As the Omicron variant continues to sweep through the world, it is possible there will be renewed talks of fiscal support if economic growth declines. For this reason, it is worth reviewing how various countries responded to the pandemic over the past two years. One thing stands out: The U.S. fiscal response was among the largest of any industrialized country.

A team of researchers looked at 166 countries and ranked their fiscal responses to the pandemic as a percentage of GDP. International comparisons can be challenging because in 2020 and 2021 not all countries measured spending in the same way. As one example, their analysis actually has Japan leading among the fiscal responses to the pandemic, with an estimated 55 percent of its GDP directed towards stimulus. However, this estimate includes spending not directly related to the pandemic, such as government efforts to reduce carbon emissions and certain loan guarantees that do not affect current spending.

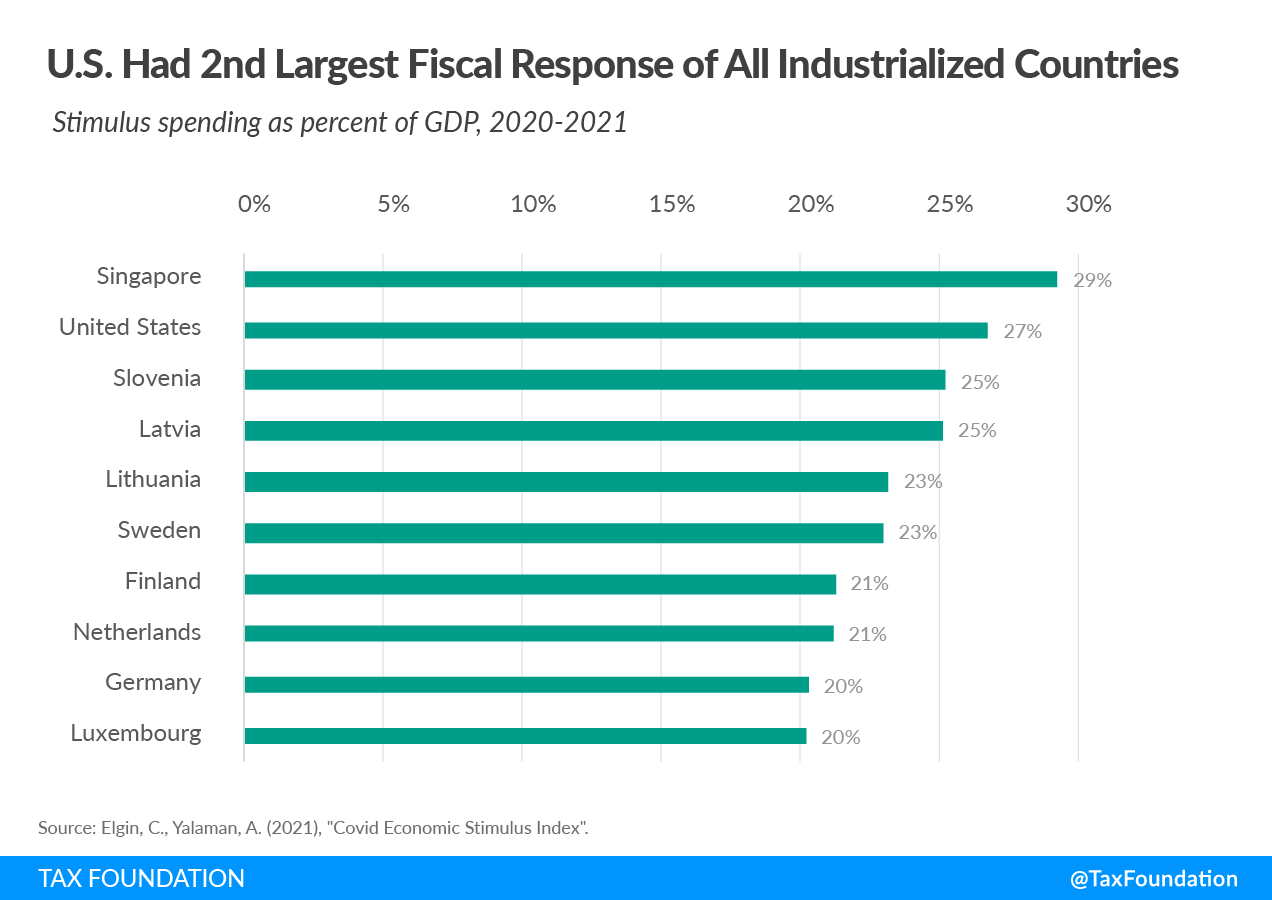

When removing this spending from the total, Japan’s fiscal stimulus drops to 16 percent of GDP, and the country falls out of the top 10 largest fiscal responses to the pandemic. Singapore leads the pack of industrialized countries with 29 percent of its GDP dedicated towards fiscal stimulus, with the U.S. not far behind with 27 percent of its GDP for this purpose. Only eight other countries spent more than 20 percent of their GDP on fiscal stimulus.

Compared to Europe, the U.S. was more likely to offer direct cash assistance to households, whereas European governments were more likely to rely on loan guarantees and support to businesses. Germany, for example, relied heavily on subsidies to businesses to maintain their payrolls and not lay off workers. While the U.S. experimented with a similar scheme through the Paycheck Protection Program, it also substantially expanded unemployment benefits to individuals, which continued until September 2021.

Additionally, the payments to U.S. households targeted much broader populations than the stimulus in Europe. European economies mainly administered targeted relief through existing welfare programs, while the U.S. sent payments to the vast majority of households. In total, 163 million payments were sent to U.S. individuals, about 85 percent of which went to households earning under $100,000 per year. Japan similarly sent checks of around $950 to households in 2020, but the U.S. stood alone in 2021 when it issued a third round of cash payments of up to $1,400 for individuals under the American Rescue Plan.

At a budgetary cost of $1.9 trillion, the American Rescue Plan passed in March of last year despite many economists, most notably Larry Summers, warning that the legislation could contribute to higher inflation. Furthermore, the stimulus came at a time when the U.S. national debt was already higher (as a share of GDP) than at any time since World War II, and projected to increase dramatically over the next 30 years.

As the U.S. grapples with rising price inflationInflation is when the general price of goods and services increases across the economy, reducing the purchasing power of a currency and the value of certain assets. The same paycheck covers less goods, services, and bills. It is sometimes referred to as a “hidden tax,” as it leaves taxpayers less well-off due to higher costs and “bracket creep,” while increasing the government’s spending power. , a large and growing national debt, as well as a possible economic slowdown due to Omicron, the decision to provide additional fiscal support will prove to be a difficult one. Policymakers can debate how much stimulus is appropriate, but what is clear is that the U.S. fiscal support so far during the pandemic outranks nearly every industrialized country.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe