Spanish Regions Are Not Surrendering Their Tax Competitiveness without a Fight

Spain’s central government could learn some valuable lessons from its regional governments about sound tax policy.

7 min read

Spain’s central government could learn some valuable lessons from its regional governments about sound tax policy.

7 min read

At the beginning of 2024, a fee on certain methane emissions took effect. While insignificant on its own, it is the first U.S. federal-level effort to price greenhouse gas emissions to combat climate change.

3 min read

Thirty-four states will ring in the new year with notable tax changes, including 15 states cutting individual or corporate income taxes (and some cutting both).

17 min read

Virginia Governor Youngkin unveiled the contours of a tax reform plan incorporated into his forthcoming budget, which includes three major structural elements: a reduction in the individual income tax rate, a 0.9 percentage point increase in the sales tax rate, and the broadening of the sales tax base to include some “new economy” digital services.

6 min read

In the end, the best way for the EU to support Ukraine’s post-war recovery is to guarantee its tax sovereignty, not just its territorial sovereignty.

5 min read

An alcohol by volume (ABV) tax could replace the existing alcohol tax system. An ABV tax would make alcohol taxes simpler, more transparent, and substantially more neutral than the current system.

18 min read

A national-level carbon price—a tax or cap-and-trade scheme placed on CO2 or other greenhouse gases—may seem distant in the U.S., especially since the Inflation Reduction Act, which included major climate policy, omitted one. However, policymakers on both sides of the aisle have been nibbling around the edges of carbon taxes.

5 min read

Learn more about what really happened leading up to the showdown in the harbor with this educational look through tax history.

3 min read

Marijuana taxation is one of the hottest policy issues in the United States. Twenty-one states have implemented legislation to legalize and tax recreational marijuana sales.

16 min read

With Secure 2.0, lawmakers recognized and addressed several flaws in the tax code’s treatment of saving and retirement, but there is continued work to be done simplifying and expanding savings and retirement options for taxpayers.

5 min read

Americans are saving less. While the U.S. saving rate has regularly lagged behind its peers, it has yet to return to pre-pandemic levels. Increasingly, people are turning to credit cards to fill the gaps in their budgets.

What historical lessons of wartime finance can Ukrainian and EU policymakers learn to put Ukraine’s economy on a path to success during, and especially after, the war?

5 min read

The fate of the $10,000 cap on state and local tax (SALT) deductions remains uncertain, with some policymakers pushing for an increase or repeal of the cap before its scheduled expiration in 2026.

6 min read

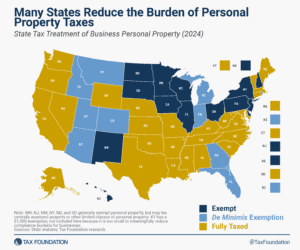

All policy choices involve trade-offs—but occasionally, the ratio of costs and benefits is shockingly lopsided. Adopting a de minimis exemption for tangible personal property (TPP) taxes is just such a policy: one which massively reduces compliance and administrative burdens at trivial cost.

18 min read

When it comes to comprehensive tax reform, poorly designed local tax policies can offset any improvements brought about by state tax policies.

6 min read

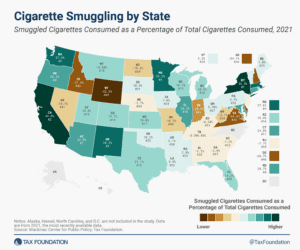

People respond to incentives. As tax rates increase or products are banned from sale, consumers and producers search for ways around these penalties and restrictions.

17 min read

At first glance, a ruling for the plaintiffs in Moore might seem to solve some of the timing problems with the U.S. tax system. Unfortunately, upon greater inspection, such a ruling might create new timing problems. And the more rigid the ruling, the harder it would be to fix the timing problems it would create.

5 min read

Unless Congress acts, Americans are in for a tax hike in 2026.

3 min read

In Congress, both parties have expressed widespread support for improving the treatment of R&D and potentially extending some or all of the major business provisions, while the White House and congressional Democrats have indicated interest in an expanded child tax credit, suggesting potential for a deal.

6 min read

Contrary to initial expectations, the pandemic years were good for state and local tax collections, and while the surges of 2021 and 2022 have not continued into calendar year 2023, revenues remain robust in most states and well above pre-pandemic levels even after accounting for inflation.

5 min read