Trump Tariffs: Tracking the Economic Impact of the Trump Trade War

The tariffs amount to an average tax increase of nearly $1,300 per US household in 2025.

38 min read

The tariffs amount to an average tax increase of nearly $1,300 per US household in 2025.

38 min read

The One Big Beautiful Bill is now law—but what does it actually do? In this episode, we break down the new tax law’s key provisions, including who benefits, who doesn’t, and what it means for the economy, tax certainty, and the federal deficit.

Sean Bray interviews Dr. Michele Chang, Director of the Masters in Transatlantic Affairs and Professor of European Political Governance at the College of Europe, about the future of the EU tax mix.

12 min read

The aim of patent boxes is generally to encourage and attract local research and development (R&D) and to incentivize businesses to locate IP in the country. However, patent boxes can introduce another level of complexity to a tax system, and some recent research questions whether patent boxes are actually effective in driving innovation.

4 min read

President Trump made clear that the US wouldn’t accept the global minimum tax (known as Pillar Two) from the OECD in its current form.

The One Big Beautiful Bill Act makes many of the individual tax cuts and reforms of the TCJA permanent. It improves upon the TCJA by making expensing for R&D and equipment permanent. However, for the most part, it does not include further structural reforms, and instead introduces many new, narrow tax breaks to the code, adding complexity and raising revenue costs.

7 min read

Alabama’s 2025 legislative session mostly demonstrates a commitment to pro-growth tax policies that enhance competitiveness and reduce compliance burdens.

5 min read

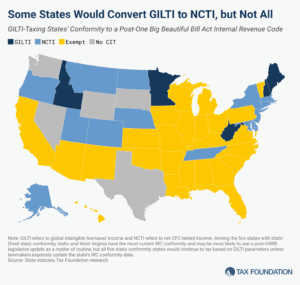

The One Big Beautiful Bill’s changes to the taxation of international income have surprising implications for state codes, yielding tax increases and a revised tax base that, through quirks of state incorporation, bears very little resemblance to the federal base and almost nothing of its purpose.

10 min read

The BEPS project’s 15 actions were decisive responses to real problems in cross-border taxation, offering real benefits but also real costs. A decade of implementation experience has revealed a critical side effect: sharply higher compliance costs for both tax administrations and the business community.

Policymakers continue to debate international tax rules after the US gained agreement on a new approach at the G7 that could result in US anti-avoidance policies existing side-by-side with the global minimum tax.

4 min read

We estimate the One Big Beautiful Bill Act would increase long-run GDP by 1.2 percent and reduce federal tax revenue by $5 trillion over the next decade on a conventional basis.

11 min read

President Trump signed the One Big Beautiful Bill Act into law on July 4, 2025.

16 min read

We are living in an age of hyperbole, or as writer Matthew Hennessey calls it, the “Age of Excusability,” in which our politicians succeed by making outlandish claims. So it goes with the One Big Beautiful Bill, which will usher in a new golden age or send us down the tubes for good, depending on your sources.

Independence Day is notable for its insistence not just on light taxation, but more importantly on taxation being subject to the consent of the governed through a representative form of government.

4 min read

Tax Foundation Europe’s Sean Bray interviews Dr. Monika Köppl-Turyna, director of the EcoAustria Institute for Economic Research, about the future of the EU tax mix.

14 min read

Lawmakers should consider maintaining QBAI and applying the several billion dollars from the Senate’s change toward other pro-growth international tax reforms instead.

6 min read

Congress is racing to pass the One Big Beautiful Tax Bill before the July 4 deadline. In this episode, Kyle Hulehan and Erica York break down what just happened over the weekend, what’s actually in the bill, and what comes next as the House and Senate try to reconcile their differences.

Lawmakers are right to be concerned about deficits and economic growth. The best path to address those concerns is to ensure OBBB provides permanent full expensing of capital investment, avoids inefficient tax cuts, and offsets remaining revenue losses by closing tax loopholes and reducing spending.

8 min read

Expanding and updating the US tax treaty network—both by forging new agreements and modernizing existing ones—is vital to maintaining the country’s competitiveness in a rapidly evolving global tax landscape.

4 min read

Summer has arrived, and states are beginning to implement policy changes that were enacted during this year’s legislative session (or that have delayed effective dates or are being phased in over time).

28 min read