With GDP forecasts turning sharply negative for the quarter, states are bracing for the worst—or will be when legislative sessions resume after the suspensions many have implemented in light of the COVID-19 pandemic. On Sunday, Goldman Sachs cut its second quarter U.S. GDP estimate from 0 percent to a stunning -5 percent, which would represent the worst single-quarter contraction since the recessionA recession is a significant and sustained decline in the economy. Typically, a recession lasts longer than six months, but recovery from a recession can take a few years. of 1958. The investment bank projects that the decline, though steep, will not be protracted, with GDP growing again in the third and fourth quarters and ending the year in modestly positive territory.

State officials can only hope. No one really knows. At least in the short term, however, states must anticipate reduced taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. collections as the economy slows. And here, not all taxes are created equal.

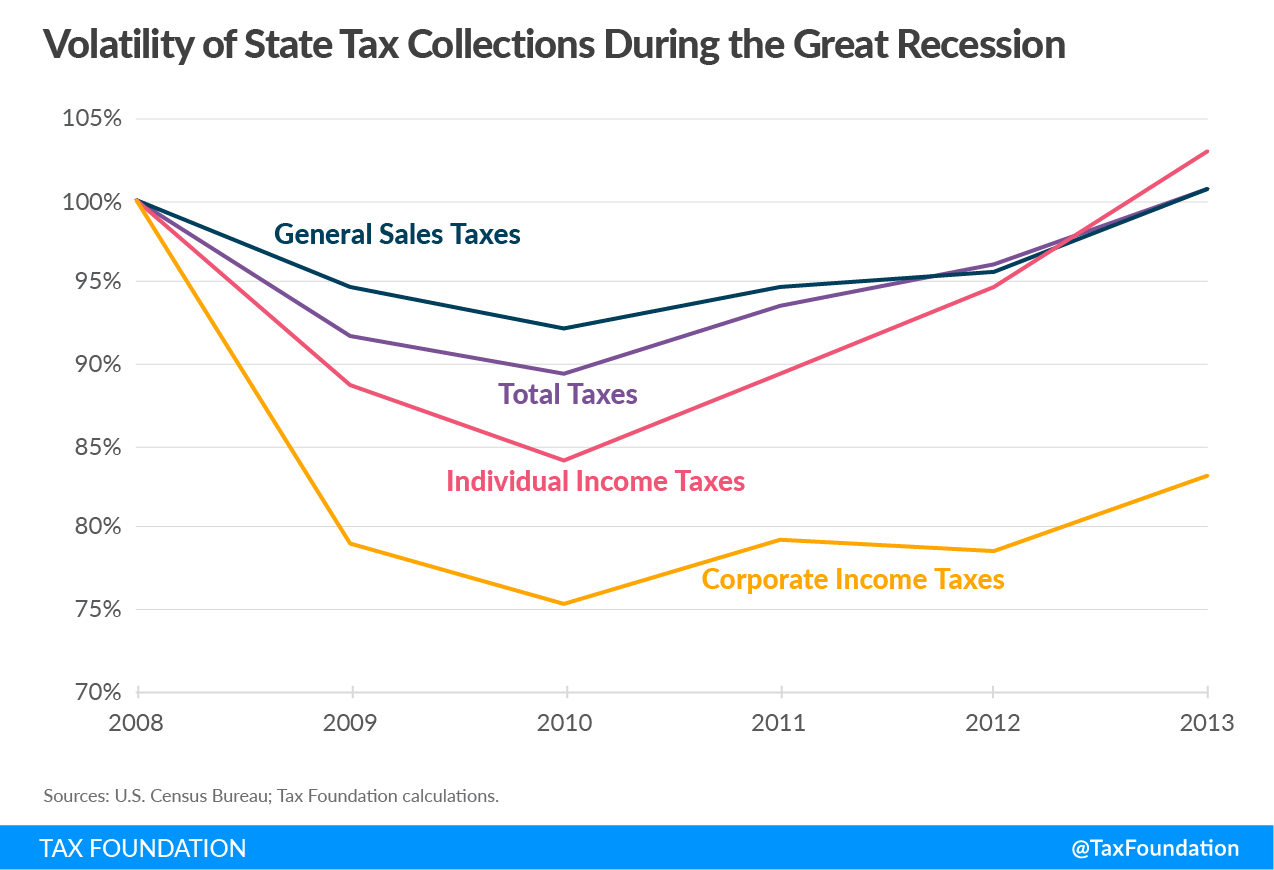

As a general rule, income taxes are more volatile than consumption taxes, as can be seen from aggregate state tax collections during and immediately after the Great Recession. By 2010, general sales taxes were down 8 percent from their 2008 peak, while individual income taxes fell 16 percent and corporate income taxA corporate income tax (CIT) is levied by federal and state governments on business profits. Many companies are not subject to the CIT because they are taxed as pass-through businesses, with income reportable under the individual income tax. collections plummeted a full 25 percent.

The relative stability of sales taxes compared to income taxes was not unique to the Great Recession, and indeed, it makes logical sense. While most of us curtail some expenditures during an economic downturn, there is only so much we can—or are willing to—cut. Even those with no wage income continue to consume, supported by savings and governmental assistance, while those whose incomes decline are likely to reduce savings rates more drastically than consumption. Corporate income tax collections are the most volatile because, even in a deep recession, most individuals earn taxable incomeTaxable income is the amount of income subject to tax, after deductions and exemptions. For both individuals and corporations, taxable income differs from—and is less than—gross income. , whereas corporations may post actual losses and thus have no net income to tax.

