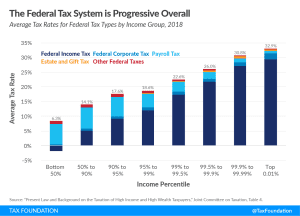

Joint Committee on Taxation Data Shows Federal Tax System Is Progressive

New Joint Committee on Taxation (JCT) data indicates that the federal tax system is progressive, consistent with similar analysis by the Congressional Budget Office (CBO), and the OECD.

2 min read