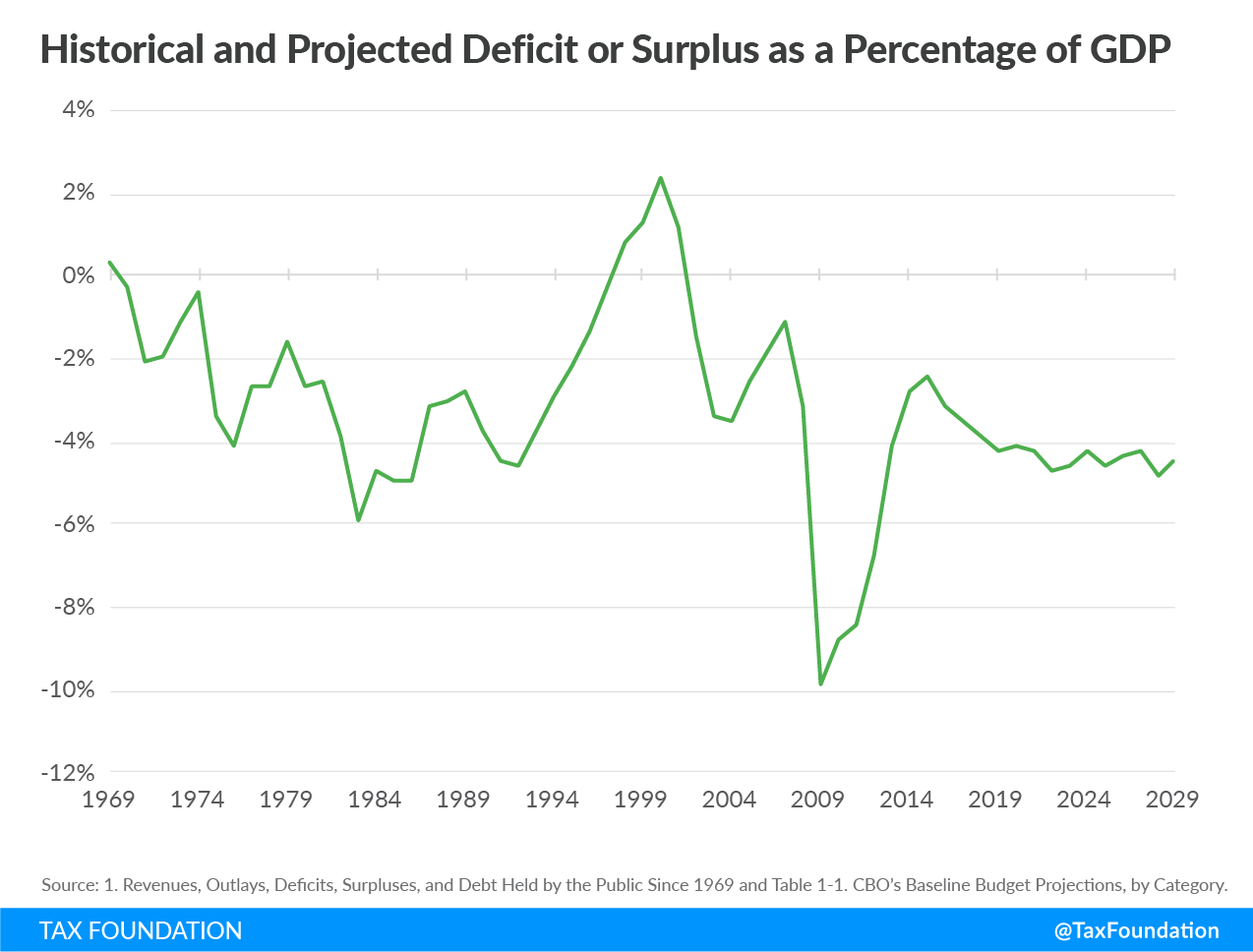

Over the next 10 years, if existing laws remain unchanged, the Congressional Budget Office (CBO) projects that federal budget deficits will fluctuate between 4.1 percent and 4.7 percent of gross domestic product (GDP). This is above the average observed over the last 50 years.

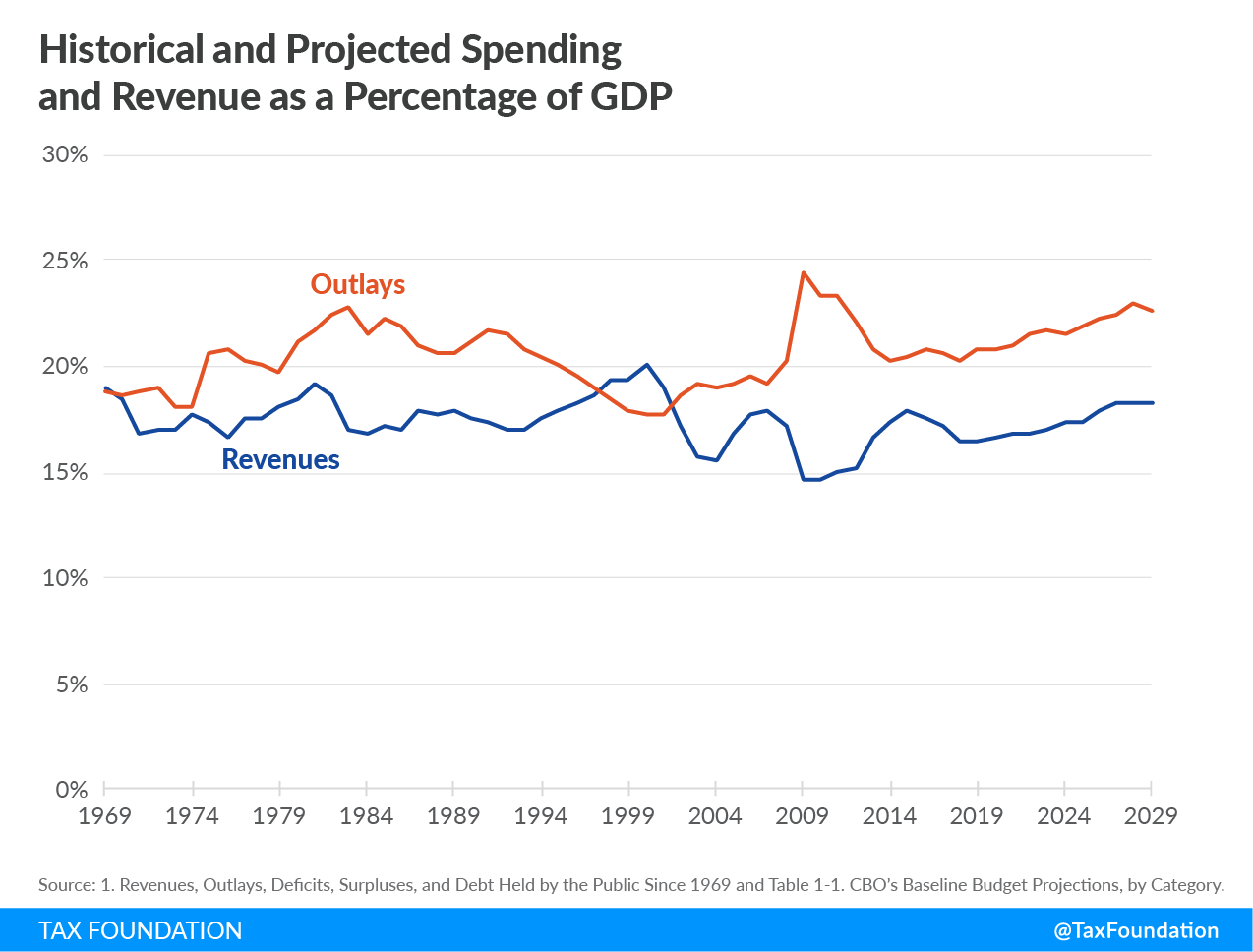

The charts below show CBO data on historical and projected government spending, revenues, and deficits/surpluses, covering years 1969 through 2029. Generally, surpluses have occurred alongside economic expansions while deficits have occurred alongside economic downturns. Over the past five decades, revenues have averaged 17.4 percent of GDP while outlays have averaged 20.3 percent of GDP. This has resulted in an average deficit of 2.9 percent of GDP over the same period.

In 2018, revenues were below the 50-year average, at 16.4 percent, while spending was on par with its 50-year average. The 2018 deficit was 3.9 percent of GDP, above its 50-year average. The CBO states:

Over the 2020–2029 period, deficits are projected to average 4.4 percent of GDP, totaling $11.6 trillion. Such deficits would be significantly larger than the 2.9 percent of GDP that deficits averaged over the past 50 years. Revenues and outlays are both projected to rise in relation to GDP, but the gap between them is projected to persist, resulting in large deficits and rising debt.

By 2029, spending as a share of GDP is projected to rise above its 50-year average, reaching 23 percent. Meanwhile, revenues are also expected to rise above their 50-year average, reaching 18.3 percent of GDP in 2029. This will result in a deficit of 4.7 percent of GDP in 2029, well above the 50-year average of 2.9 percent.

Importantly, these projections assume that the existing laws related to taxes and spending remain the same. If lawmakers were to make provisions like taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. extenders or the temporary parts of the Tax Cuts and Jobs Act permanent, revenue projections would not look the same. Likewise, if lawmakers enacted new programs, the spending side of the equation would be different. In all, the CBO expects deficits as a share of the economy to continue increasing in size over the next decade under current law.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe