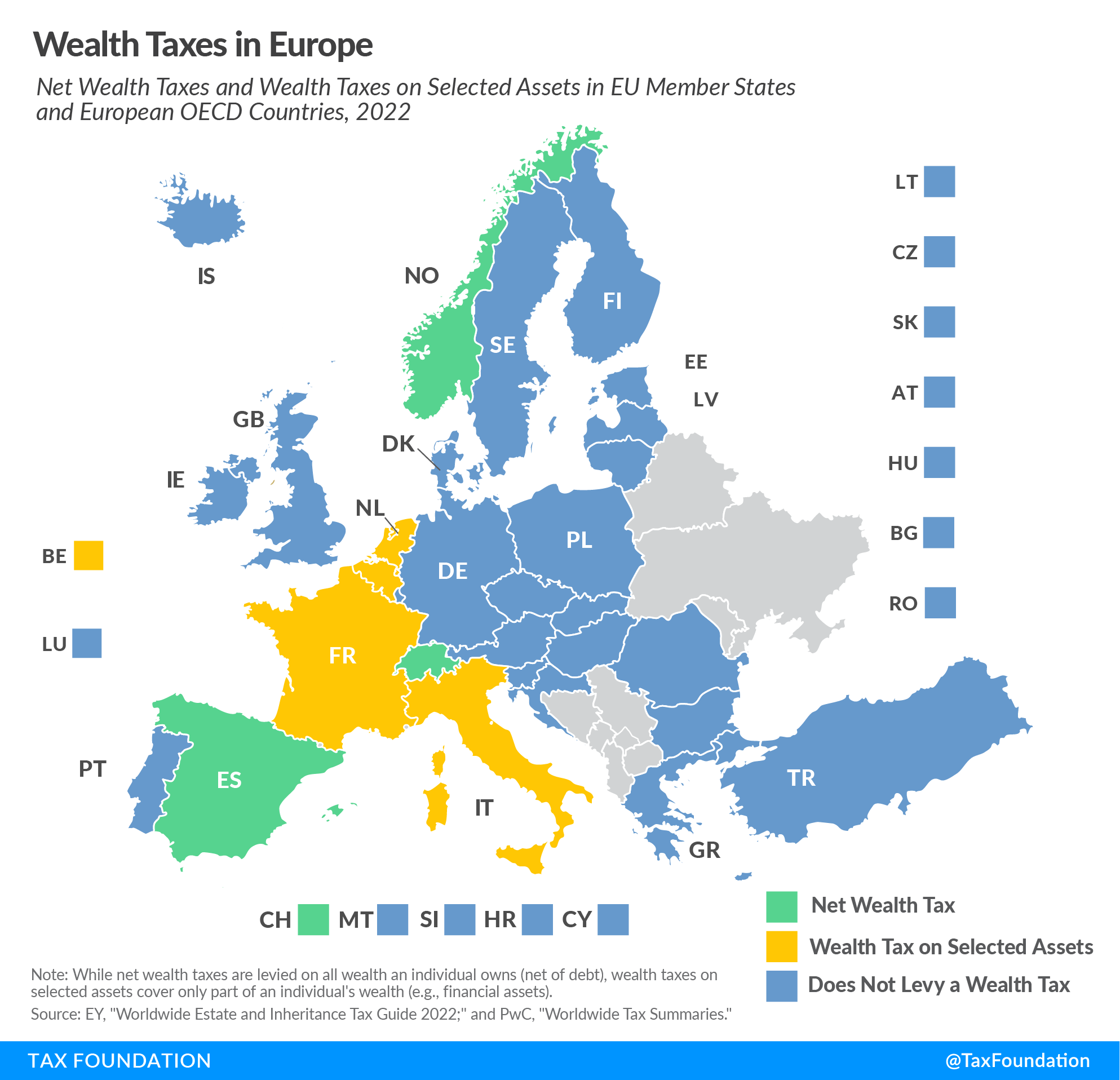

Wealth Taxes in Europe, 2023

4 min readBy:Net wealth taxes are recurrent taxes on an individual’s wealth, net of debt. The concept of a net wealth taxA wealth tax is imposed on an individual’s net wealth, or the market value of their total owned assets minus liabilities. A wealth tax can be narrowly or widely defined, and depending on the definition of wealth, the base for a wealth tax can vary. is similar to a real property taxA property tax is primarily levied on immovable property like land and buildings, as well as on tangible personal property that is movable, like vehicles and equipment. Property taxes are the single largest source of state and local revenue in the U.S. and help fund schools, roads, police, and other services. . But instead of only taxing real estate, it covers all wealth an individual owns. As today’s map shows, only three European countries levy a net wealth tax—Norway, Spain, and Switzerland. France and Italy levy wealth taxes on selected assets but not on an individual’s net wealth per se.

Net Wealth Taxes

Norway levies a net wealth taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. of 0.95 percent on individuals’ wealth stocks exceeding NOK 1.7 million (EUR 140,000 or USD 160,000), with 0.7 percent going to municipalities and 0.25 percent to the central government. Norway’s net wealth tax dates to 1892. Additionally, for net wealth exceeding NOK 20 million (USD 1.87 million), the tax rate is 1.1 percent.

Spain’s net wealth tax is a progressive tax ranging from 0.2 percent to 3.75 percent on wealth stocks above EUR 700,000 (USD 771,530; lower in some regions), with rates varying substantially across Spain’s autonomous regions (Madrid and Andalusia offer 100 percent relief). Spanish residents are subject to the tax on a worldwide basis while nonresidents pay the tax only on assets located in Spain.

Additionally, the Spanish central government introduced a “solidarity wealth tax” ranging from 1.7 percent to 3.5 percent on individuals with net assets exceeding EUR 3 million (USD 3.31 million) for 2022 and 2023. Under this new scheme, the central government collects any additional revenue from the solidarity tax once the regional wealth tax collection is deducted. This wealth tax will affect not only taxpayers in Andalusia and Madrid, but all taxpayers that live in a region that approved a higher tax exemption threshold or lower tax rates than the ones established by the central government.

