Carbon Taxes in Europe, 2025

In recent years, several countries have taken measures to reduce carbon emissions, including instituting environmental regulations, emissions trading systems (ETSs), and carbon taxes.

4 min read

In recent years, several countries have taken measures to reduce carbon emissions, including instituting environmental regulations, emissions trading systems (ETSs), and carbon taxes.

4 min read

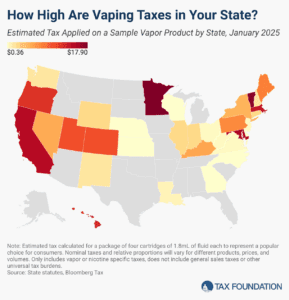

The vaping industry has grown rapidly in recent decades, becoming a well-established product category and a viable alternative to cigarettes for those trying to quit smoking. US states levy a variety of tax structures on vaping products.

7 min read

Many countries incentivize business investment in research and development (R&D), intending to foster innovation. A common approach is to provide direct government funding for R&D activity. However, a significant number of jurisdictions also offer R&D tax incentives.

4 min read

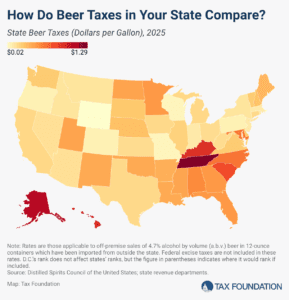

In the United States, taxes are the single most expensive ingredient in beer. The tax burden accounts for more of the final price of beer than labor and materials combined—the many different layers of applicable taxes combining to total as much as 40.8 percent of the retail price.

6 min read

The ongoing economic uncertainty from Russia’s war in Ukraine, economic recovery, supply chain disruptions, and rising interest rates have highlighted the importance of business investment.

30 min read

To make the taxation of labor more efficient, policymakers should understand their country’s tax wedge and how their tax burden funds government services.

5 min read

Different taxes have different economic effects, so policymakers should always consider how tax revenue is raised and not just how much is raised.

4 min read

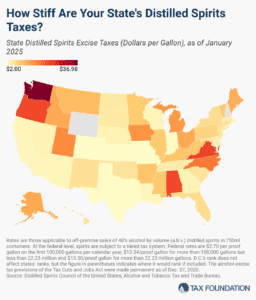

The significant disparity in tax rates across states underscores the complex tax and regulatory environment governing distilled spirits.

6 min read

Developed countries raise tax revenue through individual income taxes, corporate income taxes, social insurance taxes, taxes on goods and services, and property taxes—the combination of which determines how distortionary or neutral a tax system is.

4 min read

Carryover provisions help businesses “smooth” their risk and income, making the tax code more neutral across investments and over time.

5 min read

According to the latest economic data from the US Census Bureau, the average per capita state and local tax burden is $7,109. However, collections vary widely by state, reflecting differences in tax rates and bases, natural resource endowments, the scale and scope of taxable economic activity in each state, and residents’ political preferences.

5 min read

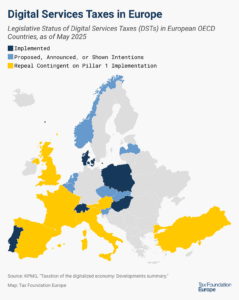

Currently, about half of all European OECD countries have either announced, proposed, or implemented a digital services tax. Because these taxes mainly impact US companies and are thus perceived as discriminatory, the US responded with retaliatory tariff threats.

5 min read

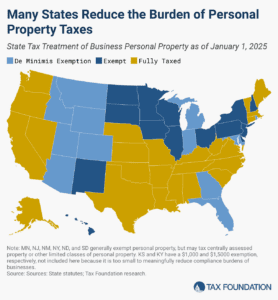

Does your state have a small business exemption for machinery and equipment?

4 min read

Without businesses as their taxpayers and tax collectors, governments would not have the resources to provide even the most basic services.

5 min read

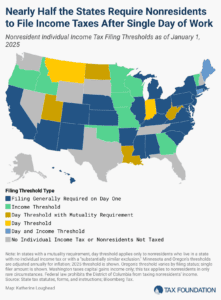

One area of the tax code in which extreme complexity and low compliance go hand-in-hand—and where reform is desperately needed—is in states’ nonresident individual income tax filing and withholding laws.

7 min read

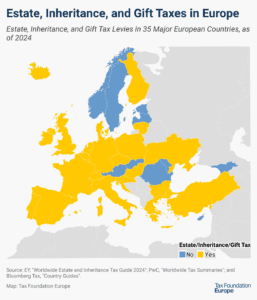

Twenty-four out of the 35 European countries covered in this map currently levy estate, inheritance, or gift taxes.

3 min read

Many states regulate and tax legal marijuana sales and consumption, despite the ongoing federal prohibition. Explore the data here.

8 min read

Facts & Figures serves as a one-stop state tax data resource that compares all 50 states on over 40 measures of tax rates, collections, burdens, and more.

2 min read

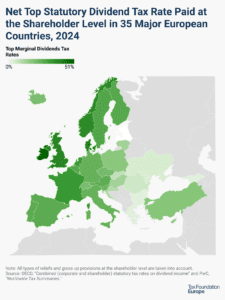

Many countries’ personal income tax systems tax various sources of individual income—including investment income such as dividends and capital gains.

4 min read

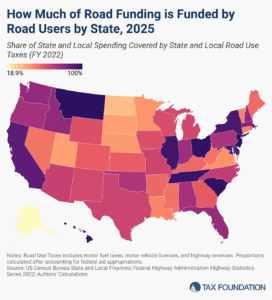

The amount of revenue states raise through roadway-related revenues varies significantly across the US. Only three states raise enough revenue to fully cover their highway spending.

5 min read