A Mis-STEP for the European Union: The New Subsidy Race to the Bottom

Enhancing the European Union’s competitiveness is necessary, but the European Commission’s latest attempt is the wrong approach.

4 min read

Enhancing the European Union’s competitiveness is necessary, but the European Commission’s latest attempt is the wrong approach.

4 min read

It is hard to imagine the IRS Direct e-File Program operating seamlessly with the complexity of the current U.S. tax system. Instead, lawmakers should first address the more fundamental problem that causes taxpayer frustration: our highly complicated tax code.

4 min read

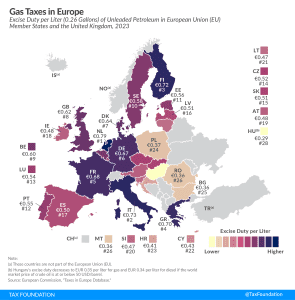

As the EU pursues massive changes in public policy as part of its green transition, expect fuel taxes to be central to any policy discussions.

5 min read

The European Commission proposed a new source of revenue as part of its second basket of own resources: a “temporary statistical own resource based on company profits.” This is an attempt to bolster the EU’s budget as it repays its debt.

5 min read

This tax reform plan would boost long-run GDP by 2.5%, grow wages by 1.4%, and add 1.3M jobs, all while collecting a similar amount of tax revenue as the current code and reducing the long-run debt burden.

38 min read

Reviewing reported income helps to understand the composition of the federal government’s revenue base and how Americans earn their taxable income. The individual income tax, the federal government’s largest source of revenue, is largely a tax on labor.

10 min read

At least 32 notable tax policy changes recently took effect across 18 states, including alterations to income taxes, payroll taxes, sales and use taxes, property taxes, and excise taxes. See if your state tax code changed.

16 min read

What does the tax reform package do well? What does it do poorly? How would it affect me?

4 min read

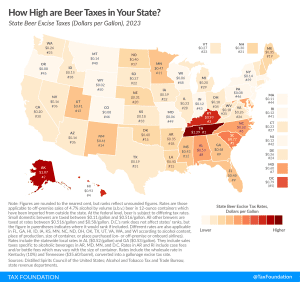

Taxes are the single most expensive ingredient in beer, costing more than the labor and raw materials combined.

3 min read

Lawmakers should focus on simplifying the federal tax code, creating stability, and broadly improving economic incentives. There are incremental steps that can be made on the path to fundamental tax reform.

The JCT analysis raises some useful questions for the U.S. domestic debate over Pillar Two. The Treasury Department should examine its support for an agreement that will reduce its own revenue intake. But it is also worth noting that the principal mechanism for the revenue reduction—the foreign tax credit—is a policy already baked into U.S. law, including the Republican-enacted global minimum tax from 2017. The OECD deal merely takes advantage of this longstanding feature.

6 min read

House Republicans are proposing to expand the Opportunity Zone program and alter its reporting requirements as part of a new suite of tax bills packaged as the American Families and Jobs Act.

4 min read

As fiscal year 2023 draws to a close, North Carolina’s House and Senate have each passed their own versions of the biennial budget for fiscal years 2024-25. While legislative leaders have generally agreed to overall spending levels, negotiations remain ongoing to resolve different approaches to tax policy.

7 min read

Texas’s robust surpluses create an opportunity to use state funds to lower local property taxes. However, it remains important for legislators to pursue a principled approach to rate compression, rather than enacting a plan that will simply shift the tax burden in nonneutral ways.

3 min read

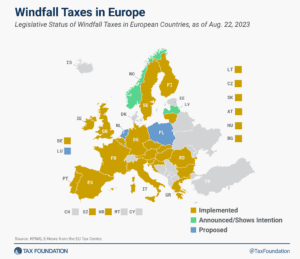

It’s unlikely these implemented and proposed windfall taxes will achieve their goals of raising additional revenues without distorting the market. Instead, they would penalize domestic production and punitively target certain industries without a sound tax base.

13 min read

Sens. Kevin Cramer (R-ND) and Christopher Coons (D-DE) have recently introduced a bill laying the groundwork for a possible solution to the problem: a tax on the carbon content of imports. But it falls short of the optimal approach in several ways.

4 min read

By extending bonus depreciation and introducing neutral cost recovery, the RSC budget would significantly improve the treatment of investment leading to increased growth, expanded employment, and higher wages.

3 min read

What both parties ignore: The IRS does not need more money for enforcement; it needs fewer things to enforce.