All Related Articles

2017 GDP and Employment by Industry

In the U.S. economy, there are tens of millions of businesses, including more than 30 million pass-through businesses and more than a million C corporations. Most output and employment come from firms that provide services to consumers—such as education, health care, and social assistance services—though a large share of output and employment still comes from firms in production industries, particularly manufacturing.

2 min read

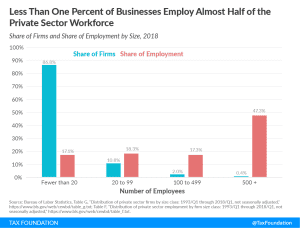

Firm Variation by Employment and Taxes

Less than one percent of businesses employ almost half of the private sector workforce. Large companies pay 89% of corporate income taxes in the United States.

2 min read

Sources of Government Revenue in the OECD, 2019

OECD countries have on average become more reliant on consumption taxes and less reliant on individual income taxes. These policy changes matter, considering that consumption-based taxes raise revenue with less economic damage and distortionary effects than taxes on income.

10 min read

Tax Treaty Network of European Countries

1 min read

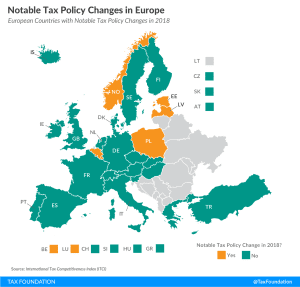

Notable Tax Policy Changes in Europe

2 min read

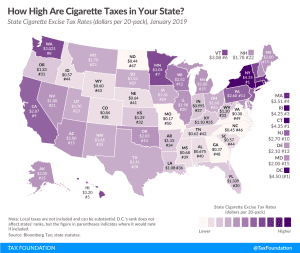

How High Are Cigarette Taxes in Your State?

Cigarette taxes around the country are levied on top of the federal rate of $1.0066 per 20-pack of cigarettes. As of 2016, taxes accounted for almost half of the retail cost of a pack of cigarettes.

2 min read

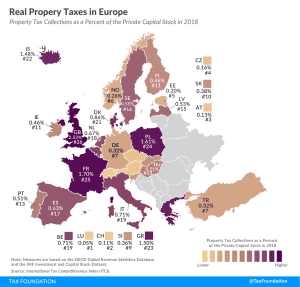

Real Property Taxes in Europe, 2019

3 min read

Capital Cost Recovery across the OECD, 2019

Capital cost recovery, though often overlooked, can have a significant impact on investment decisions—with far-reaching economic consequences.

24 min read

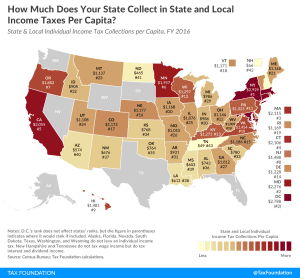

Putting A Face On America’s Tax Returns: Summary

Who really bears the burden of federal taxes? How progressive is our current tax system and what role do taxes play in the debate over income inequality?

5 min read

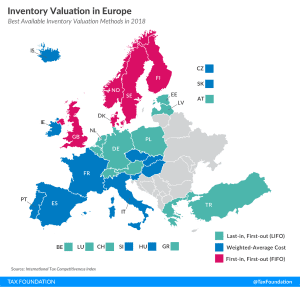

Inventory Valuation in Europe

2 min read

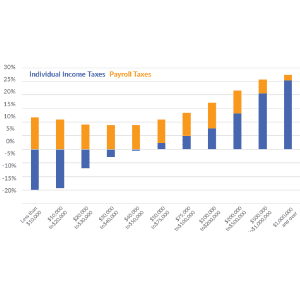

New Report Shows the Burdens of Payroll and Income Taxes

The tax burden for most Americans in 2019 –67.8 percent—will come primarily from payroll taxes, not income taxes. While the income tax is progressive, with average rates rising with income, the payroll tax is regressive, with the highest average rate falling on Americans with the lowest incomes.

4 min read