All Related Articles

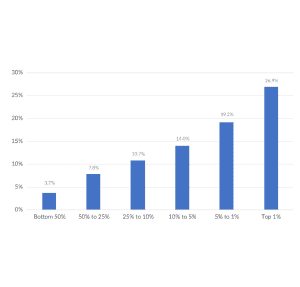

America Already Has a Progressive Tax System

Recent interest in raising the tax burden on high-income individuals glosses over the fact that the U.S. federal tax code is already progressive.

3 min read

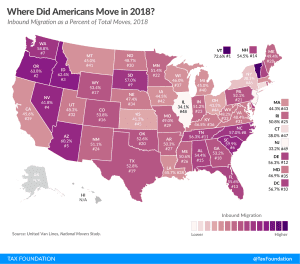

Where Did Americans Move in 2018?

2 min read

We Shouldn’t Scrap Dynamic Scoring

2 min read

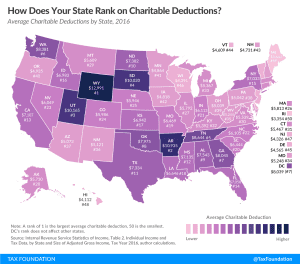

Charitable Deductions by State

2 min read

Wireless Taxes and Fees Climb Again in 2018

A typical family with four cell phones paying $100 per month for service can expect to pay about $229 per year in wireless taxes, fees, and surcharges. Nationally, these impositions make up about 19.1 percent of the average customer’s cell phone bill.

35 min read

2019 Tax Brackets

The IRS recently released its 2019 individual income tax brackets and rates. Check out the new standard deduction, child tax credit, earned income tax credit, rates and brackets, and more.

5 min read

Corporate Tax Rates Around the World, 2018

Since 1980, the worldwide average statutory corporate tax rate has consistently decreased as countries have realized the negative impact that corporate taxes have on business investment decisions.

11 min read

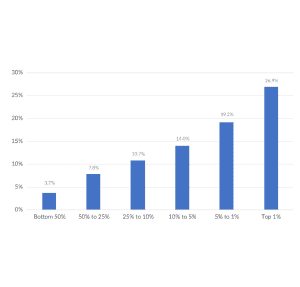

Summary of the Latest Federal Income Tax Data, 2018 Update

The top 50 percent of all taxpayers pay 97 percent of all individual income taxes, while the bottom 50 percent paid the remaining 3 percent.

21 min read

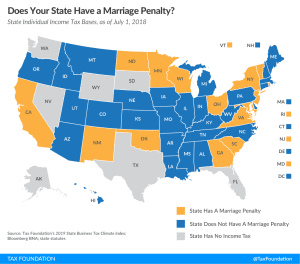

Does Your State Have a Marriage Penalty?

1 min read