 | 28 | |

| Oregon | $22.86 | 4 | (a) |

| Pennsylvania | $7.48 | 21 | (a) |

| Rhode Island | $5.40 | 32 | (b) |

| South Carolina | $5.42 | 31 | (c) |

| South Dakota | $4.93 | 33 | (b, d) |

| Tennessee | $4.46 | 36 | (c) |

| Texas | $2.40 | 47 | (b) |

| Utah | $16.07 | 6 | (a) |

| Vermont | $9.06 | 16 | (a) |

| Virginia | $23.47 | 2 | (a) |

| Washington | $36.98 | 1 | (d, f) |

| West Virginia | $8.98 | 17 | (a) |

| Wisconsin | $3.25 | 42 | |

| Wyoming | -- | -- | (a) |

(b) Different rates also applicable according to alcohol content, place of production, size of container, or place purchased (on- or off-premise or onboard airlines).

(c) Includes case fees and/or bottle fees which may vary with size of container.

(d) Includes sales taxes specific to alcoholic beverages.

(e) Includes the wholesale tax rate of 11%, converted to a gallonage excise tax rate.

(f) Includes the retail (17%) and distributor (5%/10%) license fees, converted into a gallonage excise tax rate.

Note: Rates are those applicable to off-premise sales of 40% alcohol by volume (a.b.v.) distilled spirits in 750ml containers. At the federal level, spirits are subject to a tiered tax system. Federal rates are $2.70 per proof gallon on the first 100,000 gallons per calendar year, $13.34/proof gallon for more than 100,000 gallons but less than 22.23 million and $13.50/proof gallon for more than 22.23 million gallons. D.C.’s rank does not affect states’ ranks, but the figure in parentheses indicates where it would rank if included. The alcohol excise tax provisions of the Tax Cuts and Jobs Act were made permanent as of Dec. 27, 2020.

Source: Distilled Spirits Council of the United States; Alcohol and Tobacco Tax and Trade Bureau.

Data compiled by Adam Hoffer

Changes from 2024 Data

- North Carolina increased their per gallon tax rate from $16.40 to $18.23.

- Arkansas increased their per gallon tax rate from $8.01 to $9.47.

- Virginia increased their per gallon tax rate from $22.06 to $23.47.

- Alabama increased their per gallon tax rate from $21.69 to $22.87.

- Iowa increased their per gallon tax rate from $14.10 to $15.14.

- Michigan increased their per gallon tax rate from $13.57 to $14.61.

Myriad tax policies are applied to distilled spirits across state jurisdictions. To allow for comparability between states, we use data to create a standard measure across the various ways spirits are taxed and sold. The governments of 17 states have granted themselves a monopoly over liquor sales. In these “control” states, the government can leverage its monopoly power to artificially inflate prices in lieu of levying a formal tax. The data in the map reflect the implied excise rates in those states with government-controlled liquor stores.

Some control states, like Virginia and Alabama, use their market power to levy notably high tax rates compared to other jurisdictions. Almost all control states have effective excise tax rates on spirits higher than the median rate across the country. Wyoming and New Hampshire, however, have set prices low enough to effectively be selling spirits without levying an additional tax. Instead, these states generate revenue from alcohol sales themselves through government stores.

The data also include any additional fees and special sales taxes applied to spirits in addition to legislated excise taxes. These include case and bottle fees, special sales taxes applied to spirits sales, wholesale taxes, and retail and distributor license fees. Distilled spirits tax rates may also vary within states according to alcohol content, place of production, or place purchased (such as on- or off-premises or onboard airlines). For these estimates, sales are assumed to be off-premises sales of 40 percent alcohol spirits in 750 mL containers.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe