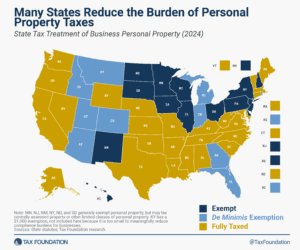

Tangible Personal Property De Minimis Exemptions by State, 2024

Does your state have a small business exemption for machinery and equipment?

3 min read

Does your state have a small business exemption for machinery and equipment?

3 min read

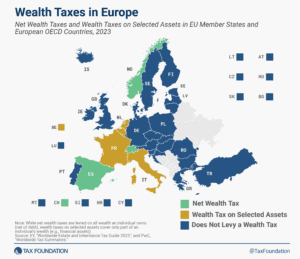

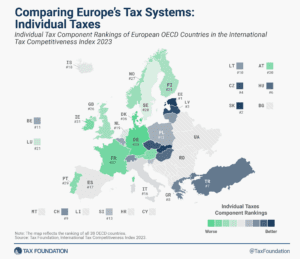

Only three European countries levy a net wealth tax—Norway, Spain, and Switzerland. France and Italy levy wealth taxes on selected assets.

4 min read

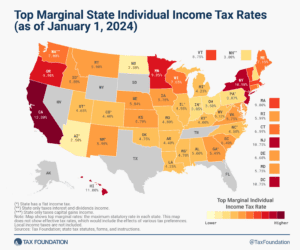

Individual income taxes are a major source of state government revenue, accounting for more than a third of state tax collections. How do income taxes compare in your state?

8 min read

Denmark (55.9 percent), France (55.4 percent), and Austria (55 percent) have the highest top statutory personal income tax rates among European OECD countries.

3 min read

Retail sales taxes are an essential part of most states’ revenue toolkits, responsible for 32 percent of state tax collections and 13 percent of local tax collections (24 percent of combined collections).

9 min read

A few European countries have made changes to their VAT rates, including the Czech Republic, Estonia, Switzerland, and Turkey.

3 min read

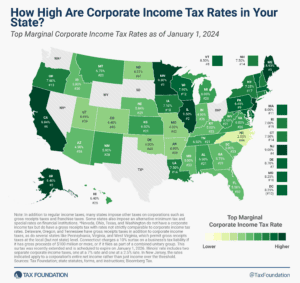

Graduated corporate rates are inequitable—that is, the size of a corporation bears no necessary relation to the income levels of the owners.

7 min read

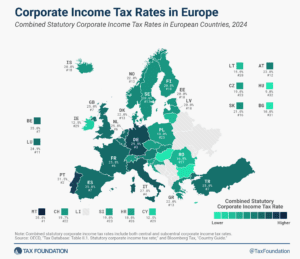

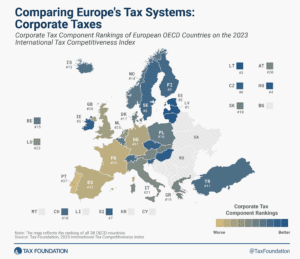

Like most regions around the world, European countries have experienced a decline in corporate income tax rates over the past four decades, but the average corporate income tax rate has leveled off in recent years.

2 min read

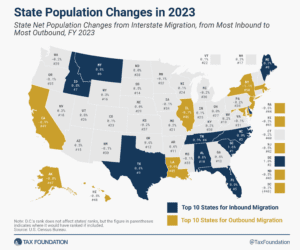

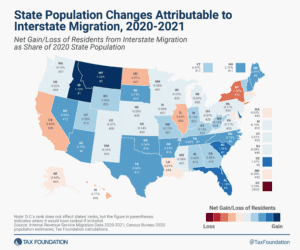

The pandemic has accelerated changes to the way we live and work, making it far easier for people to move—and they have. As states work to maintain their competitive advantage, they should pay attention to where people are moving, and try to understand why.

5 min read

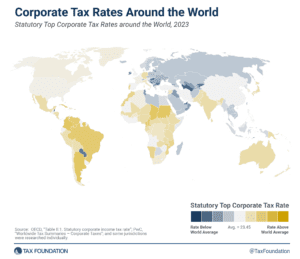

Of the 225 jurisdictions around the world, only six have increased their top corporate income tax rate in 2023, a trend that might be reversed in the coming years as more countries agree to implement the global minimum tax.

17 min read

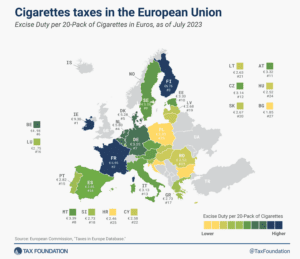

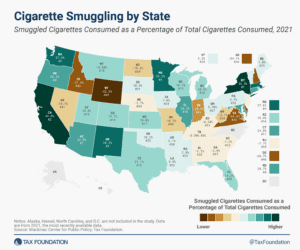

People respond to incentives. As tax rates increase or products are banned from sale, consumers and producers search for ways around these penalties and restrictions.

17 min read

Contrary to initial expectations, the pandemic years were good for state and local tax collections, and while the surges of 2021 and 2022 have not continued into calendar year 2023, revenues remain robust in most states and well above pre-pandemic levels even after accounting for inflation.

5 min read

Estonia has the most competitive individual tax system in the OECD for the 10th consecutive year.

2 min read

Explore the IRS inflation-adjusted 2024 tax brackets, for which taxpayers will file tax returns in early 2025.

4 min read

The latest IRS and Census data show that people and businesses favor states with low and structurally sound tax systems, which can impact the state’s economic growth and governmental coffers.

8 min read

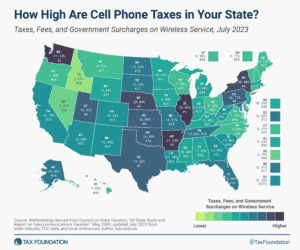

To alleviate the regressive impact on wireless consumers, states should examine their existing communications tax structures and consider policies that transition their tax systems away from narrowly based wireless taxes and toward broad-based tax sources.

18 min read

According to the corporate tax component of the 2023 International Tax Competitiveness Index, Latvia and Estonia have the best corporate tax systems in the OECD.

2 min read

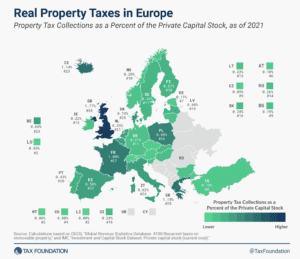

High property taxes levied not only on land but also on buildings and structures can discourage investment in infrastructure, which businesses would have to pay additional tax on.

2 min read

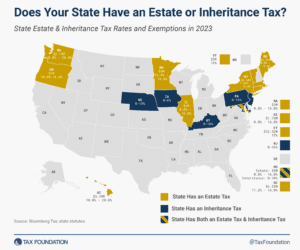

In addition to the federal estate tax, with a top rate of 40 percent, some states levy an additional estate or inheritance tax.

4 min read