All Related Articles

U.S. Tax Incentives Could be Caught in the Global Minimum Tax Crossfire

The current prospect for the global minimum tax requires the attention of U.S. lawmakers. Otherwise, a tax benefit at home will just mean a tax increase abroad.

6 min read

States Should Act Fast on UC Trust Fund Deposits, and Other Takeaways from the New Treasury Guidance on ARPA Funding

States will continue to cut taxes because revenues are skyrocketing. But some will also be keeping a close eye on litigation targeting this dubious restriction on states’ fiscal autonomy.

8 min read

Tennessee Should Build on Success and Improve Corporate Taxes

While Tennessee now boasts no individual income tax, there is still more work to be done for businesses—Tennessee is in a good position to get the job done.

7 min read

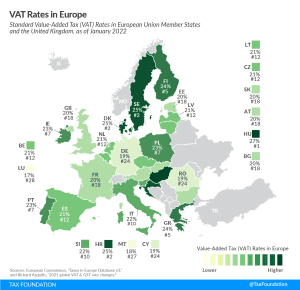

VAT Rates in Europe, 2022

The VAT is a consumption tax assessed on the value added in each production stage of a good or service. Every business along the value chain receives a tax credit for the VAT already paid. The end consumer does not, making it a tax on final consumption.

4 min read

Mississippi Nears Income Tax Repeal but Additional Work Is Necessary

Before declaring victory, it is imperative to get the details right. The latest proposal is a drastic improvement over the last one, but there is still more work to be done if the Magnolia State is to sustain the intended transformation.

7 min read

Taxes, Fiscal Policy, and Inflation

Consumer prices rose by 7 percent in 2021, the highest annual rate of inflation since 1982. Where did this inflation come from and what might its impacts be? Tax and fiscal policy offer important clues.

5 min read

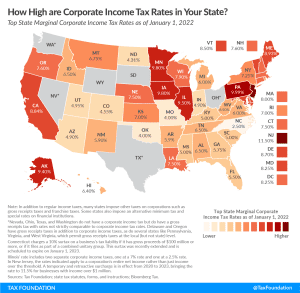

State Corporate Income Tax Rates and Brackets, 2022

Forty-four states levy a corporate income tax. Rates range from 2.5 percent in North Carolina to 11.5 percent in New Jersey.

8 min read

Net Operating Loss Provisions: State Treatment and the Economic Benefits

Well-designed Net Operating Loss (NOL) provisions benefit the economy by smoothing business income, which mitigates entrepreneurial risk and helps firms survive economic downturns.

24 min read

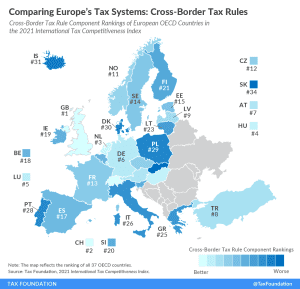

Comparing Europe’s Tax Systems: Cross-Border Tax Rules

Cross-border tax rules define how income earned abroad and by foreign entities are taxed domestically, making them an important element of each country’s tax code.

3 min read

State Tax Changes Effective January 1, 2022

Twenty-one states and D.C. had significant tax changes take effect on January 1, including five states that cut individual income taxes and four states that saw corporate income tax rates decrease.

17 min read

California Considers Doubling its Taxes

Practically doubling state taxes—even if the burden is partially offset through state-provided health coverage—could send taxpayers racing for the exits.

6 min read

Eight State Tax Reforms for Mobility and Modernization

States are unprepared for the ongoing shift to remote and flexible work arrangements, or for the industries and activities of today, to say nothing of tomorrow. In some states, moreover, existing tax provisions exacerbate the impact of high inflation and contribute to the supply chain crisis.

40 min read

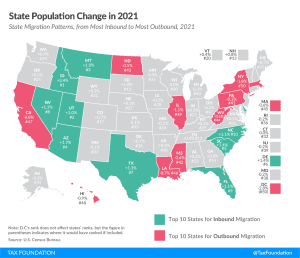

Americans Moved to Low-Tax States in 2021

The pandemic has accelerated changes in the way we live and work, making it far easier for people to move—and they have. As states work to maintain their competitive advantage, they should pay attention to where people are moving, and try to understand why.

6 min read

U.S. Fiscal Response to COVID-19 Among Largest of Industrialized Countries

As the U.S. grapples with rising price inflation, a large and growing national debt, as well as a possible economic slowdown due to Omicron, the decision to provide additional fiscal support will prove to be a difficult one. Policymakers can debate how much stimulus is appropriate, but what is clear is that the U.S. fiscal support so far during the pandemic outranks nearly every industrialized country.

3 min read

A Holiday Tradition: Tax Extenders Slated to Expire at End of 2021

Tax extenders this year can be split into three rough groups: expiring parts of the Tax Cuts and Jobs Act (TCJA), expiring parts of various COVID-19 economic relief packages, and the Island of Misfit Extenders.

8 min read

Gift or Lump of Coal: U.S. Cross-border Tax Changes Won’t Be Home for Christmas

As 2021 comes to a close, countries are moving toward harmonizing tax rules for multinationals, but stalled talks on the Build Back Better Act in the United States means new uncertainties for a global agreement and for taxpayers.

5 min read

What Do Global Minimum Tax Rules Mean for Corporate Tax Policies?

The new OECD global minimum tax rules are complex, and some countries may opt to put them in place on top of preexisting rules for taxing multinational companies. However, countries should also consider ways to reform their existing rules in response to the minimum tax.

7 min read

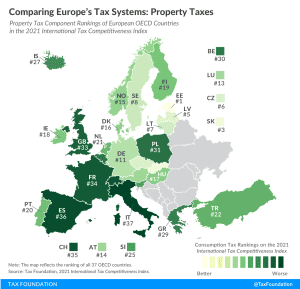

Comparing Europe’s Tax Systems: Property Taxes

According to the 2021 International Tax Competitiveness Index, Switzerland has the best-structured consumption tax among OECD countries while Poland has the worst-structured consumption tax code.

2 min read