Switzerland levies its net wealth tax at the cantonal level and covers worldwide assets (except real estate and permanent establishments located abroad). The tax rates and allowances vary significantly across cantons. The Swiss net wealth tax was first implemented in 1840.

Wealth Taxes on Selected Assets

France abolished its net wealth tax in 2018 and replaced it that year with a real estate wealth tax. French tax residents whose net worldwide real estate assets are valued at or above EUR 1.3 million (USD 1.43 million) are subject to the tax, as well as non-French tax residents whose net real estate assets located in France are valued at or above EUR 1.3 million. Depending on the net value of the real estate assets, the tax rate ranges as much as 1.5 percent.

Italy taxes financial assets held abroad without Italian intermediaries by individual resident taxpayers at 0.2 percent. In addition, real estate properties held abroad by Italian tax residents are taxed at 0.76 percent.

Since 2021, Belgium has had a solidarity tax or tax on securities accounts (TSA) of 0.15 percent on securities accounts with an average value of EUR 1 million (USD 1.1 million).

In the Netherlands, the value of net wealth (excluding primary residence and substantial interests in companies) is included in the income tax, with effective tax rates ranging from 0.56 percent to 1.78 percent. Nevertheless, in 2021, the Dutch Supreme Court ruled that this system violates European Law regarding property rights and non-discrimination. In 2022, an alternative system was proposed where each asset category—savings, debts, and others—would have its own deemed return. 2022 was a transition year where taxpayers had to choose under which system (the old system or the new proposal) they preferred to be taxed.

While wealth taxes collect little revenue, an OECD report argues that these taxes can also disincentivize entrepreneurship, harming innovation and long-term growth. In practice, the recent wealth tax developments have pushed Spain’s regional governments to appeal the “solidarity wealth tax” to the Constitutional Court. Additionally, Norway approved a higher exit tax as billionaires are fleeing the country. Instead of reforming and hiking the wealth tax, perhaps policymakers should consider whether the tax is serving its intended objectives, and, if not, consider repealing the tax altogether.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe