State Individual Income Taxes on Nonresidents: A Primer

As a rule, an individual’s income can be taxed both by the state in which the taxpayer resides and by the state in which the taxpayer’s income is earned.

52 min read

As a rule, an individual’s income can be taxed both by the state in which the taxpayer resides and by the state in which the taxpayer’s income is earned.

52 min read

Republican policymakers in Congress are considering options to raise revenue as part of their expected legislative package in 2025. One such option involves raising the tax rate on university endowments first put in place as part of the TCJA in 2017.

4 min read

Despite stark competitiveness differences, both New Jersey and Utah share a common goal this legislative session: reforming economic nexus rules that require out-of-state sellers and marketplace facilitators to collect and remit state sales taxes.

4 min read

By streamlining, simplifying, and reducing tax burdens for remote and nonresident workers, a newly proposed bill could make Arkansas a more attractive state for both employees and employers.

4 min read

With so much emphasis on politics and procedure, the actual policy debate suffers.

What will the future of tax policy look like? In this episode, we dive into the critical challenges and opportunities looming on the horizon, especially with major tax cuts set to expire, which could increase taxes for 62 percent of filers.

The proposed ad quantum tax would be the system that most closely follows the global best practices for alcohol taxes we previously outlined.

4 min read

Facing a projected $3 billion budget deficit in fiscal year 2026, with forecasts of a growing gap over the next five years, Governor Wes Moore (D) has included about $1 billion in proposed tax increases in his budget proposal.

7 min read

Nebraska has an opportunity to revise the property tax package enacted in 2024 to ensure that Nebraskans enjoy meaningful property tax relief.

32 min read

Given the poor state of the budget process and worsening debt trajectory, lawmakers should move boldly and quickly to address the issue, including via a fiscal commission process. Issues to consider should include reforms to both spending and taxes.

42 min read

With war continuing in Ukraine, political instability in France and Germany, and the return of Donald Trump to the White House, this could be a year of major realignment for Europe. The tax policy mindset in Brussels should shift accordingly.

From 2021-2024, within the span of 3.5 years, more states enacted laws converting graduated-rate individual income tax structures into single-rate income tax structures than did so in the whole 108-year history of state income taxation up until that point.

10 min read

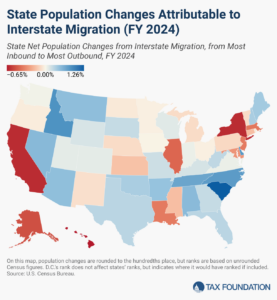

Americans were on the move in 2024, and many chose low-tax states over high-tax ones.

6 min read

According to a new poll from the Tax Foundation and Public Policy Polling, more than half of taxpayers lack basic tax literacy, regardless of educational attainment, income level, or political affiliation.

The analysis provides key insights into how their models work and the sort of outputs we can expect from their models as part of next year’s tax debate.

8 min read

Thirty-nine states will begin 2025 with notable tax changes, including nine states cutting individual income taxes. Recent years have seen a wave of significant tax reforms, and the changes scheduled for 2025 show that these efforts have not let up.

25 min read

While tariffs are often presented as tools to enhance US competitiveness, a long history of evidence and recent experience shows they lead to increased costs for consumers and unprotected producers and harmful retaliation, which outweighs the benefits afforded to protected industries.

The US already has massive problems with cigarette smuggling. A cigarette prohibition would be devastating to tax coffers while pushing smokers toward what could become the world’s largest illicit market.

4 min read

The holiday season is marked by time with friends and family, joy, and gift-giving. But could tax policy make the sticker shock from your shopping list next year tariff-ying?

4 min read

Taxes and their broader impact are generally overlooked in American education. Taxes influence earnings, budgets, voting, and decisions on where to live, but do American taxpayers understand the US tax system?

25 min read