Sources of U.S. Tax Revenue by Tax Type, 2023

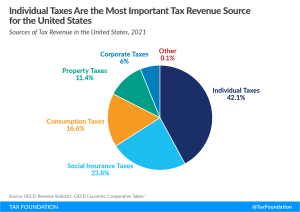

Different taxes have different economic effects, so policymakers should always consider how tax revenue is raised and not just how much is raised.

4 min read

Different taxes have different economic effects, so policymakers should always consider how tax revenue is raised and not just how much is raised.

4 min read

Designing tax policy in a way that sustainably finances government activities while minimizing distortions is important for supporting a productive economy.

5 min read

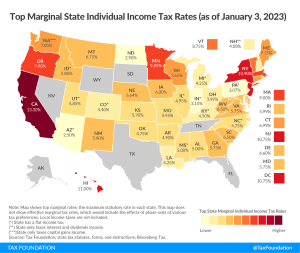

Individual income taxes are a major source of state government revenue, accounting for more than a third of state tax collections:

9 min read

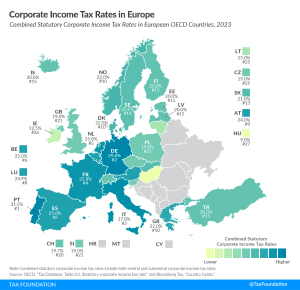

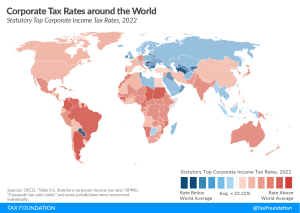

Taking into account central and subcentral taxes, Portugal has the highest corporate tax rate in Europe at 31.5 percent, followed by Germany and Italy at 29.8 percent and 27.8 percent, respectively

2 min read

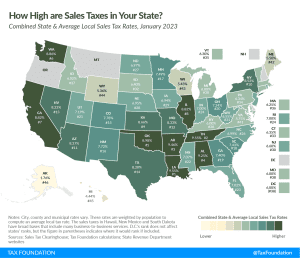

While many factors influence business location and investment decisions, sales taxes are something within policymakers’ control that can have immediate impacts.

11 min read

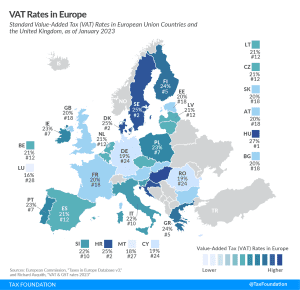

The EU countries with the highest standard VAT rates are Hungary (27 percent), Croatia, Denmark, and Sweden (all at 25 percent). Luxembourg levies the lowest standard VAT rate at 16 percent, followed by Malta (18 percent), Cyprus, Germany, and Romania (all at 19 percent).

4 min read

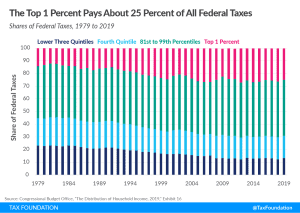

The latest IRS data shows that the U.S. federal individual income tax continued to be progressive, borne primarily by the highest income earners.

43 min read

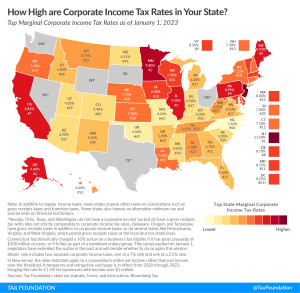

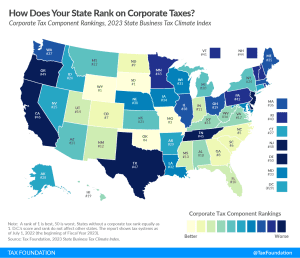

New Jersey levies the highest top statutory corporate tax rate at 11.5 percent, followed by Minnesota (9.8 percent) and Illinois (9.50 percent). Alaska and Pennsylvania levy top statutory corporate tax rates of 9.40 percent and 8.99 percent, respectively.

6 min read

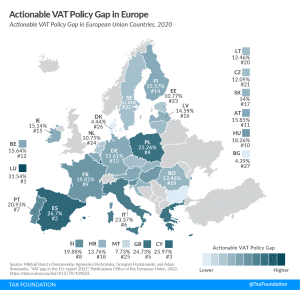

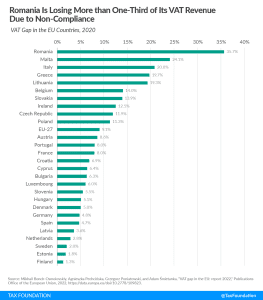

Value-added taxes (VAT) make up approximately one-fifth of total tax revenues in Europe. However, European countries differ significantly in how efficiently they raise VAT revenues. One way to measure a country’s VAT efficiency is the VAT Gap.

4 min read

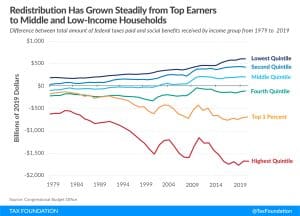

Newly published data from the CBO indicates in 2019, before the onset of the pandemic, American incomes continued to rise as part of a broad economic expansion. It also shows that, contrary to common perceptions, the federal tax system is progressive.

4 min read

Since VAT revenues are such a significant and stable contributor to overall government revenues, EU policymakers should pay particular attention to how efficiently those revenues are raised.

22 min read

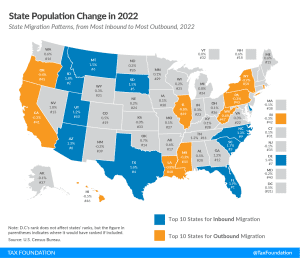

The pandemic has accelerated changes to the way we live and work, making it far easier for people to move—and they have. As states work to maintain their competitive advantage, they should pay attention to where people are moving, and try to understand why.

5 min read

Most of the 2023 state tax changes represent net tax reductions, the result of an unprecedented wave of rate reductions and other tax cuts in the past two years as states respond to burgeoning revenues, greater tax competition in an era of enhanced mobility, and the impact of high inflation on residents.

20 min read

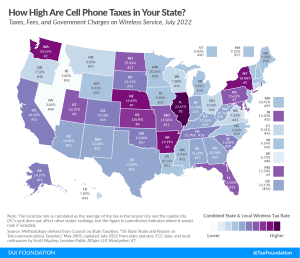

While the wireless market has become increasingly competitive in recent years, resulting in steady declines in the average price for wireless services, the price reduction for consumers has been partially offset by higher taxes.

41 min read

New CBO data shows that the current U.S. fiscal system—both taxes and direct federal benefits—is very progressive and very redistributive.

7 min read

Lawmakers should recognize both the growing importance of business R&D and the need to support it through a commonsense tax policy, namely a return to full and immediate expensing for R&D.

6 min read

A new report shows that corporate tax rates around the world continue to level off. “We aren’t seeing a race to the bottom, we’re seeing a race toward the middle,” said Sean Bray, EU policy analyst at the Tax Foundation.

25 min read

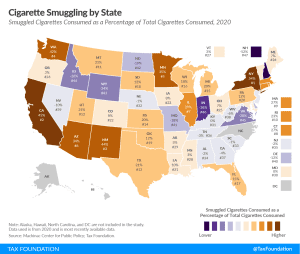

People respond to incentives. As tax rates increase or products are banned from sale, consumers and producers search for ways around these penalties and restrictions.

19 min read

All corporate income taxes fall on capital investment, but the structure should not make matters worse, and policymakers should take care not to distort investment decisions through the use of targeted incentives for select firms or activities instead of a lower rate for all businesses.

2 min read

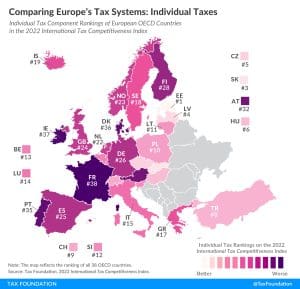

France’s individual income tax system is the least competitive among OECD countries. France’s top marginal tax rate of 45.9 percent is applied at 14.7 times the average national income. Additionally, a 9.7 surtax is applied to those at the upper end of the income distribution. Capital gains and dividends are both taxed at comparably high top rates of 34 percent.

2 min read