All Related Articles

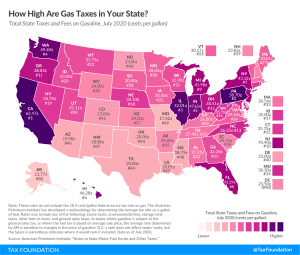

Gas Tax Rates by State, 2020

California pumps out the highest tax rate of 62.47 cents per gallon, followed by Pennsylvania (58.7 cpg), Illinois (52.01 cpg), and Washington (49.4 cpg).

2 min read

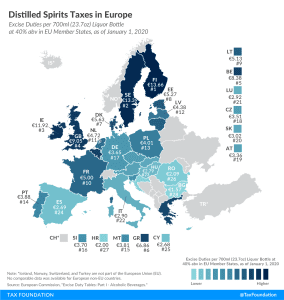

Distilled Spirits Taxes in Europe

2 min read

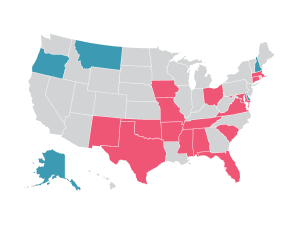

Sales Tax Holidays by State, 2020

In the midst of the coronavirus crisis, some states are hoping that a sales tax holiday might help restart struggling industries by stimulating the economy. However, sales tax holidays can mislead consumers about savings and distract from genuine, permanent tax relief.

41 min read

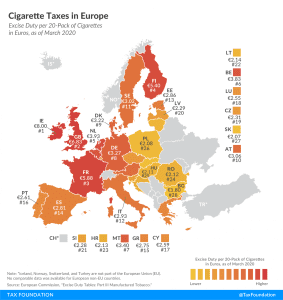

Cigarette Taxes in Europe, 2020

Ireland and the United Kingdom levy the highest excise duties on cigarettes in the European Union (EU), at €8.00 ($8.95) and €6.83 ($7.64) per 20-cigarette pack, respectively. This compares to an EU average of €3.22 ($3.61). Bulgaria (€1.80 or $2.01) and Slovakia (€2.07 or $2.32) levy the lowest excise duties.

3 min read

Sources of Personal Income, Tax Year 2017

Reviewing the sources of personal income shows that the personal income tax is largely a tax on labor, primarily because our personal income is mostly derived from labor. However, varied sources of capital income also play a role in American incomes.

9 min read

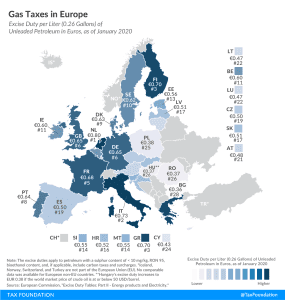

Gas Taxes in Europe, 2020

4 min read

State Tax Changes Effective July 1, 2020

Nineteen states had notable tax changes take effect on July 1, 2020. Pandemic-shortened sessions contributed to less—and different—activity on the tax front than is seen in most years, and will likely yield an unusually active summer and autumn, with many legislatures considering new measures during special sessions.

12 min read

State and Local Sales Tax Rates, Midyear 2020

Sales tax rates differ by state, but sales tax bases also impact how much revenue is collected from a tax and how the tax affects the economy.

12 min read

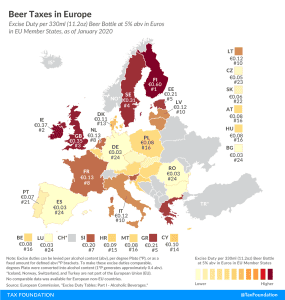

Beer Taxes in Europe, 2020

3 min read

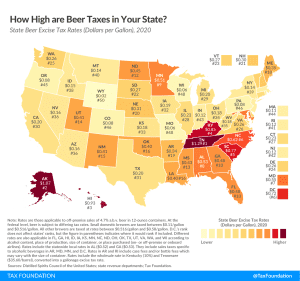

Beer Taxes by State, 2020

4 min read

Estimated Impact of Improved Cost Recovery Treatment by State

We estimate that moving to permanent full expensing and neutral cost recovery for structures would add more than 1 million full-time equivalent jobs to the long-run economy and boost the long-run capital stock by $4.8 trillion.

4 min read

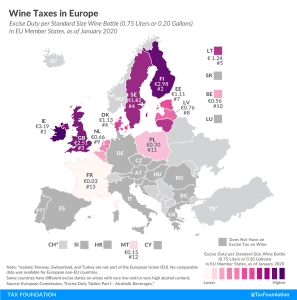

Wine Taxes in Europe

2 min read

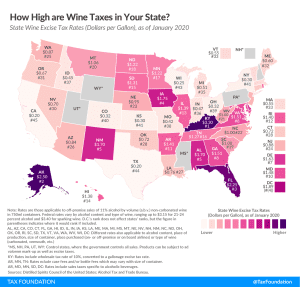

How High are Wine Taxes in Your State?

2 min read

Capital Gains Tax Rates in Europe, 2020

2 min read

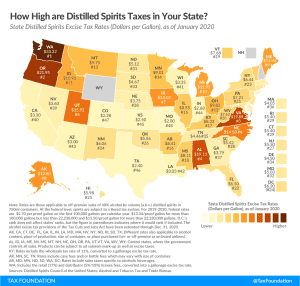

Distilled Spirits Taxes by State, 2020

2 min read

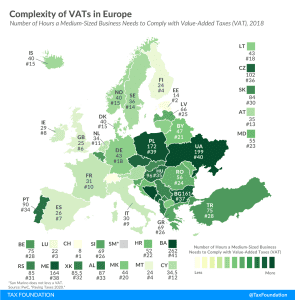

Complexity of VATs in Europe

2 min read