Top Personal Income Tax Rates in Europe, 2024

Denmark (55.9 percent), France (55.4 percent), and Austria (55 percent) have the highest top statutory personal income tax rates among European OECD countries.

3 min read

Denmark (55.9 percent), France (55.4 percent), and Austria (55 percent) have the highest top statutory personal income tax rates among European OECD countries.

3 min read

For most Americans, saving is a taxing experience. Our neighbors to the north have found a better solution—and U.S. lawmakers should take note.

5 min read

One particular provision of the Biden administration’s proposal to ban so-called “junk fees” would have unintended consequences.

5 min read

Retail sales taxes are an essential part of most states’ revenue toolkits, responsible for 32 percent of state tax collections and 13 percent of local tax collections (24 percent of combined collections).

9 min read

From a revenue standpoint, about $9 billion of the $11.7 billion in lost revenue would accrue to joint filers earning more than $200,000.

5 min read

The U.S. House of Representatives has passed a highly anticipated bipartisan tax deal. The Tax Relief for American Workers and Families Act now awaits action in the Senate.

6 min read

Local income taxes in Maryland constitute about 35 percent of local tax collections and more than 17 percent of local revenue, giving Maryland’s localities the highest dependence on income taxes in the nation.

5 min read

Historical evidence and recent studies have shown that retaliatory tax and trade proposals raise prices and reduce the quantity of goods and services available to U.S. businesses and consumers, resulting in lower incomes, reduced employment, and lower economic output.

5 min read

Portugal’s value-added tax (VAT) policy is a treasure trove of tax oddities. Thankfully, VAT base broadening is an ideal instrument to give the Portuguese government the fiscal room to implement pro-growth tax reforms

5 min read

After years of strong revenue growth, Kansas has substantial cash reserves on hand, and policymakers on both sides of the aisle have expressed a desire to return some of the extra revenue to taxpayers.

5 min read

As policymakers continue efforts to improve Kentucky’s tax structure and competitiveness, they should keep in mind that not all offsets are created equal.

59 min read

The House Ways and Means Committee has advanced a tax deal to the House floor that would temporarily—and retroactively—restore two major business deductions for cost recovery and expand the child tax credit through 2025.

10 min read

Two pieces of tobacco legislation in Michigan have the potential to decrease state tax collections by $320 million per year, deter smokers from switching to less harmful products, and increase illicit trade and crime.

4 min read

Lawmakers should prioritize creating a tax system that supports investment more broadly rather than subsidizing specific industries and allowing broad, neutral pro-investment provisions to expire.

3 min read

Nebraskans need property tax relief and there are sound ways to provide it. However, increasing the sales tax rate to the highest in the country and dramatically increasing cigarette excises is not sound tax policy.

5 min read

While some recommendations follow the principles of sound tax policy and may improve the District’s tax climate, some proposals make the tax code more complex and less neutral, potentially disincentivizing investment and business activity.

6 min read

In such a determinant semester for Europe, principled tax policy can be an important tool for a more competitive European Union.

5 min read

Lawmakers should use the year ahead to thoroughly review and debate lasting, fundamental tax reform and prioritize policies that best boost work and investment incentives in a fiscally responsible manner.

4 min read

Financial literacy is a problem that educators around the country are trying to tackle. Today, we’re speaking with Jed Collins, a former NFL player, who is leading the charge in the financial education arena by guiding high school and college students, as well as professional athletes, through the world of finance.

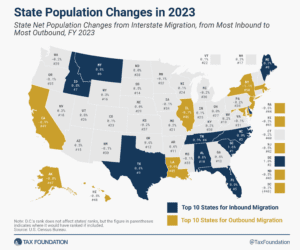

The pandemic has accelerated changes to the way we live and work, making it far easier for people to move—and they have. As states work to maintain their competitive advantage, they should pay attention to where people are moving, and try to understand why.

5 min read