State Individual Income Taxes on Nonresidents: A Primer

As a rule, an individual’s income can be taxed both by the state in which the taxpayer resides and by the state in which the taxpayer’s income is earned.

52 min read

As a rule, an individual’s income can be taxed both by the state in which the taxpayer resides and by the state in which the taxpayer’s income is earned.

52 min read

In a recent speech at the Davos Economic Forum, European Commission President Ursula von der Leyen announced plans to create a single set of rules for corporate law, insolvency, labor law, and taxation, under which companies could seamlessly operate across the European Single Market.

7 min read

As lawmakers work through the reconciliation process, permanently enacting improvements to deductions for capital investment and research and development (R&D) costs will create an economically powerful package.

7 min read

Republican policymakers in Congress are considering options to raise revenue as part of their expected legislative package in 2025. One such option involves raising the tax rate on university endowments first put in place as part of the TCJA in 2017.

4 min read

Despite stark competitiveness differences, both New Jersey and Utah share a common goal this legislative session: reforming economic nexus rules that require out-of-state sellers and marketplace facilitators to collect and remit state sales taxes.

4 min read

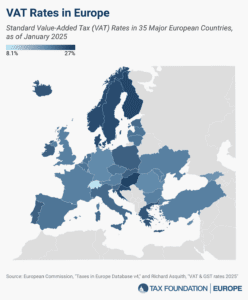

More than 175 countries worldwide—including all major European countries—levy a value-added tax (VAT) on goods and services. EU Member States’ VAT rates vary across countries, though they’re somewhat harmonized by the EU.

5 min read

By streamlining, simplifying, and reducing tax burdens for remote and nonresident workers, a newly proposed bill could make Arkansas a more attractive state for both employees and employers.

4 min read

We estimate the 25 percent tariffs on Canada and Mexico and 10 percent tariffs on China proposed to go into effect as early as February 1, 2025, would shrink economic output by 0.4 percent and increase taxes by $1.2 trillion between 2025 and 2034 on a conventional basis.

20 min read

What will the future of tax policy look like? In this episode, we dive into the critical challenges and opportunities looming on the horizon, especially with major tax cuts set to expire, which could increase taxes for 62 percent of filers.

This week, the incoming Trump administration issued a day-one executive order on the global minimum tax agreement known as Pillar Two, which seeks to ensure multinational corporations pay at least 15 percent in income tax.

6 min read

The proposed ad quantum tax would be the system that most closely follows the global best practices for alcohol taxes we previously outlined.

4 min read

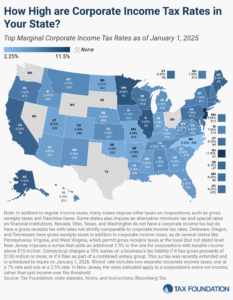

Forty-four states levy a corporate income tax, with top rates ranging from a 2.25 percent flat rate in North Carolina to a 11.5 percent top marginal rate in New Jersey.

7 min read

Facing a projected $3 billion budget deficit in fiscal year 2026, with forecasts of a growing gap over the next five years, Governor Wes Moore (D) has included about $1 billion in proposed tax increases in his budget proposal.

7 min read

Nebraska has an opportunity to revise the property tax package enacted in 2024 to ensure that Nebraskans enjoy meaningful property tax relief.

32 min read

Given the poor state of the budget process and worsening debt trajectory, lawmakers should move boldly and quickly to address the issue, including via a fiscal commission process. Issues to consider should include reforms to both spending and taxes.

42 min read

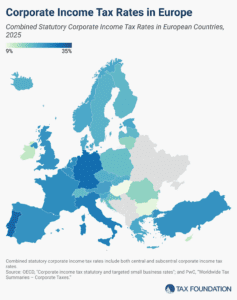

Some European countries have raised their statutory corporate rates over the past year, including Czechia, Estonia, Iceland, Lithuania, and Slovenia.

3 min read

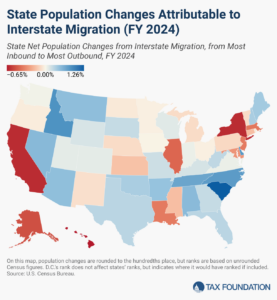

Americans were on the move in 2024, and many chose low-tax states over high-tax ones.

6 min read

The analysis provides key insights into how their models work and the sort of outputs we can expect from their models as part of next year’s tax debate.

8 min read

Thirty-nine states will begin 2025 with notable tax changes, including nine states cutting individual income taxes. Recent years have seen a wave of significant tax reforms, and the changes scheduled for 2025 show that these efforts have not let up.

25 min read

The holiday season is marked by time with friends and family, joy, and gift-giving. But could tax policy make the sticker shock from your shopping list next year tariff-ying?

4 min read