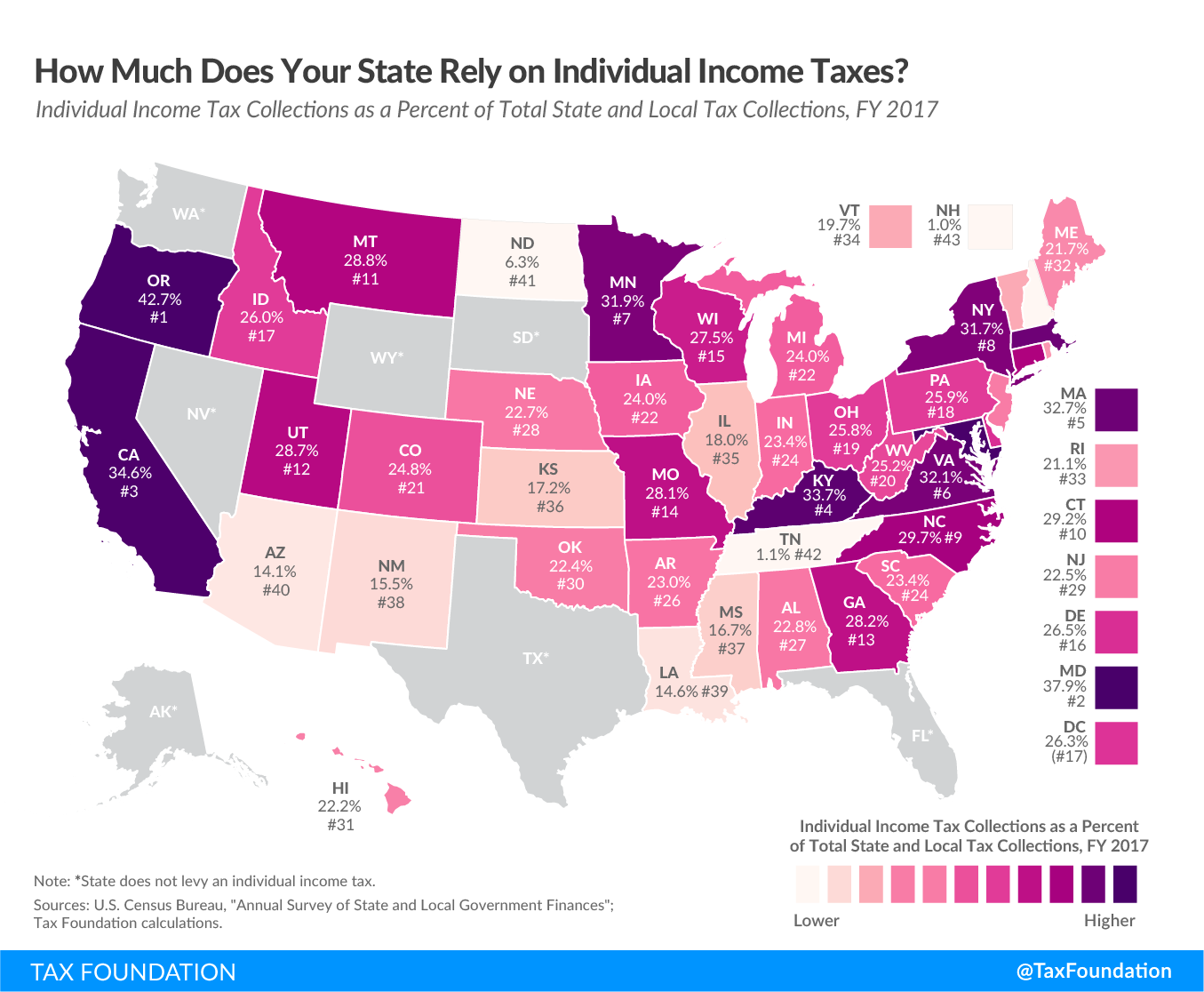

Sources of state revenue have come under closer scrutiny in light of the impact of the coronavirus outbreak, as different taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. types have differing volatility and economic impact—although even beyond these unique circumstances, it is important for policymakers to understand the trade-offs associated with different sources of tax revenue. This week’s map looks at what percentage of each state’s state and local tax collections is attributable to the individual income tax.

State and localities rely heavily on the individual income taxAn individual income tax (or personal income tax) is levied on the wages, salaries, investments, or other forms of income an individual or household earns. The U.S. imposes a progressive income tax where rates increase with income. The Federal Income Tax was established in 1913 with the ratification of the 16th Amendment. Though barely 100 years old, individual income taxes are the largest source of tax revenue in the U.S. , which comprised 23.3 percent of total U.S. state and local tax collections in fiscal year 2017, the latest year of data available. The individual income tax ranks just below the general sales tax (23.6 percent), both behind property taxes (31.9 percent) as the largest category of state and local revenue sources (See Facts & Figures Table 8).

Of all the states, Oregon and Maryland rely most heavily on individual income taxes, which account for 42.7 percent and 37.9 percent of their total state and local tax collections respectively. Both are among the 17 states where localities also levy income taxes. Oregon has chosen not to collect sales taxes, a decision which contributes to that state’s heavy reliance on the individual income tax.

While the individual income tax tends to be a major revenue source for state and local governments, some states rely on it very little, and some not at all. Seven states (Alaska, Florida, Nevada, South Dakota, Texas, Washington, and Wyoming) do not collect individual income taxes, while two states (New Hampshire and Tennessee) collect taxes on dividend and interest income but not wage income. Tennessee’s tax on investment income—known as the “Hall tax”—is in the process of being phased out and will be fully repealed next year, which will leave the state with no individual income tax.

It comes as no surprise that New Hampshire and Tennessee raise the least amount of revenue from the individual income tax, 1.0 and 1.1 percent respectively. In North Dakota and Arizona, the next lowest states, the individual income tax generates 6.3 percent and 14.1 percent of their total tax collections respectively.

While the current outbreak differs from other economic crises in that social distancing restrictions and the nature of pandemics have caused consumption to drop dramatically, it is generally true that income taxes are more volatile than consumption taxes in an economic downturn, as income itself tends to fluctuate more than consumption. In addition, states’ mirroring of the federal government by delaying income tax deadlines means that income tax collections will temporarily be much lower than in years past.

Volatility is not the only factor to consider. As we’ve pointed out in the past, a state’s combination of tax sources has implications for its revenue stability and economic growth. Income taxes tend to be more harmful to economic growth than consumption taxes and property taxes. Income taxes fall on labor and savings, while consumption taxes, like the sales taxA sales tax is levied on retail sales of goods and services and, ideally, should apply to all final consumption with few exemptions. Many governments exempt goods like groceries; base broadening, such as including groceries, could keep rates lower. A sales tax should exempt business-to-business transactions which, when taxed, cause tax pyramiding. , fall on what people spend instead of what they earn. As a result, income taxes tend to be less neutral than sales taxes.

Note: This is part of a map series in which we examine the primary sources of state and local tax collections

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe