All Related Articles

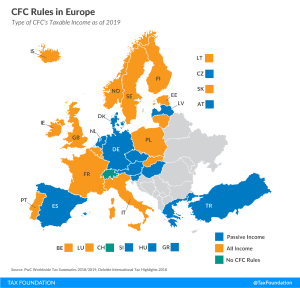

CFC Rules in Europe

2 min read

How High Are Wine Taxes in Your State?

2 min read

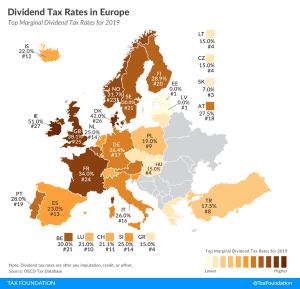

Dividend Tax Rates in Europe, 2019

2 min read

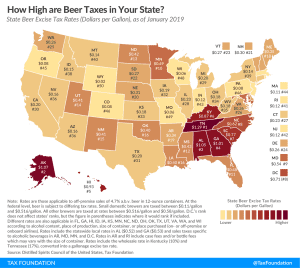

Beer Taxes by State, 2019

4 min read

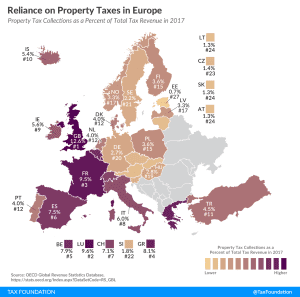

Reliance on Property Taxes in Europe

1 min read

Business in America

Who are the workers, consumers, and shareholders who interact with businesses in the U.S.? What forms do these businesses take? How do business taxes impact people’s lives? It is essential we answer these questions in order to design a business tax system that is simple, efficient, and enables economic progress.

5 min read

The U.S. Tax Burden on Labor, 2019

13 min read

Tax Burden on Labor in Europe, 2019

2 min read

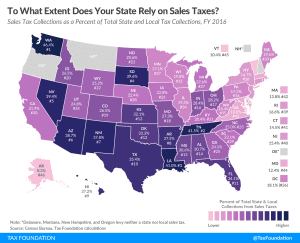

To What Extent Does Your State Rely on Sales Taxes?

Many states are seeing a significant narrowing of their bases as lawmakers continue to carve out exemptions, and as consumption patterns shift ever more towards relatively-untaxed services.

4 min read

Reliance on Consumption Taxes in Europe

2 min read

The Tax Gap Tops $500 Billion a Year

4 min read

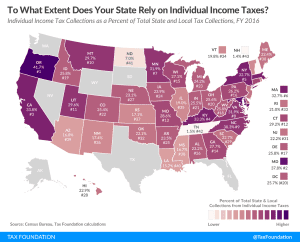

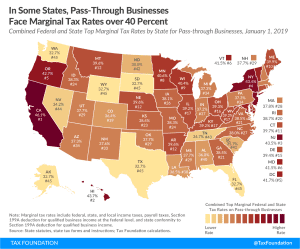

Marginal Tax Rates for Pass-through Businesses Vary by State

Pass-through businesses are now the dominant business form in the U.S., making up more than half of the private sector workforce in every state. Federal taxes on income set a minimum tax rate for pass throughs, but marginal rates for pass throughs vary based on how states tax individual income.

3 min read

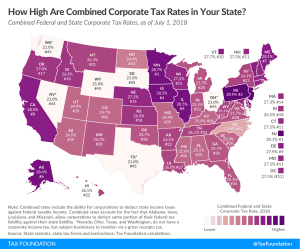

State Corporate Income Taxes Increase Tax Burden on Corporate Profits

The Tax Cuts and Jobs Act (TCJA) reduced the U.S. federal corporate income tax rate from 35 percent to 21 percent. However, most U.S. states also tax corporate income. These state-level taxes mean the average statutory corporate income tax rate in the U.S., which combines the average of state corporate income tax rates with the federal corporate income tax rate, is 25.8 percent in 2019.

2 min read

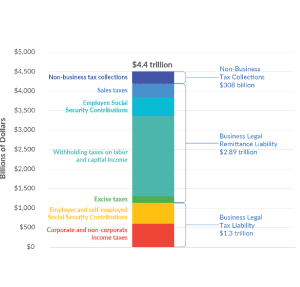

U.S. Businesses Pay or Remit 93 Percent of All Taxes Collected in America

Setting aside the debate over whether a low tax bill is fair, what is missed in such stories is that American businesses are critical to the tax collection system at every level of government—federal, state, and local. Businesses either pay or remit more than 93 percent of all the taxes collected by governments in the U.S. Without businesses as their taxpayers and tax collectors, American governments would not have the resources to provide even the most basic services.

5 min read