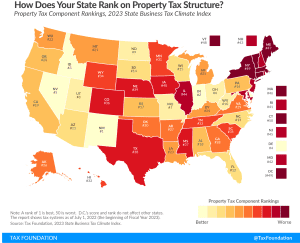

Ranking Property Taxes on the 2023 State Business Tax Climate Index

States are in a better position to attract business investment when they maintain competitive real property tax rates and avoid harmful taxes on tangible personal property, intangible property, wealth, and asset transfers.

3 min read