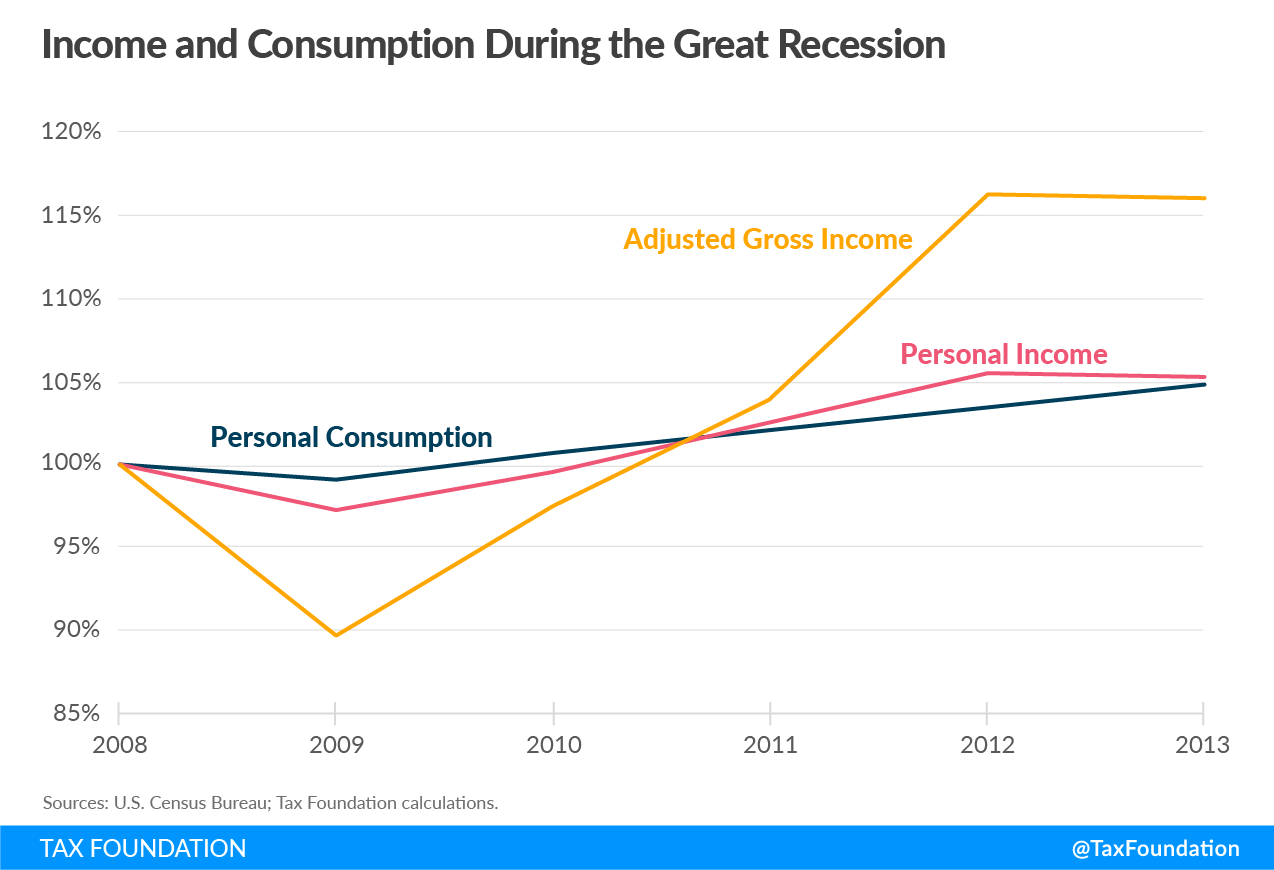

Both income and consumption fall when the economy contracts, but not in tandem, with personal expenditures representing a greater share of income during a downturn. This can be seen by digging into the changes in spending and income that underlie those fluctuations in tax collections. As is obvious below, personal consumption expenditures were relatively stable throughout the Great Recession, and personal income wasn’t much worse, but adjusted gross incomeFor individuals, gross income is the total pre-tax earnings from wages, tips, investments, interest, and other forms of income and is also referred to as “gross pay.” For businesses, gross income is total revenue minus cost of goods sold and is also known as “gross profit” or “gross margin.” proved extremely volatile. What’s going on?

The U.S. measure of personal income includes income from all sources, including government. During a recession, wage, salary, and investment income declines, but (untaxable) governmental assistance tends to rise, providing a smoothing effect. Income that is potentially taxable, however, falls sharply. Most states begin their own individual income taxAn individual income tax (or personal income tax) is levied on the wages, salaries, investments, or other forms of income an individual or household earns. The U.S. imposes a progressive income tax where rates increase with income. The Federal Income Tax was established in 1913 with the ratification of the 16th Amendment. Though barely 100 years old, individual income taxes are the largest source of tax revenue in the U.S. calculations with adjusted gross income, and during an economic contraction, both gross income and the share of gross income that is taxable (since income below certain levels is typically excluded through deductions and exemptions) can be expected to decline.

None of these measures is perfect. Measures of personal consumption, for instance, overstate the stability of a sales taxA sales tax is levied on retail sales of goods and services and, ideally, should apply to all final consumption with few exemptions. Many governments exempt goods like groceries; base broadening, such as including groceries, could keep rates lower. A sales tax should exempt business-to-business transactions which, when taxed, cause tax pyramiding. because they include more stable forms of consumption (including groceries) that are often exempt from state sales taxes, or where the consumption is imputed and is not associated with a taxable transaction. Nevertheless, we see the same trends in both tax collections and the underlying income and consumption data. Taxes on consumption are more stable than taxes on income and can be made even more robust when there are fewer exemptions.

The coronavirus outbreak may test these expectations, particularly in the short term, as consumers’ purchasing habits are curtailed by policies of social distancing, not just reduced capacity. Discretionary expenditures decline in any recession, but whereas fewer people go to the movies when their income declines, no one may be going to the movies if an ongoing public health crisis makes large gatherings inadvisable or impermissible for extended periods. The same forces driving those declines in consumption, however, would also yield reduced employment and substantially lower taxable income.

The present crisis is genuinely different from prior economic contractions, and this introduces added uncertainty as we attempt to apply the lessons of the past. It is, however, more likely than not that, while sales tax receipts may decline first (sales taxes are remitted to governments much more regularly than income taxes), income taxes will be responsible for a steeper decline.

Share this article